Form Hm-4 - Return Of Hotel Motel Tax - City Of Dayton

ADVERTISEMENT

For Office Use Only

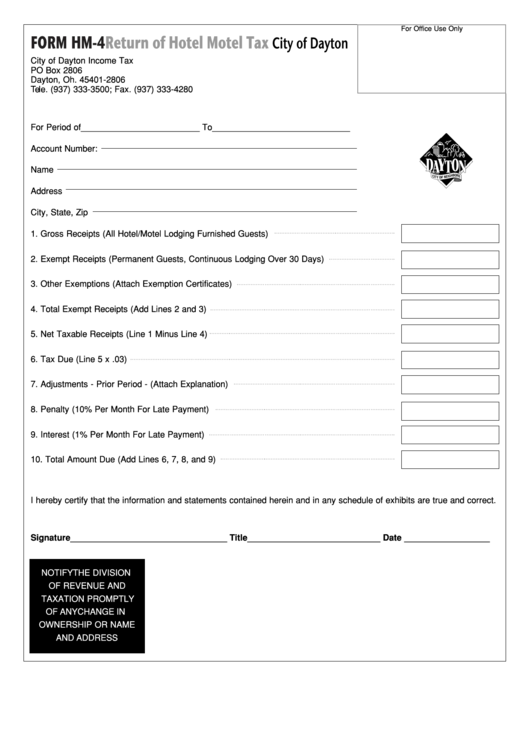

FORM HM-4

Return of Hotel Motel Tax

City of Dayton

City of Dayton Income Tax

PO Box 2806

Dayton, Oh. 45401-2806

Tele. (937) 333-3500; Fax. (937) 333-4280

For Period of_________________________ To_____________________________

Account Number:

Name

Address

City, State, Zip

1. Gross Receipts (All Hotel/Motel Lodging Furnished Guests)

2. Exempt Receipts (Permanent Guests, Continuous Lodging Over 30 Days)

3. Other Exemptions (Attach Exemption Certificates)

4. Total Exempt Receipts (Add Lines 2 and 3)

5. Net Taxable Receipts (Line 1 Minus Line 4)

6. Tax Due (Line 5 x .03)

7. Adjustments - Prior Period - (Attach Explanation)

8. Penalty (10% Per Month For Late Payment)

9. Interest (1% Per Month For Late Payment)

10. Total Amount Due (Add Lines 6, 7, 8, and 9)

I hereby certify that the information and statements contained herein and in any schedule of exhibits are true and correct.

Signature_________________________________ Title____________________________ Date __________________

NOTIFY THE DIVISION

OF REVENUE AND

TAXATION PROMPTLY

OF ANY CHANGE IN

OWNERSHIP OR NAME

AND ADDRESS

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1