Instructions For Form Qba - Qualified Business Designation Application - Qualified Equity And Subordinated Debt Investments Tax Credit Page 2

ADVERTISEMENT

2

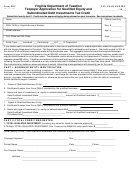

or before December 31, taxpayers shall apply by April 1 of the

exchange for services provided to such business as an

employee, officer, director, manager, independent contractor or

subsequent calendar year.

otherwise in connection with or within one year before or after

the date of such investment.

For purposes hereof,

All eligible taxpayers shall be notified by June 30 following the

reimbursement of reasonable expenses incurred shall not be

filing of Form EDC as to the allowable credit amount that may

deemed to be compensation. A qualified investment shall not

be claimed for the qualified investment. Upon receiving such

include existing investments or instruments that have been

notification, taxpayers may claim the tax credit on the applicable

purchased, transferred, or otherwise obtained without providing

Virginia income tax return and compute any carryover credit

new capital to a qualified business.

amount.

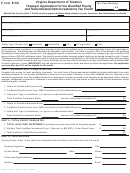

"Qualified business" means a business which (i) has annual

IMPORTANT: Taxpayers who will not receive the notification of

gross revenues of no more than five million dollars in its most

allowable credit amounts prior to the due date of the Virginia

recent tax year, (ii) is commercially domiciled in the

income tax return must file the appropriate return extension

Commonwealth, (iii) is primarily engaged in business or does

request or file an amended tax return to claim the tax credit

substantially all of its production in the Commonwealth, and (iv)

within the applicable statute of limitations.

is not primarily engaged, or is not primarily organized to engage,

in any of the following types of businesses:

P

-T

E

I

ASS

HROUGH

NTITY

DENTIFICATION

The Virginia Department of Taxation will notify each partnership,

1. Banks;

S corporation or limited liability company qualifying to claim a

portion of this credit by issuing a credit certificate specifying the

2. Savings and loan institutions;

amount of credit authorized.

3. Credit or finance;

4. Financial, broker or investment;

Each S corporation qualifying for this credit must attach a copy

of the certificate along with a schedule listing the name,

5. Businesses organized for the primary purpose of rendering

address, social security number and credit amount for each

professional services as defined in Chapter 7 (§ 13.1-542

et seq.) of Title 13.1;

individual shareholder to whom the credit is distributed. Each

partnership or limited liability company qualifying for this credit

6. Accounting;

must return a copy of the credit certificate and the same partner

7. Government, charitable, religious or trade institutions or

or member information directly to the Virginia Department of

organizations;

Taxation, ATTN: Qualified Equity and Subordinated Debt

8. Conventional coal, oil and gas, and mineral exploration;

Investments Tax Credit, P. O. Box 2426, Richmond, Virginia

23218-2426 within 60 days of making the distribution.

9. Insurance;

10. Real estate design or engineering;

Each partnership, shareholder and limited liability company

11. Construction or construction contracting;

distributing this credit to its partners, shareholders and members

must also provide a copy of the credit certificate and statement

12. Business consulting or business brokering;

specifying the amount and percentage of the credit distributed.

13. Residential housing, real estate brokerage, sale or leasing

businesses, or real estate development; or

The partner, shareholder or member claiming the credit must

14. Any business which is in violation of the law.

attach a copy of the credit certificate and statement received to

the tax return in order for the credit to be allowed.

"Commercial domicile" means the state in which is located the

principal office from which the business affairs of the

D

EFINITIONS

corporation are normally directed or managed. See Regulation

"Equity" means common stock or preferred stock, regardless

23 VAC 10-120-140 D.

of class or series, of a corporation; a partnership interest in a

limited partnership; or a membership interest in a limited liability

“Primarily engaged in business in the Commonwealth”

company, any of which is not required or subject to an option on

means 50% or more of the entity’s gross receipts are derived

the part of the taxpayer to be redeemed by the issuer within five

from sources within Virginia.

years from the date of issuance.

"Substantially all of its production in the Commonwealth"

"Subordinated debt" means indebtedness of a corporation,

means 80% or more of the entity's expenses are incurred within

general or limited partnership, or limited liability company that

Virginia.

(a) by its terms requires no repayment of principal for the first

three years after issuance; (b) is not guaranteed by any other

W

G

H

HERE TO

ET

ELP

person or entity, or secured by any assets of the issuer or any

For assistance, write the Virginia Department of Taxation,

other person or entity; and (c) is subordinated to all

P. O. Box 1115, Richmond, VA 23218-1115 or call (804) 367-

indebtedness and obligations of the issuer to national or state-

8036. To order forms or the regulations, call 1-888-268-2829

chartered banking or savings and loan institutions.

(toll free outside Richmond), (804) 236-2760 or (804) 236-

"Qualified investment" means a cash investment in a qualified

2761. If you have access to the World Wide Web, connect to

business in the form of equity or subordinated debt.

An

our web page at to obtain most

investment shall not be qualified, however, if the taxpayer who

Virginia income tax forms and additional tax information. Forms

holds such investment, or any of such taxpayer's family

are also available from the office of your local Commissioner of

members, or any entity affiliated with such taxpayer, receives or

the Revenue, Director of Finance, or Director of Tax

has received compensation from the qualified business in

Administration.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2