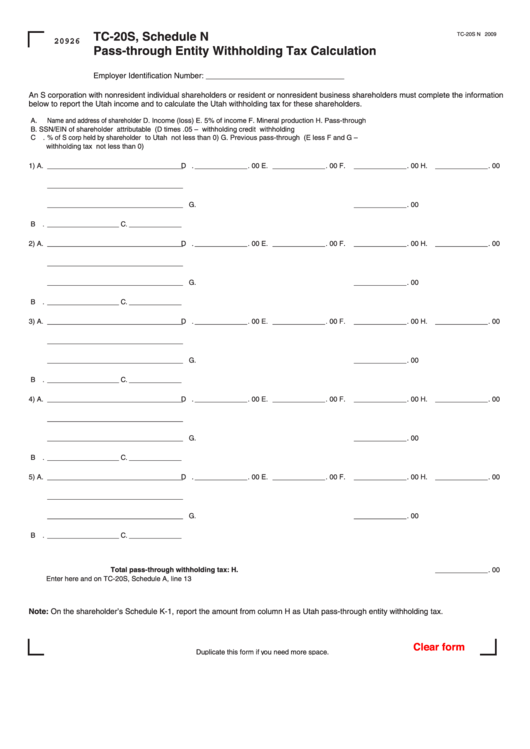

TC-20S, Schedule N

TC-20S N 2009

20926

Pass-through Entity Withholding Tax Calculation

Employer Identification Number: __ _________________

An S corporation with nonresident individual shareholders or resident or nonresident business shareholders must complete the information

below to report the Utah income and to calculate the Utah withholding tax for these shareholders.

A. Name and address of shareholder

D. Income (loss)

E. 5% of income

F. Mineral production

H. Pass-through

B. SSN/EIN of shareholder

attributable

(D times .05 –

withholding credit

withholding

C. % of S corp held by shareholder

to Utah

not less than 0)

G. Previous pass-through

(E less F and G –

withholding tax

not less than 0)

1) A. _ __ __ _ __ _ __ _ _ _ _ _ __ _ _ _ D. _ __ _ _ __ _ . 00 E. _ __ _ __ _ _ . 00

F. _ _ __ _ __ _ . 00

H. __ __ ____ . 00

_ _ __ _ __ _ __ _ _ _ _ __ _ _ __ _

_ _ __ _ __ _ __ _ _ _ _ __ _ _ __ _

G. _ __ _ __ _ _ . 00

B. _ _ __ _ __ _ __ _ C. _ __ _ _ __ _

2) A. _ __ __ _ __ _ __ _ _ _ _ _ __ _ _ _ D. _ __ _ _ __ _ . 00 E. _ __ _ __ _ _ . 00

F. _ _ __ _ __ _ . 00

H. __ __ ____ . 00

_ _ __ _ __ _ __ _ _ _ _ __ _ _ __ _

_ _ __ _ __ _ __ _ _ _ _ __ _ _ __ _

G. _ __ _ __ _ _ . 00

B. _ _ __ _ __ _ __ _ C. _ __ _ _ __ _

3) A. _ __ __ _ __ _ __ _ _ _ _ _ __ _ _ _ D. _ __ _ _ __ _ . 00 E. _ __ _ __ _ _ . 00

F. _ _ __ _ __ _ . 00

H. __ __ ____ . 00

_ _ __ _ __ _ __ _ _ _ _ __ _ _ __ _

_ _ __ _ __ _ __ _ _ _ _ __ _ _ __ _

G. _ __ _ __ _ _ . 00

B. _ _ __ _ __ _ __ _ C. _ __ _ _ __ _

4) A. _ __ __ _ __ _ __ _ _ _ _ _ __ _ _ _ D. _ __ _ _ __ _ . 00 E. _ __ _ __ _ _ . 00

F. _ _ __ _ __ _ . 00

H. __ __ ____ . 00

_ _ __ _ __ _ __ _ _ _ _ __ _ _ __ _

_ _ __ _ __ _ __ _ _ _ _ __ _ _ __ _

G. _ __ _ __ _ _ . 00

B. _ _ __ _ __ _ __ _ C. _ __ _ _ __ _

5) A. _ __ __ _ __ _ __ _ _ _ _ _ __ _ _ _ D. _ __ _ _ __ _ . 00 E. _ __ _ __ _ _ . 00

F. _ _ __ _ __ _ . 00

H. __ __ ____ . 00

_ _ __ _ __ _ __ _ _ _ _ __ _ _ __ _

_ _ __ _ __ _ __ _ _ _ _ __ _ _ __ _

G. _ __ _ __ _ _ . 00

B. _ _ __ _ __ _ __ _ C. _ __ _ _ __ _

Total pass-through withholding tax:

H. __ __ ____ . 00

Enter here and on TC-20S, Schedule A, line 13

Note: On the shareholder’s Schedule K-1, report the amount from column H as Utah pass-through entity withholding tax.

Clear form

Duplicate this form if you need more space.

1

1 2

2