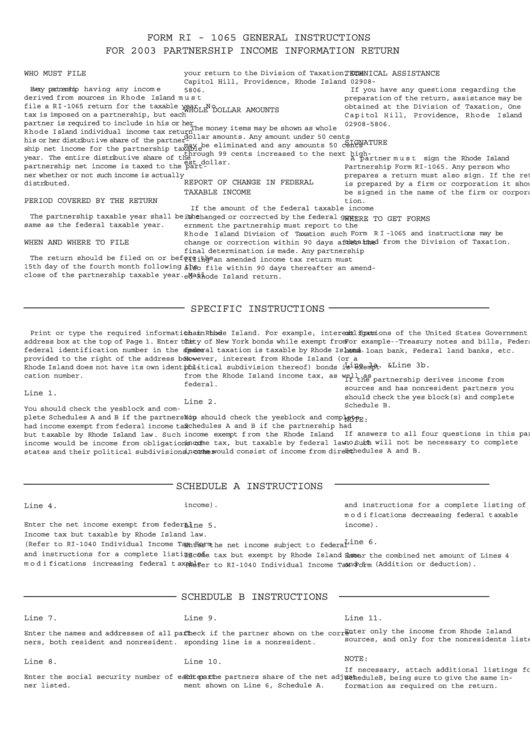

Form Ri-1065 General Instructons For 2003 Partnership Income Information Return

ADVERTISEMENT

FORM RI - 1065 GENERAL INSTRUCTIONS

FOR 2003 PAR TNERSHIP INCOME INFORMATION RETURN

your r etur n to the Division of Taxation, One

WHO MUST FILE

TECHNICAL ASSISTANCE

Capitol Hill, Pr ovidence, Rhode Island 02908-

Ever y par t ner shi p havi ng any i ncom e

If you have any questions r egar ding the

5806.

der i ved f r om sour ces i n R hode I sl and m ust

pr eparation of the r etur n, assistance may be

f i l e a R I -1065 r et ur n f or t he t axabl e year . N o

obtained at the Division of Taxation, One

WHOLE DOLLAR AMOUNTS

t ax i s i m posed on a par t ner shi p, but each

C api t ol H i l l , Pr ovi dence, R hode I sl and

par t ner i s r equi r ed t o i ncl ude i n hi s or her

02908-5806.

The money items may be shown as whole

R hode I sl and i ndi vi dual i ncom e t ax r et ur n

dollar amounts. Any amount under 50 cents

hi s or her di st r i but i ve shar e of t he par t ner -

SIGNATURE

may be eliminated and any amounts 50 cents

shi p net i ncom e f or t he par t ner shi p t axabl e

thr ough 99 cents incr eased to the next high-

year . The ent i r e di st r i but i ve shar e of t he

A par t ner m ust si gn t he Rhode I sl and

est dollar .

par t ner shi p net i ncom e i s t axed t o t he par t -

Partnership Form RI-1065. Any person who

ner w het her or not such i ncom e i s act ual l y

pr epar es a r etur n must also sign. If the r etur n

REPOR T OF CHANGE IN FEDERAL

di st r i but ed.

is pr epar ed by a firm or corporation it should

TAXABLE INCOME

be signed in the name of the firm or corpora-

PERIOD COVERED BY THE RETURN

tion.

If the amount of the federal taxable income

The partnership taxable year shall be the

is changed or corr ected by the federal gov-

WHERE TO GET FORMS

same as the federal taxable year .

er nment the partnership must r eport to the

For m RI - 1065 and i nst r uct i ons m ay be

R hode I sl and D i vi si on of Taxat i on such

obtained fr om the Division of Taxation.

WHEN AND WHERE TO FILE

change or corr ection within 90 days after the

final determination is made. Any partnership

The r etur n should be filed on or befor e the

filing an amended income tax r etur n must

15th day of the fourth month following the

also file within 90 days ther eafter an amend-

close of the partnership taxable year . Mail

ed Rhode Island r etur n.

SPECIFIC INSTRUCTIONS

Print or type the r equir ed information in the

than Rhode Island. For example, inter est fr om

obligations of the United States Gover nment.

addr ess box at the top of Page 1. Enter the

City of New York bonds while exempt fr om

For example--Tr easury notes and bills, Federal

federal identification number in the space

federal taxation is taxable by Rhode Island.

home loan bank, Federal land banks, etc.

pr ovided to the right of the addr ess box--

However , inter est fr om Rhode Island (or a

Line 3a. & Line 3b.

Rhode Island does not have its own identifi-

political subdivision ther eof) bonds is exempt

cation number .

fr om the Rhode Island income tax, as well as

If the partnership derives income fr om R.I.

federal.

sour ces and has nonr esident partners you

Line 1.

should check the yes block(s) and complete

Line 2.

Schedule B.

You should check the yes block and com-

plete Schedules A and B if the partnership

You should check the

yes block and complete

NOTE:

had income exempt fr om federal income tax

Schedules A and B if the partnership had

If answers to all four questions in this part ar e

i ncom e exem pt f r om

t he R hode I sl and

but t axabl e by R hode I sl and l aw . Such

no, it will not be necessary to complete

income would be income fr om obligations of

income tax, but taxable by federal law . Such

Schedules A and B.

states and their political subdivisions, other

income would consist of income fr om dir ect

SCHEDULE A INSTRUCTIONS

Line 4.

income).

and instructions for a complete listing of

m odi f i cat i ons decr easi ng f eder al t axabl e

Enter the net income exempt fr om federal

income).

Line 5.

Income tax but taxable by Rhode Island law .

Line 6.

(Refer to RI-1040 Individual Income Tax Form

Ent er t he net i ncom e subj ect t o f eder al

and instructions for a complete listing of

Income tax but exempt by Rhode Island law .

Enter the combined net amount of Lines 4

m odi f i cat i ons i ncr easi ng f eder al t axabl e

and 5. (Addition or deduction).

(Refer to RI-1040 Individual Income Tax Form

SCHEDULE B INSTRUCTIONS

Line 7.

Line 9.

Line 11.

Enter only the income fr om Rhode Island

Enter the names and addr esses of all part-

Check if the partner shown on the corr e-

sour ces, and only for the nonr esidents listed.

ners, both r esident and nonr esident.

sponding line is a nonr esident.

NOTE:

Line 8.

Line 10.

If necessary, attach additional listings fo

Enter the social security number of each part-

Enter the partners shar e of the net adjust-

Schedule B, being sur e to give the same in-

ner listed.

ment shown on Line 6, Schedule A.

formation as r equir ed on the r etur n.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1