Instructions For Form Qba - Qualified Business Designation Application - Qualified Equity And Subordinated Debt Investments Tax Credit

ADVERTISEMENT

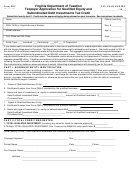

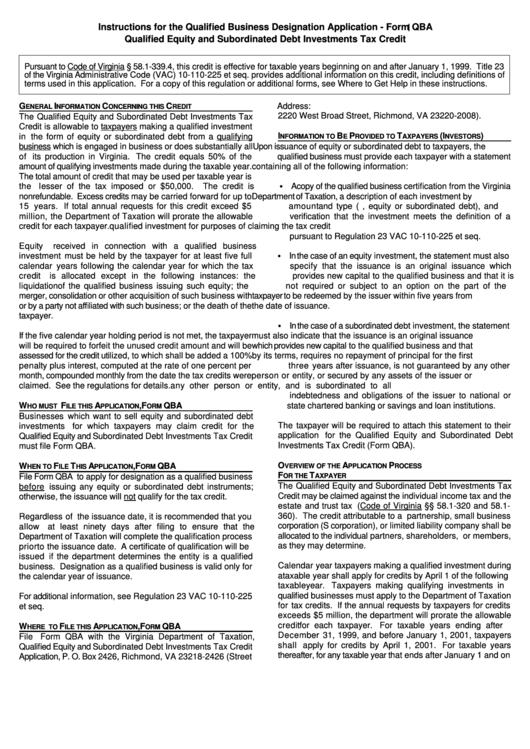

Instructions for the Qualified Business Designation Application - Form QBA

1

Qualified Equity and Subordinated Debt Investments Tax Credit

Pursuant to Code of Virginia § 58.1-339.4, this credit is effective for taxable years beginning on and after January 1, 1999. Title 23

of the Virginia Administrative Code (VAC) 10-110-225 et seq. provides additional information on this credit, including definitions of

terms used in this application. For a copy of this regulation or additional forms, see Where to Get Help in these instructions.

G

I

C

C

Address:

ENERAL

NFORMATION

ONCERNING THIS

REDIT

2220 West Broad Street, Richmond, VA 23220-2008).

The Qualified Equity and Subordinated Debt Investments Tax

Credit is allowable to taxpayers making a qualified investment

I

B

P

T

(I

)

in the form of equity or subordinated debt from a qualifying

NFORMATION TO

E

ROVIDED TO

AXPAYERS

NVESTORS

business which is engaged in business or does substantially all

Upon issuance of equity or subordinated debt to taxpayers, the

of its production in Virginia. The credit equals 50% of the

qualified business must provide each taxpayer with a statement

amount of qualifying investments made during the taxable year.

containing all of the following information:

The total amount of credit that may be used per taxable year is

C A copy of the qualified business certification from the Virginia

the lesser of the tax imposed or $50,000.

The credit is

nonrefundable. Excess credits may be carried forward for up to

Department of Taxation, a description of each investment by

15 years. If total annual requests for this credit exceed $5

amount and type (i.e., equity or subordinated debt), and

million, the Department of Taxation will prorate the allowable

verification that the investment meets the definition of a

credit for each taxpayer.

qualified investment for purposes of claiming the tax credit

pursuant to Regulation 23 VAC 10-110-225 et seq.

Equity received in connection with a qualified business

C In the case of an equity investment, the statement must also

investment must be held by the taxpayer for at least five full

calendar years following the calendar year for which the tax

specify that the issuance is an original issuance which

credit is allocated except in the following instances: the

provides new capital to the qualified business and that it is

liquidation of the qualified business issuing such equity; the

not required or subject to an option on the part of the

merger, consolidation or other acquisition of such business with

taxpayer to be redeemed by the issuer within five years from

or by a party not affiliated with such business; or the death of the

the date of issuance.

taxpayer.

C In the case of a subordinated debt investment, the statement

If the five calendar year holding period is not met, the taxpayer

must also indicate that the issuance is an original issuance

will be required to forfeit the unused credit amount and will be

which provides new capital to the qualified business and that

assessed for the credit utilized, to which shall be added a 100%

by its terms, requires no repayment of principal for the first

penalty plus interest, computed at the rate of one percent per

three years after issuance, is not guaranteed by any other

month, compounded monthly from the date the tax credits were

person or entity, or secured by any assets of the issuer or

claimed. See the regulations for details.

any other person or entity, and is subordinated to all

indebtedness and obligations of the issuer to national or

W

F

A

, F

QBA

state chartered banking or savings and loan institutions.

HO MUST

ILE THIS

PPLICATION

ORM

Businesses which want to sell equity and subordinated debt

The taxpayer will be required to attach this statement to their

investments for which taxpayers may claim credit for the

application for the Qualified Equity and Subordinated Debt

Qualified Equity and Subordinated Debt Investments Tax Credit

Investments Tax Credit (Form QBA).

must file Form QBA.

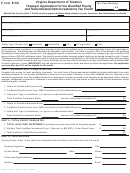

O

A

P

W

F

T

A

, F

QBA

VERVIEW OF THE

PPLICATION

ROCESS

HEN TO

ILE

HIS

PPLICATION

ORM

F

T

File Form QBA to apply for designation as a qualified business

OR THE

AXPAYER

The Qualified Equity and Subordinated Debt Investments Tax

before issuing any equity or subordinated debt instruments;

Credit may be claimed against the individual income tax and the

otherwise, the issuance will not qualify for the tax credit.

estate and trust tax (Code of Virginia §§ 58.1-320 and 58.1-

360). The credit attributable to a partnership, small business

Regardless of the issuance date, it is recommended that you

corporation (S corporation), or limited liability company shall be

allow at least ninety days after filing to ensure that the

allocated to the individual partners, shareholders, or members,

Department of Taxation will complete the qualification process

as they may determine.

prior to the issuance date. A certificate of qualification will be

issued if the department determines the entity is a qualified

Calendar year taxpayers making a qualified investment during

business. Designation as a qualified business is valid only for

a taxable year shall apply for credits by April 1 of the following

the calendar year of issuance.

taxable year.

Taxpayers making qualifying investments in

qualified businesses must apply to the Department of Taxation

For additional information, see Regulation 23 VAC 10-110-225

for tax credits. If the annual requests by taxpayers for credits

et seq.

exceeds $5 million, the department will prorate the allowable

credit for each taxpayer.

For taxable years ending after

W

F

A

, F

QBA

HERE TO

ILE THIS

PPLICATION

ORM

December 31, 1999, and before January 1, 2001, taxpayers

File Form QBA with the Virginia Department of Taxation,

shall apply for credits by April 1, 2001. For taxable years

Qualified Equity and Subordinated Debt Investments Tax Credit

thereafter, for any taxable year that ends after January 1 and on

Application, P. O. Box 2426, Richmond, VA 23218-2426 (Street

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2