Form G-600 - Gift Tax Return - North Carolina Department Of Revenue

ADVERTISEMENT

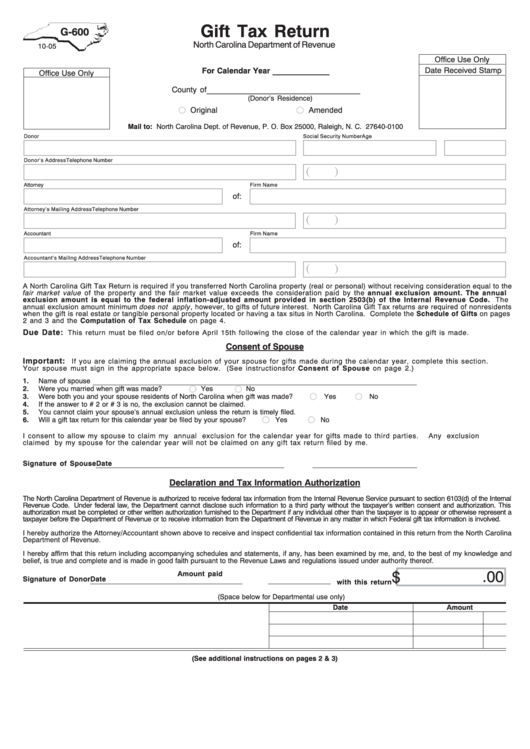

Gift Tax Return

G-600

North Carolina Department of Revenue

10-05

Office Use Only

For Calendar Year _____________

Date Received Stamp

Office Use Only

County of___________________________________

(Donor’s Residence)

Original

Amended

Mail to: North Carolina Dept. of Revenue, P. O. Box 25000, Raleigh, N. C. 27640-0100

Donor

Social Security Number

Age

Donor’s Address

Telephone Number

(

)

Attorney

Firm Name

of:

Attorney’s Mailing Address

Telephone Number

(

)

Accountant

Firm Name

of:

Accountant’s Mailing Address

Telephone Number

(

)

A North Carolina Gift Tax Return is required if you transferred North Carolina property (real or personal) without receiving consideration equal to the

fair market value of the property and the fair market value exceeds the consideration paid by the annual exclusion amount. The annual

exclusion amount is equal to the federal inflation-adjusted amount provided in section 2503(b) of the Internal Revenue Code. The

annual exclusion amount minimum does not apply, however, to gifts of future interest. North Carolina Gift Tax returns are required of nonresidents

when the gift is real estate or tangible personal property located or having a tax situs in North Carolina. Complete the Schedule of Gifts on pages

2 and 3 and the Computation of Tax Schedule on page 4.

Due Date:

This return must be filed on/or before April 15th following the close of the calendar year in which the gift is made.

Consent of Spouse

Important:

If you are claiming the annual exclusion of your spouse for gifts made during the calendar year, complete this section.

Your spouse must sign in the appropriate space below. (See instructions for Consent of Spouse on page 2.)

1.

Name of spouse

2.

Were you married when gift was made?

Yes

No

3.

Were both you and your spouse residents of North Carolina when gift was made?

Yes

No

4.

If the answer to # 2 or # 3 is no, the exclusion cannot be claimed.

5.

You cannot claim your spouse’s annual exclusion unless the return is timely filed.

6.

Will a gift tax return for this calendar year be filed by your spouse?

Yes

No

I consent to allow my spouse to claim my annual exclusion for the calendar year for gifts made to third parties.

Any exclusion

claimed by my spouse for the calendar year will not be claimed on any gift tax return filed by me.

Signature of Spouse

Date

Declaration and Tax Information Authorization

The North Carolina Department of Revenue is authorized to receive federal tax information from the Internal Revenue Service pursuant to section 6103(d) of the Internal

Revenue Code. Under federal law, the Department cannot disclose such information to a third party without the taxpayer’s written consent and authorization. This

authorization must be completed or other written authorization furnished to the Department if any individual other than the taxpayer is to appear or otherwise represent a

taxpayer before the Department of Revenue or to receive information from the Department of Revenue in any matter in which Federal gift tax information is involved.

I hereby authorize the Attorney/Accountant shown above to receive and inspect confidential tax information contained in this return from the North Carolina

Department of Revenue.

I hereby affirm that this return including accompanying schedules and statements, if any, has been examined by me, and, to the best of my knowledge and

belief, is true and complete and is made in good faith pursuant to the Revenue Laws and regulations issued under authority thereof.

.00

$

Amount paid

Signature of Donor

Date

with this return

(Space below for Departmental use only)

Date

Amount

(See additional instructions on pages 2 & 3)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4