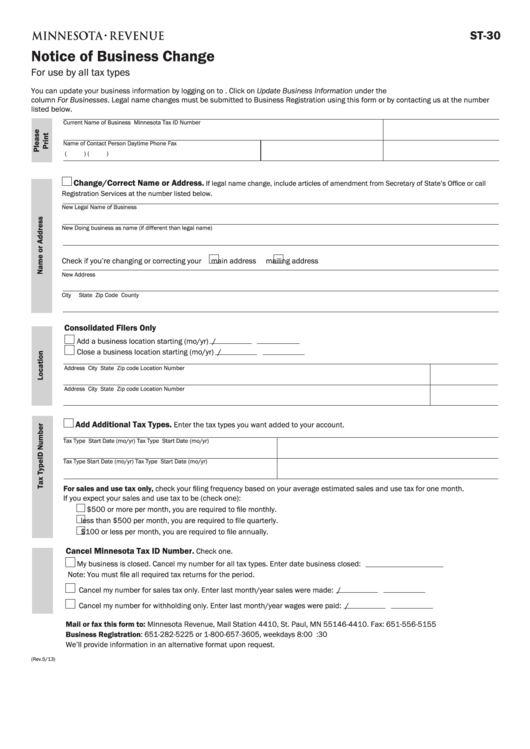

ST-30

Notice of Business Change

For use by all tax types

You can update your business information by logging on to Click on Update Business Information under the

column For Businesses. Legal name changes must be submitted to Business Registration using this form or by contacting us at the number

listed below.

Current Name of Business

Minnesota Tax ID Number

Name of Contact Person

Daytime Phone

Fax

(

)

(

)

Change/Correct Name or Address.

If legal name change, include articles of amendment from Secretary of State’s Office or call

Registration Services at the number listed below.

New Legal Name of Business

New Doing business as name (if different than legal name)

Check if you’re changing or correcting your

main address

mailing address

New Address

City

State

Zip Code

County

Consolidated Filers Only

Add a business location starting (mo/yr)

/

Close a business location starting (mo/yr)

/

Address

City

State

Zip code

Location Number

Address

City

State

Zip code

Location Number

Add Additional Tax Types.

Enter the tax types you want added to your account.

Tax Type

Start Date (mo/yr)

Tax Type

Start Date (mo/yr)

Tax Type

Start Date (mo/yr)

Tax Type

Start Date (mo/yr)

For sales and use tax only, check your filing frequency based on your average estimated sales and use tax for one month.

If you expect your sales and use tax to be (check one):

$500 or more per month, you are required to file monthly.

less than $500 per month, you are required to file quarterly.

$100 or less per month, you are required to file annually.

Cancel Minnesota Tax ID Number.

Check one.

My business is closed. Cancel my number for all tax types. Enter date business closed:

Note: You must file all required tax returns for the period.

Cancel my number for sales tax only. Enter last month/year sales were made:

/

Cancel my number for withholding only. Enter last month/year wages were paid:

/

Mail or fax this form to: Minnesota Revenue, Mail Station 4410, St. Paul, MN 55146-4410. Fax: 651-556-5155

Business Registration: 651-282-5225 or 1-800-657-3605, weekdays 8:00 a.m. to 4:30 p.m.

We’ll provide information in an alternative format upon request.

(Rev.5/13)

1

1