Form Cd-57hc Instructions - Real Estate Transfer Tax Declaration Of Consideration For Real Estate Holding Companies

ADVERTISEMENT

FORM

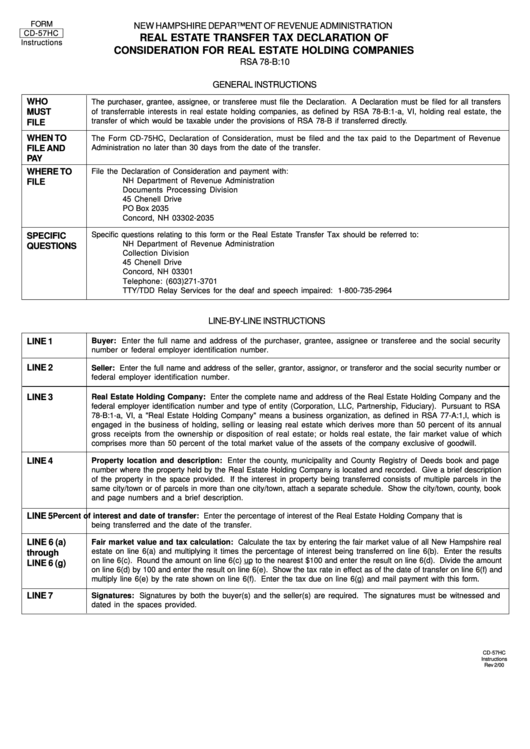

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

CD-57HC

REAL ESTATE TRANSFER TAX DECLARATION OF

Instructions

CONSIDERATION FOR REAL ESTATE HOLDING COMPANIES

RSA 78-B:10

GENERAL INSTRUCTIONS

WHO

The purchaser, grantee, assignee, or transferee must file the Declaration. A Declaration must be filed for all transfers

MUST

of transferrable interests in real estate holding companies, as defined by RSA 78-B:1-a, VI, holding real estate, the

transfer of which would be taxable under the provisions of RSA 78-B if transferred directly.

FILE

WHEN TO

The Form CD-75HC, Declaration of Consideration, must be filed and the tax paid to the Department of Revenue

FILE AND

Administration no later than 30 days from the date of the transfer.

PAY

WHERE TO

File the Declaration of Consideration and payment with:

NH Department of Revenue Administration

FILE

Documents Processing Division

45 Chenell Drive

PO Box 2035

Concord, NH 03302-2035

Specific questions relating to this form or the Real Estate Transfer Tax should be referred to:

SPECIFIC

NH Department of Revenue Administration

QUESTIONS

Collection Division

45 Chenell Drive

Concord, NH 03301

Telephone: (603)271-3701

TTY/TDD Relay Services for the deaf and speech impaired: 1-800-735-2964

LINE-BY-LINE INSTRUCTIONS

Buyer: Enter the full name and address of the purchaser, grantee, assignee or transferee and the social security

LINE 1

number or federal employer identification number.

LINE 2

Seller: Enter the full name and address of the seller, grantor, assignor, or transferor and the social security number or

federal employer identification number.

LINE 3

Real Estate Holding Company: Enter the complete name and address of the Real Estate Holding Company and the

federal employer identification number and type of entity (Corporation, LLC, Partnership, Fiduciary). Pursuant to RSA

78-B:1-a, VI, a "Real Estate Holding Company" means a business organization, as defined in RSA 77-A:1,I, which is

engaged in the business of holding, selling or leasing real estate which derives more than 50 percent of its annual

gross receipts from the ownership or disposition of real estate; or holds real estate, the fair market value of which

comprises more than 50 percent of the total market value of the assets of the company exclusive of goodwill.

LINE 4

Property location and description: Enter the county, municipality and County Registry of Deeds book and page

number where the property held by the Real Estate Holding Company is located and recorded. Give a brief description

of the property in the space provided. If the interest in property being transferred consists of multiple parcels in the

same city/town or of parcels in more than one city/town, attach a separate schedule. Show the city/town, county, book

and page numbers and a brief description.

LINE 5

Percent of interest and date of transfer: Enter the percentage of interest of the Real Estate Holding Company that is

being transferred and the date of the transfer.

Fair market value and tax calculation: Calculate the tax by entering the fair market value of all New Hampshire real

LINE 6 (a)

estate on line 6(a) and multiplying it times the percentage of interest being transferred on line 6(b). Enter the results

through

on line 6(c). Round the amount on line 6(c) up to the nearest $100 and enter the result on line 6(d). Divide the amount

LINE 6 (g)

on line 6(d) by 100 and enter the result on line 6(e). Show the tax rate in effect as of the date of transfer on line 6(f) and

multiply line 6(e) by the rate shown on line 6(f). Enter the tax due on line 6(g) and mail payment with this form.

LINE 7

Signatures: Signatures by both the buyer(s) and the seller(s) are required. The signatures must be witnessed and

dated in the spaces provided.

CD-57HC

Instructions

Rev 2/00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1