Uniform Domestic Relations Form 17 - Shared Parenting Plan Page 13

ADVERTISEMENT

EACH PARTY TO THIS SUPPORT ORDER MUST NOTIFY THE CHILD SUPPORT AGENCY

IN WRITING OF HIS OR HER CURRENT MAILING ADDRESS, CURRENT RESIDENCE

ADDRESS, CURRENT RESIDENCE TELEPHONE NUMBER, CURRENT DRIVER’S LICENSE

NUMBER AND OF ANY CHANGES IN THAT INFORMATION. EACH PARTY MUST NOTIFY

THE AGENCY OF ALL CHANGES UNTIL FURTHER NOTICE FROM THE COURT. IF YOU

ARE THE OBLIGOR UNDER A CHILD SUPPORT ORDER AND YOU FAIL TO MAKE THE

REQUIRED NOTIFICATIONS, YOU MAY BE FINED UP TO $50.00 FOR A FIRST OFFENSE,

$100.00 FOR A SECOND OFFENSE, AND $500.00 FOR EACH SUBSEQUENT OFFENSE. IF

YOU ARE AN OBLIGOR OR OBLIGEE UNDER ANY SUPPORT ORDER AND YOU

WILLFULLY FAIL TO MAKE THE REQUIRED NOTIFICATIONS YOU MAY BE SUBJECTED

TO FINES OF UP TO $1,000.00 AND IMPRISONMENT FOR NOT MORE THAN 90 DAYS.

IF YOU ARE AN OBLIGOR AND YOU FAIL TO MAKE THE REQUIRED NOTIFICATIONS, YOU

MAY NOT RECEIVE NOTICE OF THE FOLLOWING ENFORCEMENT ACTIONS AGAINST

YOU: IMPOSITION OF LIENS AGAINST YOUR PROPERTY; LOSS OF YOUR

PROFESSIONAL OR OCCUPATIONAL LICENSE, DRIVER'S LICENSE, OR RECREATIONAL

LICENSE; WITHHOLDING FROM YOUR INCOME; ACCESS RESTRICTIONS AND

DEDUCTIONS FROM YOUR ACCOUNTS IN FINANCIAL INSTITUTIONS; AND ANY OTHER

ACTION PERMITTED BY LAW TO OBTAIN MONEY FROM YOU AND TO SATISFY YOUR

SUPPORT OBLIGATION.

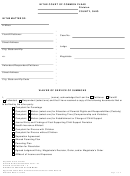

G.

Payment shall be made in accordance with Chapter 3121. of the Revised Code.

H.

Arrearage

Any temporary child support arrearage will survive this judgment entry.

Any temporary child support arrearage will not survive this judgment entry.

Other:

FIFTH: TAX EXEMPTIONS

Income tax dependency exemptions (check all that apply):

A.

The Plaintiff/Petitioner 1 shall be entitled to claim the following minor child(ren) for all tax

purposes for

even-numbered tax years

odd-numbered tax years

all eligible tax years, so

long as Plaintiff is substantially current in any child support Plaintiff is required to pay as of

December 31 of the tax year in question:

The Defendant/Petitioner 2 shall be entitled to claim the following minor child(ren) for all

tax purposes for

even-numbered tax years

odd-numbered tax years

all eligible tax years, so

long as Defendant is substantially current in any child support Defendant is required to pay

as of December 31 of the tax year in question:

Supreme Court of Ohio

Uniform Domestic Relations Form – 17

SHARED PARENTING PLAN

Approved under Ohio Civil Rule 84 and Ohio Juvenile Rule 46

Amended: March 15, 2016

Page 13 of 14

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14