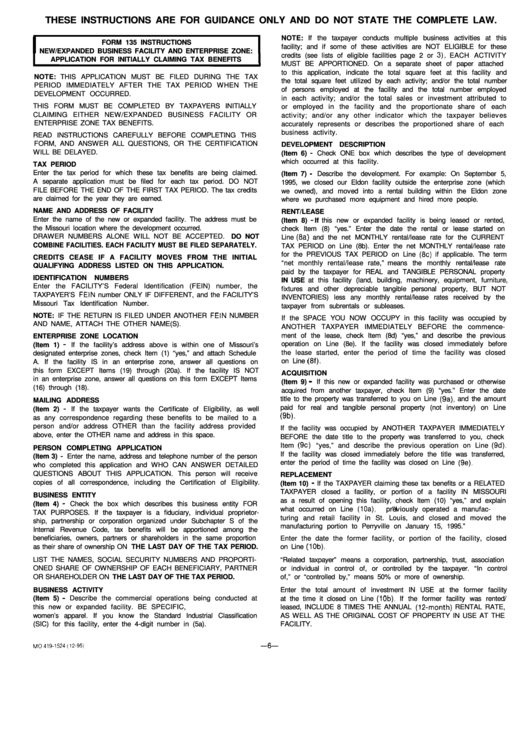

Form 135 Instructions - New/expanded Business Facility And Enterprise Zone: I Application For Initially Claiming Tax Benefits

ADVERTISEMENT

I

I

(9b).

MO419-1524 (12-95)

-6-

THESE INSTRUCTIONS ARE FOR GUIDANCE ONLY AND DO NOT STATE THE COMPLETE LAW.

NOTE: If the taxpayer conducts multiple business activities at this

FORM 135 INSTRUCTIONS

facility; and if some of these activities are NOT ELIGIBLE for these

NEW/EXPANDED BUSINESS FACILITY AND ENTERPRISE ZONE:

credits (see lists of eligible facilities page 2 or 3), EACH ACTIVITY

APPLICATION FOR INITIALLY CLAIMING TAX BENEFITS

MUST BE APPORTIONED. On a separate sheet of paper attached

to this application, indicate the total square feet at this facility and

NOTE: THIS APPLICATION MUST BE FILED DURING THE TAX

the total square feet utilized by each activity; and/or the total number

PERIOD IMMEDIATELY AFTER THE TAX PERIOD WHEN THE

of persons employed at the facility and the total number employed

DEVELOPMENT OCCURRED.

in each activity; and/or the total sales or investment attributed to

THIS FORM MUST BE COMPLETED BY TAXPAYERS INITIALLY

or employed in the facility and the proportionate share of each

CLAIMING EITHER NEW/EXPANDED BUSINESS FACILITY OR

activity; and/or any other indicator which the taxpayer believes

ENTERPRISE ZONE TAX BENEFITS.

accurately represents or describes the proportioned share of each

business activity.

READ INSTRUCTIONS CAREFULLY BEFORE COMPLETING THIS

FORM, AND ANSWER ALL QUESTIONS, OR THE CERTIFICATION

DEVELOPMENT DESCRIPTION

WILL BE DELAYED.

(Item 6) - Check ONE box which describes the type of development

which occurred at this facility.

TAX PERIOD

Enter the tax period for which these tax benefits are being claimed.

(Item 7) - Describe the development. For example: On September 5,

A separate application must be filed for each tax period. DO NOT

1995, we closed our Eldon facility outside the enterprise zone (which

FILE BEFORE THE END OF THE FIRST TAX PERIOD. The tax credits

we owned), and moved into a rental building within the Eldon zone

are claimed for the year they are earned.

where we purchased more equipment and hired more people.

NAME AND ADDRESS OF FACILITY

RENT/LEASE

Enter the name of the new or expanded facility. The address must be

(Item 8) - If this new or expanded facility is being leased or rented,

the Missouri location where the development occurred. P.O. BOXES OR

check Item (8) “ yes.” Enter the date the rental or lease started on

DRAWER NUMBERS ALONE WILL NOT BE ACCEPTED. DO NOT

Line (8a) and the net MONTHLY rental/lease rate for the CURRENT

COMBINE FACILITIES. EACH FACILITY MUST BE FILED SEPARATELY.

TAX PERIOD on Line (8b). Enter the net MONTHLY rental/lease rate

for the PREVIOUS TAX PERIOD on Line (8~) if applicable. The term

CREDITS CEASE IF A FACILITY MOVES FROM THE INITIAL

“ net monthly rental/lease rate,” means the monthly rental/lease rate

QUALIFYING ADDRESS LISTED ON THIS APPLICATION.

paid by the taxpayer for REAL and TANGIBLE PERSONAL property

IDENTIFICATION

NUMBERS

IN USE at this facility (land, building, machinery, equipment, furniture,

Enter the FACILITY’ S Federal Identification (FEIN) number, the

fixtures and other depreciable tangible personal property, BUT NOT

TAXPAYER’ S FEIN number ONLY IF DIFFERENT, and the FACILITY’ S

INVENTORIES) less any monthly rental/lease rates received by the

Missouri Tax Identification Number.

taxpayer from subrentals or subleases.

NOTE: IF THE RETURN IS FILED UNDER ANOTHER FEIN NUMBER

If the SPACE YOU NOW OCCUPY in this facility was occupied by

AND NAME, ATTACH THE OTHER NAME(S).

ANOTHER TAXPAYER IMMEDIATELY BEFORE the commence-

ment of the lease, check Item (8d) “ yes,” and describe the previous

ENTERPRISE ZONE LOCATION

operation on Line (8e). If the facility was closed immediately before

(Item 1) - If the facility’ s address above is within one of Missouri’ s

the lease started, enter the period of time the facility was closed

designated enterprise zones, check Item (1) “ yes,” and attach Schedule

on Line (8f).

A. If the facility IS in an enterprise zone, answer all questions on

this form EXCEPT Items (19) through (20a). If the facility IS NOT

ACQUISITION

in an enterprise zone, answer all questions on this form EXCEPT Items

(Item 9) - If this new or expanded facility was purchased or otherwise

(16) through (18).

acquired from another taxpayer, check Item (9) “ yes.” Enter the date

title to the property was transferred to you on Line (9a), and the amount

MAILING ADDRESS

paid for real and tangible personal property (not inventory) on Line

(Item 2) - If the taxpayer wants the Certificate of Eligibility, as well

as any correspondence regarding these benefits to be mailed to a

person and/or address OTHER than the facility address provided

If the facility was occupied by ANOTHER TAXPAYER IMMEDIATELY

above, enter the OTHER name and address in this space.

BEFORE the date title to the property was transferred to you, check

Item (9c) “ yes,” and describe the previous operation on Line (9d).

PERSON COMPLETING APPLICATION

If the facility was closed immediately before the title was transferred,

(Item 3) - Enter the name, address and telephone number of the person

enter the period of time the facility was closed on Line (9e).

who completed this application and WHO CAN ANSWER DETAILED

QUESTIONS ABOUT THIS APPLICATION. This person will receive

REPLACEMENT

copies of all correspondence, including the Certification of Eligibility.

(Item 10) - If the TAXPAYER claiming these tax benefits or a RELATED

TAXPAYER closed a facility, or portion of a facility IN MISSOURI

BUSINESS ENTITY

as a result of opening this facility, check Item (10) “ yes,” and explain

(Item 4) - Check the box which describes this business entity FOR

what occurred on Line (lOa), e.g. “ I previously operated a manufac-

TAX PURPOSES. If the taxpayer is a fiduciary, individual proprietor-

turing and retail facility in St. Louis, and closed and moved the

ship, partnership or corporation organized under Subchapter S of the

manufacturing portion to Perryville on January 15, 1995.”

Internal Revenue Code, tax benefits will be apportioned among the

beneficiaries, owners, partners or shareholders in the same proportion

Enter the date the former facility, or portion of the facility, closed

as their share of ownership ON THE LAST DAY OF THE TAX PERIOD.

on Line (lob).

LIST THE NAMES, SOCIAL SECURITY NUMBERS AND PROPORTI-

“ Related taxpayer” means a corporation, partnership, trust, association

ONED SHARE OF OWNERSHIP OF EACH BENEFICIARY, PARTNER

or individual in control of, or controlled by the taxpayer. “ In control

OR SHAREHOLDER ON THE LAST DAY OF THE TAX PERIOD.

of,” or “ controlled by,” means 50% or more of ownership.

BUSINESS ACTIVITY

Enter the total amount of investment IN USE at the former facility

(Item 5) - Describe the commercial operations being conducted at

at the time it closed on Line (lob). If the former facility was rented/

this new or expanded facility. BE SPECIFIC, e.g. manufacturer of

leased, INCLUDE 8 TIMES THE ANNUAL (1Pmonth) RENTAL RATE,

women’ s apparel. If you know the Standard Industrial Classification

AS WELL AS THE ORIGINAL COST OF PROPERTY IN USE AT THE

(SIC) for this facility, enter the 4-digit number in (5a).

FACILITY.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10