Individual/business Income Tax Return - Ashland Municipal Income Tax - 2010

ADVERTISEMENT

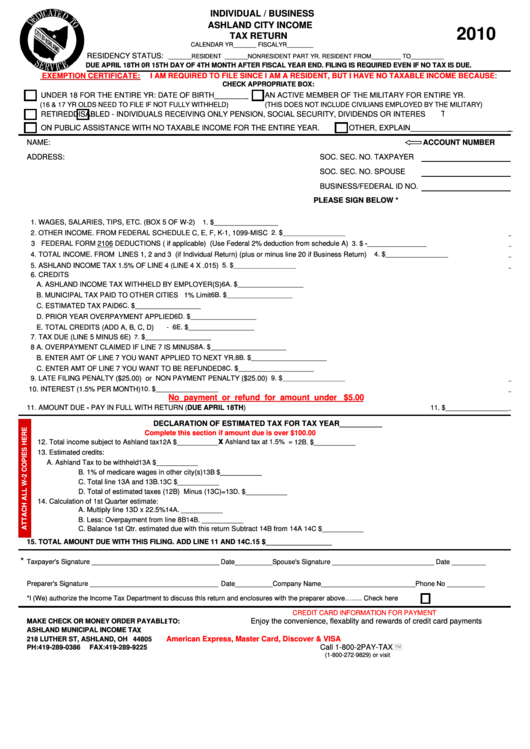

INDIVIDUAL / BUSINESS

ASHLAND CITY INCOME

2010

TAX RETURN

CALENDAR YR_______ FISCALYR________

RESIDENCY STATUS:

_______RESIDENT _______NONRESIDENT

PART YR. RESIDENT FROM_________ TO__________

DUE APRIL 18TH 0R 15TH DAY OF 4TH MONTH AFTER FISCAL YEAR END. FILING IS REQUIRED EVEN IF NO TAX IS DUE.

EXEMPTION CERTIFICATE:

I AM REQUIRED TO FILE SINCE I AM A RESIDENT, BUT I HAVE NO TAXABLE INCOME BECAUSE

:

CHECK APPROPRIATE BOX:

UNDER 18 FOR THE ENTIRE YR: DATE OF BIRTH_________

AN ACTIVE MEMBER OF THE MILITARY FOR ENTIRE YR.

(16 & 17 YR OLDS NEED TO FILE IF NOT FULLY WITHHELD)

(THIS DOES NOT INCLUDE CIVILIANS EMPLOYED BY THE MILITARY)

RETIRED

DISABLED - INDIVIDUALS RECEIVING ONLY PENSION, SOCIAL SECURITY, DIVIDENDS OR INTEREST

ON PUBLIC ASSISTANCE WITH NO TAXABLE INCOME FOR THE ENTIRE YEAR.

OTHER, EXPLAIN_________________________

NAME:

ACCOUNT NUMBER

ADDRESS:

SOC. SEC. NO. TAXPAYER

SOC. SEC. NO. SPOUSE

BUSINESS/FEDERAL ID NO.

PLEASE SIGN BELOW *

1. WAGES, SALARIES, TIPS, ETC. (BOX 5 OF W-2)

1. $_________________

2. $

2. OTHER INCOME. FROM FEDERAL SCHEDULE C, E, F, K-1, 1099-MISC

____________________

3 FEDERAL FORM 2106 DEDUCTIONS ( if applicable) (Use Federal 2% deduction from schedule A)

3. $ -

___________________

4. TOTAL INCOME. FROM LINES 1, 2 and 3 (if Individual Return) (plus or minus line 20 if Business Return)

4. $

____________________

5. ASHLAND INCOME TAX 1.5% OF LINE 4 (LINE 4 X .015)

5. $

____________________

6. CREDITS

A. ASHLAND INCOME TAX WITHHELD BY EMPLOYER(S)

6A. $

____________________

B. MUNICIPAL TAX PAID TO OTHER CITIES 1% Limit

6B. $

____________________

C. ESTIMATED TAX PAID

6C. $

____________________

D. PRIOR YEAR OVERPAYMENT APPLIED

6D. $

____________________

E. TOTAL CREDITS (ADD A, B, C, D)

- 6E. $

____________________

7. TAX DUE (LINE 5 MINUS 6E)

7

. $

____________________

8A. $

8 A. OVERPAYMENT CLAIMED IF LINE 7 IS MINUS

_______________________

B. ENTER AMT OF LINE 7 YOU WANT APPLIED TO NEXT YR.

8B. $

_______________________

C. ENTER AMT OF LINE 7 YOU WANT TO BE REFUNDED

8C. $

_______________________

9. LATE FILING PENALTY ($25.00) or NON PAYMENT PENALTY ($25.00)

9. $

____________________

10. INTEREST (1.5% PER MONTH)

10. $

____________________

No payment or refund for amount under $5.00

11. AMOUNT DUE - PAY IN FULL WITH RETURN (DUE APRIL 18TH)

11. $

____________________

DECLARATION OF ESTIMATED TAX FOR TAX YEAR__________

Complete this section if amount due is over $100.00

x

Ashland tax at 1.5% =

12. Total income subject to Ashland tax

12A $___________

12B. $___________

13. Estimated credits:

A. Ashland Tax to be withheld

13A $___________

B. 1% of medicare wages in other city(s)

13B $___________

C. Total line 13A and 13B.

13C $___________

D. Total of estimated taxes (12B) Minus (13C)

=

13D. $___________

14. Calculation of 1st Quarter estimate:

A. Multiply line 13D x 22.5%

14A. ___________

B. Less: Overpayment from line 8B

14B. ___________

C. Balance 1st Qtr. estimated due with this return Subtract 14B from 14A

14C $___________

15. TOTAL AMOUNT DUE WITH THIS FILING. ADD LINE 11 AND 14C.

15 $_________________

*

Taxpayer's Signature __________________________________

Date__________

Spouse's Signature ___________________________ Date _________

Preparer's Signature __________________________________

Date__________

Company Name_________________________Phone No __________

*I (We) authorize the Income Tax Department to discuss this return and enclosures with the preparer above…….. Check here

CREDIT CARD INFORMATION FOR PAYMENT

Enjoy the convenience, flexablity and rewards of credit card payments.

MAKE CHECK OR MONEY ORDER PAYABLETO:

ASHLAND MUNICIPAL INCOME TAX

American Express, Master Card, Discover & VISA

218 LUTHER ST, ASHLAND, OH 44805

Call 1-800-2PAY-TAX

PH:419-289-0386

FAX:419-289-9225

(1-800-272-9829) or visit

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2