Form 42d003 - Kentucky Wage And Tax Statements - Kentucky Revenue Cabinet - 2003

ADVERTISEMENT

42D003

COMMONWEALTH OF KENTUCKY

REVENUE CABINET

8-03

FRANKFORT

40620

TO:

Employers

DATE:

September 5, 2003

SUBJECT:

2003 Kentucky Wage and Tax Statements

Employers are required to furnish each employee with a wage and tax statement on or before January 31, 2004. This

applies to all employees from whose wages tax has been withheld or would have been withheld if no more than one

exemption had been claimed.

The Kentucky Revenue Cabinet maintains a record of the receipt of the wage and tax statements by utilizing the

Kentucky Withholding Account Number. It is extremely important that the correct number be entered in the appli-

cable block on the wage statements. Failure to enter the correct account number contributes to delays in processing

and possible mishandling of the statements.

The Revenue Cabinet is providing combination federal and Kentucky wage and tax statements based on the rate

schedule below. Orders for up to 250 forms will be filled at no charge. The forms consist of all required copies of

federal Form W-2 and Revenue Form K-2. Employers must use the Cabinet's official forms or approved commercially

printed forms. Federal W-2 forms may be used if the Kentucky tax withheld is clearly identified. Any questions regard-

ing commercially printed forms or magnetic media should be addressed to the Division of Compliance and Taxpayer

Assistance, Withholding Tax Section, Station 57 , P .O. Box 1274, Frankfort, KY 40602-1274, (502) 564-7287 .

Enclosed is a combination order blank and label. Please type or clearly print your name, address, including ZIP code,

and number of forms requested and return with payment.

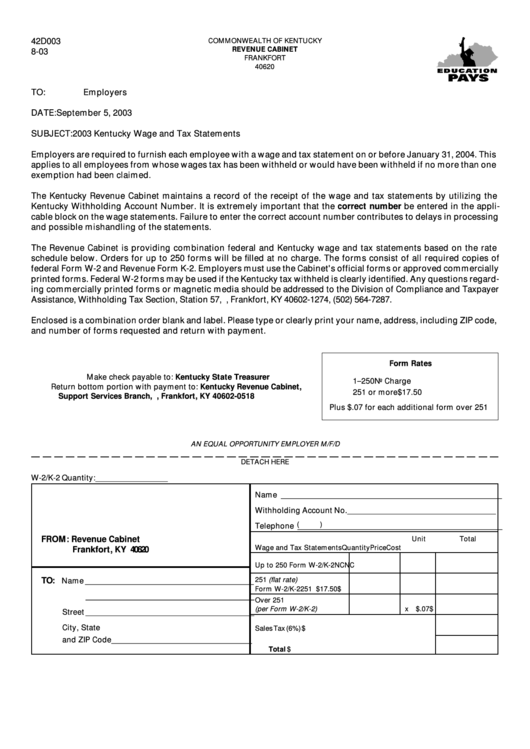

Form Rates

Make check payable to: Kentucky State Treasurer

1–250

No Charge

Return bottom portion with payment to: Kentucky Revenue Cabinet,

251 or more

$17.50

Support Services Branch, P .O. Box 518, Frankfort, KY 40602-0518

Plus $ .07 for each additional form over 251

AN EQUAL OPPORTUNITY EMPLOYER M/F/D

DETACH HERE

W-2/K-2 Quantity:__________________

Name _______________________________________________________

Withholding Account No. _____________________________________

(

)

Telephone ___________________________________________________

FROM: Revenue Cabinet

Unit

Total

Wage and Tax Statements

Quantity

Price

Cost

Frankfort, KY

40620

Up to 250 Form W-2/K-2

NC

NC

TO:

251 (flat rate)

Name __________________________________________

Form W-2/K-2

251

$ 17.50

$

__________________________________________

Over 251

(per Form W-2/K-2)

x $.07

$

Street __________________________________________

City, State

Sales Tax (6%) ...................................................................

$

and ZIP Code ___________________________________

Total ............................................................................

$

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1