Form St-30 - Notice Of Business Change - Minnesota Department Of Revenue

ADVERTISEMENT

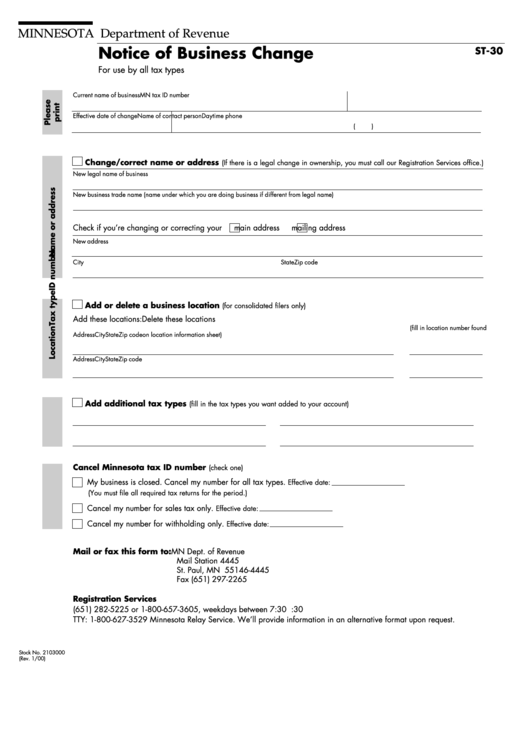

MINNESOTA Department of Revenue

Notice of Business Change

ST-30

For use by all tax types

Current name of business

MN tax ID number

Effective date of change

Name of contact person

Daytime phone

(

)

Change/correct name or address

(If there is a legal change in ownership, you must call our Registration Services office.)

New legal name of business

New business trade name (name under which you are doing business if different from legal name)

Check if you’re changing or correcting your

main address

mailing address

New address

City

State

Zip code

Add or delete a business location

(for consolidated filers only)

Add these locations:

Delete these locations

(fill in location number found

Address

City

State

Zip code

on location information sheet)

Address

City

State

Zip code

Add additional tax types

(fill in the tax types you want added to your account)

Cancel Minnesota tax ID number

(check one)

My business is closed. Cancel my number for all tax types.

Effective date:

(You must file all required tax returns for the period.)

Cancel my number for sales tax only.

Effective date:

Cancel my number for withholding only.

Effective date:

Mail or fax this form to: MN Dept. of Revenue

Mail Station 4445

St. Paul, MN 55146-4445

Fax (651) 297-2265

Registration Services

(651) 282-5225 or 1-800-657-3605, weekdays between 7:30 a.m. and 4:30 p.m.

TTY: 1-800-627-3529 Minnesota Relay Service. We’ll provide information in an alternative format upon request.

Stock No. 2103000

(Rev. 1/00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1