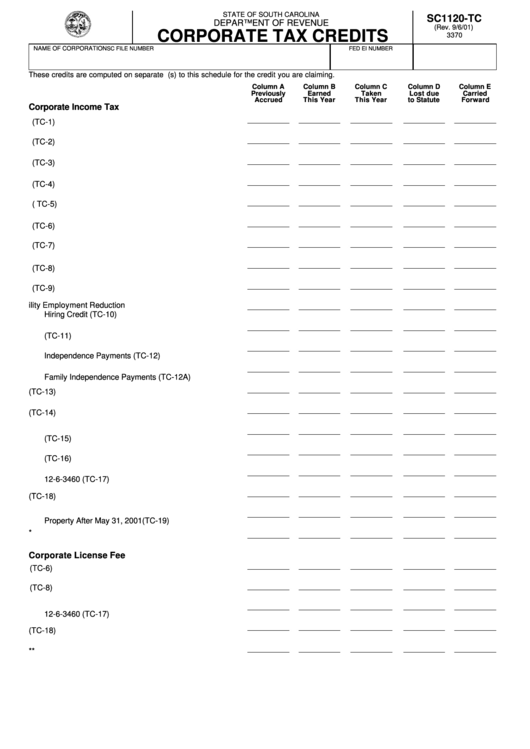

Form Sc1120-Tc - Corporate Tax Credits - South Carolina Department Of Revenue

ADVERTISEMENT

STATE OF SOUTH CAROLINA

SC1120-TC

DEPARTMENT OF REVENUE

(Rev. 9/6/01)

CORPORATE TAX CREDITS

3370

NAME OF CORPORATION

FED EI NUMBER

SC FILE NUMBER

These credits are computed on separate forms. Be sure to attach the appropriate form(s) to this schedule for the credit you are claiming.

Column A

Column B

Column C

Column D

Column E

Previously

Earned

Taken

Lost due

Carried

Accrued

This Year

This Year

to Statute

Forward

Corporate Income Tax

1. Drip/Trickle Irrigation Systems Credit (TC-1)

2. Minority Business Credit (TC-2)

3. Water Resources Credit (TC-3)

4. New Jobs Credit (TC-4)

5. Scenic River Tax Credit ( TC-5)

6. Infrastructure Credit (TC-6)

7. Palmetto Seed Capital Credit (TC-7)

8. Corporate Headquarters Credit (TC-8)

9. Credit for Child Care Program (TC-9)

10. Base Closure/Federal Facility Employment Reduction

Hiring Credit (TC-10)

11. Economic Impact Zone Property Investment Credit

(TC-11)

12. Credit for Employers Hiring Recipients of Family

Independence Payments (TC-12)

13. Additional Credit for Employers Hiring Recipients of

Family Independence Payments (TC-12A)

14. Motion Picture Credits (TC-13)

15. Community Development Tax Credit (TC-14)

16. Corporate Tax Moratorium per Section 12-10-35

(TC-15)

17. Corporate Tax Moratorium per Section 12-6-3365

(TC-16)

18. Recycling Property Tax Credit per SC Code Section

12-6-3460 (TC-17)

19. Research and Development Credit (TC-18)

20. Credit for Qualified Conservation Contribution of Real

Property After May 31, 2001 (TC-19)

21. Total Corporate Income Credits. *

Corporate License Fee

22. Infrastructure Credit (TC-6)

23. Corporate Headquarters Credit (TC-8)

24. Recycling Property Tax Credit per SC Code Section

12-6-3460 (TC-17)

25. Research and Development Credit (TC-18)

26. Total Corporate License Fee Credits. **

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1