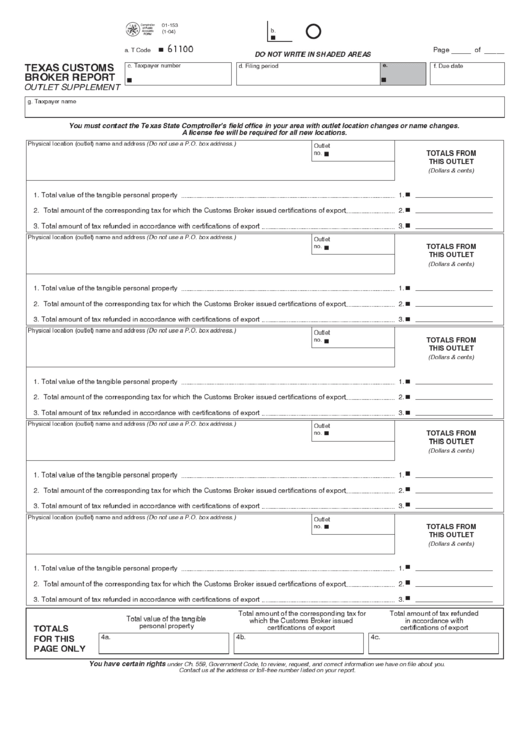

01-153

PRINT FORM

CLEAR FIELDS

b.

(1-04)

61100

Page _____ of _____

a. T Code

DO NOT WRITE IN SHADED AREAS

TEXAS CUSTOMS

c. Taxpayer number

d. Filing period

f. Due date

e.

BROKER REPORT

OUTLET SUPPLEMENT

g. Taxpayer name

You must contact the Texas State Comptroller's field office in your area with outlet location changes or name changes.

A license fee will be required for all new locations.

Physical location (outlet) name and address (Do not use a P.O. box address.)

Outlet

TOTALS FROM

no.

THIS OUTLET

(Dollars & cents)

1. Total value of the tangible personal property

1.

2. Total amount of the corresponding tax for which the Customs Broker issued certifications of export

2.

3. Total amount of tax refunded in accordance with certifications of export

3.

Physical location (outlet) name and address (Do not use a P.O. box address.)

Outlet

TOTALS FROM

no.

THIS OUTLET

(Dollars & cents)

1. Total value of the tangible personal property

1.

2. Total amount of the corresponding tax for which the Customs Broker issued certifications of export

2.

3. Total amount of tax refunded in accordance with certifications of export

3.

Physical location (outlet) name and address (Do not use a P.O. box address.)

Outlet

TOTALS FROM

no.

THIS OUTLET

(Dollars & cents)

1. Total value of the tangible personal property

1.

2. Total amount of the corresponding tax for which the Customs Broker issued certifications of export

2.

3. Total amount of tax refunded in accordance with certifications of export

3.

Physical location (outlet) name and address (Do not use a P.O. box address.)

Outlet

TOTALS FROM

no.

THIS OUTLET

(Dollars & cents)

1. Total value of the tangible personal property

1.

2. Total amount of the corresponding tax for which the Customs Broker issued certifications of export

2.

3. Total amount of tax refunded in accordance with certifications of export

3.

Physical location (outlet) name and address (Do not use a P.O. box address.)

Outlet

TOTALS FROM

no.

THIS OUTLET

(Dollars & cents)

1. Total value of the tangible personal property

1.

2. Total amount of the corresponding tax for which the Customs Broker issued certifications of export

2.

3. Total amount of tax refunded in accordance with certifications of export

3.

Total amount of the corresponding tax for

Total amount of tax refunded

Total value of the tangible

which the Customs Broker issued

in accordance with

personal property

TOTALS

certifications of export

certifications of export

FOR THIS

4a.

4b.

4c.

PAGE ONLY

You have certain rights

under Ch. 559, Government Code, to review, request, and correct information we have on file about you.

Contact us at the address or toll-free number listed on your report.

1

1