Form St-7r - Motor Vehicle Certificate Of Payment Of Sales Or Use Tax

ADVERTISEMENT

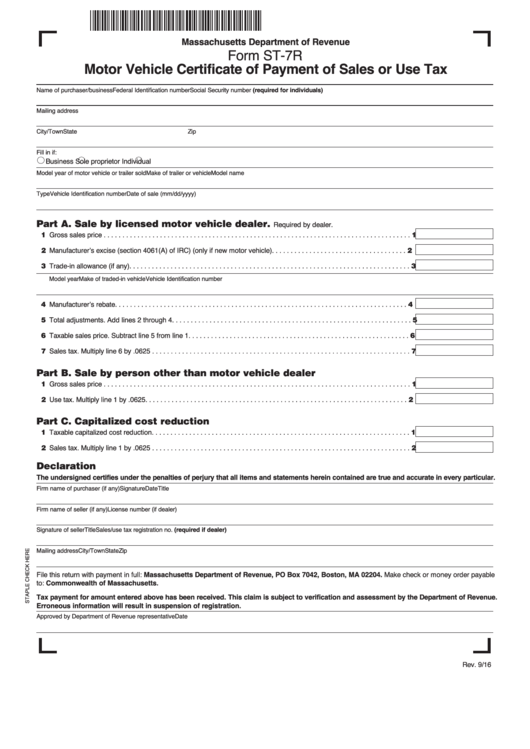

Massachusetts Department of Revenue

Form ST-7R

Motor Vehicle Certificate of Payment of Sales or Use Tax

Name of purchaser/business

Federal Identification number

Social Security number (required for individuals)

Mailing address

City/Town

State

Zip

Fill in if:

Business

Sole proprietor

Individual

Model year of motor vehicle or trailer sold

Make of trailer or vehicle

Model name

Type

Vehicle Identification number

Date of sale (mm/dd/yyyy)

Part A. Sale by licensed motor vehicle dealer.

Required by dealer.

11 Gross sales price . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

12 Manufacturer’s excise (section 4061(A) of IRC) (only if new motor vehicle) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

13 Trade-in allowance (if any). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

Model year

Make of traded-in vehicle

Vehicle Identification number

14 Manufacturer’s rebate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

15 Total adjustments. Add lines 2 through 4. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

16 Taxable sales price. Subtract line 5 from line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

17 Sales tax. Multiply line 6 by .0625 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

Part B. Sale by person other than motor vehicle dealer

11 Gross sales price . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

12 Use tax. Multiply line 1 by .0625 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

Part C. Capitalized cost reduction

11 Taxable capitalized cost reduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

12 Sales tax. Multiply line 1 by .0625 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

Declaration

The undersigned certifies under the penalties of perjury that all items and statements herein contained are true and accurate in every particular.

Firm name of purchaser (if any)

Signature

Date

Title

Firm name of seller (if any)

License number (if dealer)

Signature of seller

Title

Sales/use tax registration no. (required if dealer)

Mailing address

City/Town

State

Zip

File this return with payment in full: Massachusetts Department of Revenue, PO Box 7042, Boston, MA 02204. Make check or money order payable

to: Commonwealth of Massachusetts.

Tax payment for amount entered above has been received. This claim is subject to verification and assessment by the Department of Revenue.

Erroneous information will result in suspension of registration.

Approved by Department of Revenue representative

Date

Rev. 9/16

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1