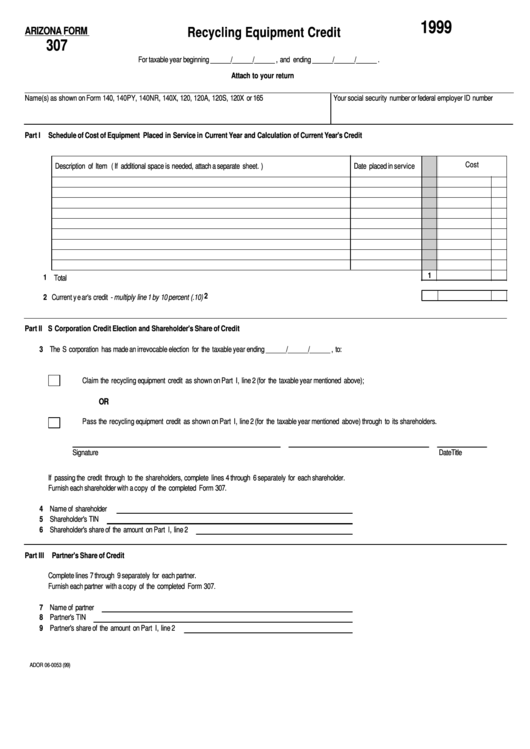

Form 307 - Recycling Equipment Credit - 1999

ADVERTISEMENT

1999

Recycling Equipment Credit

ARIZONA FORM

307

For taxable year beginning ______/______/______ , and ending ______/______/______ .

Attach to your return

Name(s) as shown on Form 140, 140PY, 140NR, 140X, 120, 120A, 120S, 120X or 165

Your social security number or federal employer ID number

Part I Schedule of Cost of Equipment Placed in Service in Current Year and Calculation of Current Year's Credit

Cost

Description of Item ( If additional space is needed, attach a separate sheet. )

Date placed in service

1

Total

1

2 Current y ear's credit - multiply line 1 by 10 percent (.10)

2

Part II S Corporation Credit Election and Shareholder's Share of Credit

3 The S corporation has made an irrevocable election for the taxable year ending ______/______/______ , to:

Claim the recycling equipment credit as shown on Part I, line 2 (for the taxable year mentioned above);

OR

Pass the recycling equipment credit as shown on Part I, line 2 (for the taxable year mentioned above) through to its shareholders.

Signature

Title

Date

If passing the credit through to the shareholders, complete lines 4 through 6 separately for each shareholder.

Furnish each shareholder with a copy of the completed Form 307.

4 Name of shareholder

5 Shareholder's TIN

6 Shareholder's share of the amount on Part I, line 2

Part III Partner's Share of Credit

Complete lines 7 through 9 separately for each partner.

Furnish each partner with a copy of the completed Form 307.

7 Name of partner

8 Partner's TIN

9 Partner's share of the amount on Part I, line 2

ADOR 06-0053 (99)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3