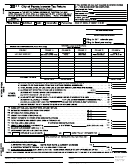

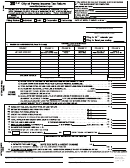

Form I-1040 - City Of Ionia Income Tax Return - 1999 Page 2

ADVERTISEMENT

ALL TOTALS FROM THIS PAGE GO OVER TO PAGE 1

(SEE THE INSTRUCTIONS FOR LINE BY LINE INFORMATION)

SCHEDULE A-NON-RESIDENTS ONLY

(To allocate the wages that were earned both inside and outside the city limits of Ionia)

A1

Wages earned partly outside Ionia by non-residents only: (If you need to allocate more than 2 W-2s, please put this information on an attached sheet of paper)

Attach documentation to verify the information you are providing

COL I

COL II

COL III

EMPLOYER #1

EMPLOYER #2

TOTAL

EMPLOYER'S NAME

00

00

a. Total number of days worked for this employer in 1999

00

00

b. Actual number of days worked in Ionia (see instructions)

00

00

c. Days worked outside Ionia (Subtract Line b from Line a)

%

%

00

00

d. Percentage of days worked outside Ionia (Line c divided by Line a)

$

$

00

00

e. Wages earned from this job (From the W-2 form)

$

$

$

00

00

00

A2

Excludable wages (multiply line d by line e) and enter total in Col III

SCHEDULE B-OTHER INCOME

Income or loss from business, sales, rentals, partnerships, capital gains, lottery

B1

INCOME OR LOSS FROM BUSINESS DBA:

00

a

RESIDENTS enter total from your Federal 1040 Form and attach all Schedule Cs

00

b

NON-RESIDENTS use the Schedule I-1040-BA and attach all Schedule Cs

B2

INCOME OR LOSS FROM SALE OR EXCHANGE OF PROPERTY

00

Attach a schedule with the following: Description, Date Acquired, Date Sold, Total Gain or Loss, and Taxable Gain or Loss

00

a

RESIDENT: Portion of gain or loss which occurred after January 1, 1994

00

b

NON-RESIDENT: Portion of gain or loss on sale of property located in Ionia which occurred after January 1, 1994

B3

RENTALS AND SUPPLEMENTAL INCOME (Attach copies of your related federal schedules)

00

a

Rents (NON-RESIDENTS exclude portion earned outside Ionia)

LOCATION

b

Partnership income (Non-residents exclude income or loss earned outside Ionia)

LOCATION

00

DBA:

00

c

Corporate distributions Name and ID Number (do not enter Sub S corp profit or loss they must file I-1120)

00

d

Other (Identify and attach shedules or documentation)

00

e

TOTAL INCOME FROM RENTS AND OTHER SUPPLEMENTAL INCOME

B4

OTHER ADDITIONS TO INCOME

00

a

Operating Loss or Capital Loss carryovers relating to prior to January 1, 1994

00

b

Other - please attach explanation and appropriate federal schedules

00

c

TOTAL OTHER ADDITIONS TO INCOME (add Lines a and b)

00

B5 TOTAL FOR SECTION B

Add B1, B2, B3e and B4c. Enter here and on line 6 of page 1.

SCHEDULE C - DEDUCTIONS

00

C1

EXCLUDABLE WAGES - Non residents only. (For wages from W-2s earned 100% outside the city limits of Ionia.)

00

C2

PARTIALLY EXCLUDABLE WAGES - Wages earned outside the City (FOR NON-RESIDENTS ONLY!)

Use Schedule A1 above and enter the amount from Line A2 above.

C3

IRA DEDUCTION as allowed on Federal return

(RESIDENTS -ENTER THE AMOUNT FROM YOUR FEDERAL TAX RETURN)

00

(NON-RESIDENTS must allocate these deductions)

a

IRA deduction (attach supporting documentation)

b

Percentage of income earned inside Ionia (Ionia income divided by total Federal income)

00

c

Allowable deduction (a times b)

C4

OTHER DEDUCTIONS - as allowed in the city income tax ordinance

00

a

Deduction (Specify type of deduction and attach supporting documentation)

b

Percentage of wages earned inside Ionia (see instructions)

00

c

Allowable deduction

00

C5 TOTAL DEDUCTIONS add Lines C1, C2, C3c, and C4c and enter here and on Line 8 of Page 1

SCHEDULE D-OTHER INFORMATION

Use this space to explain why you didn't file a 1998 city return, or to explain any other circumstances which you believe will help us in processing your return.

I-1040 page 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3