ARIZONA FORM

307

2012

Recycling Equipment Credit

For the calendar year 2012, or

M M D D Y Y Y Y

M M D D Y Y Y Y

fiscal year beginning

and ending

.

Attach to your return.

Your Name as shown on Form 140, 140PY, 140NR, 140X

Your Social Security Number

Spouse’s Name as shown on Form 140, 140PY, 140NR, 140X

Spouse’s Social Security Number

Individual Taxpayers

Laws 2003, Ch. 122, §§ 6 and 11, repealed the individual tax credit (A.R.S. § 43-1076) effective for taxable

years beginning from and after December 31, 2002. Individual taxpayers, including individual partners of

a partnership, no longer qualify for the recycling equipment credit. A partnership cannot pass the credit

through to its individual partners.

However, Laws 2003, Ch. 122, § 10, provides that individual taxpayers may claim carryovers of unused

tax credits from taxable years beginning prior to January 1, 2003 for the succeeding 15 taxable years after

the unused credit year. You cannot carryover any unused credit related to recycling equipment that had

ceased to be recycling equipment or was transferred to another person. See instructions for additional

information.

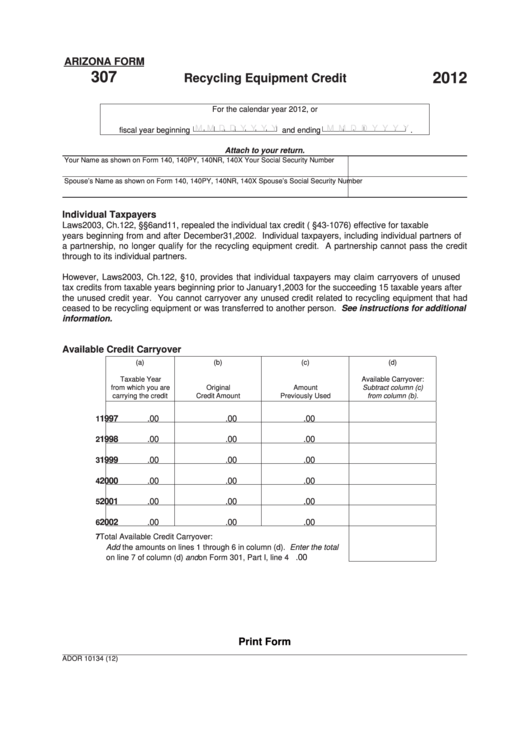

Available Credit Carryover

(a)

(b)

(c)

(d)

Taxable Year

Available Carryover:

from which you are

Original

Amount

Subtract column (c)

carrying the credit

Credit Amount

Previously Used

from column (b).

1997

.00

.00

.00

1

1998

.00

.00

.00

2

1999

.00

.00

.00

3

2000

.00

.00

.00

4

2001

.00

.00

.00

5

2002

.00

.00

.00

6

7 Total Available Credit Carryover:

Add the amounts on lines 1 through 6 in column (d). Enter the total

.00

on line 7 of column (d) and on Form 301, Part I, line 4 .......................

Print Form

ADOR 10134 (12)

1

1