Instructions For Form St-30 - Notice Of Business Change - Minnesota Department Of Revenue

ADVERTISEMENT

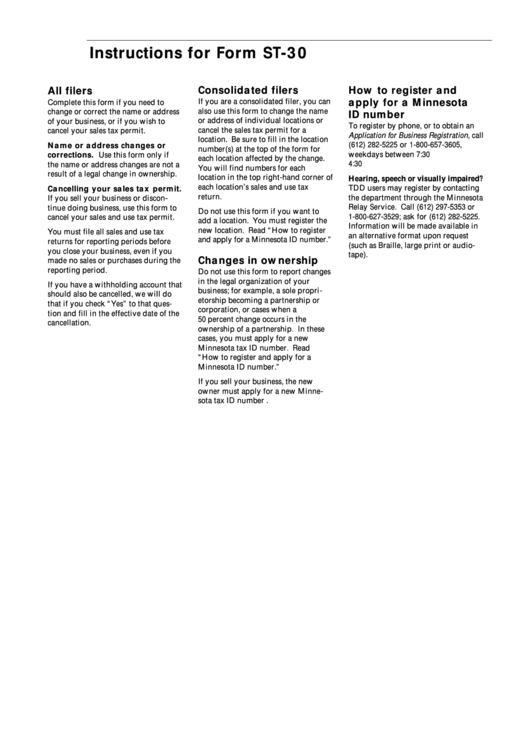

Instructions for Form ST-30

Consolidated filers

How to register and

All filers

apply for a Minnesota

If you are a consolidated filer, you can

Complete this form if you need to

also use this form to change the name

change or correct the name or address

ID number

or address of individual locations or

of your business, or if you wish to

To register by phone, or to obtain an

cancel the sales tax permit for a

cancel your sales tax permit.

Application for Business Registration, call

location. Be sure to fill in the location

Name or address changes or

(612) 282-5225 or 1-800-657-3605,

number(s) at the top of the form for

corrections. Use this form only if

weekdays between 7:30 a.m. and

each location affected by the change.

4:30 p.m.

the name or address changes are not a

You will find numbers for each

result of a legal change in ownership.

location in the top right-hand corner of

Hearing, speech or visually impaired?

each location’s sales and use tax

Cancelling your sales tax permit.

TDD users may register by contacting

return.

the department through the Minnesota

If you sell your business or discon-

Relay Service. Call (612) 297-5353 or

tinue doing business, use this form to

Do not use this form if you want to

1-800-627-3529; ask for (612) 282-5225.

cancel your sales and use tax permit.

add a location. You must register the

Information will be made available in

new location. Read “How to register

You must file all sales and use tax

an alternative format upon request

and apply for a Minnesota ID number.”

returns for reporting periods before

(such as Braille, large print or audio-

you close your business, even if you

tape).

Changes in ownership

made no sales or purchases during the

reporting period.

Do not use this form to report changes

in the legal organization of your

If you have a withholding account that

business; for example, a sole propri-

should also be cancelled, we will do

etorship becoming a partnership or

that if you check “Yes” to that ques-

corporation, or cases when a

tion and fill in the effective date of the

50 percent change occurs in the

cancellation.

ownership of a partnership. In these

cases, you must apply for a new

Minnesota tax ID number. Read

“How to register and apply for a

Minnesota ID number.”

If you sell your business, the new

owner must apply for a new Minne-

sota tax ID number .

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1