AB CD

*0115200W101704*

b

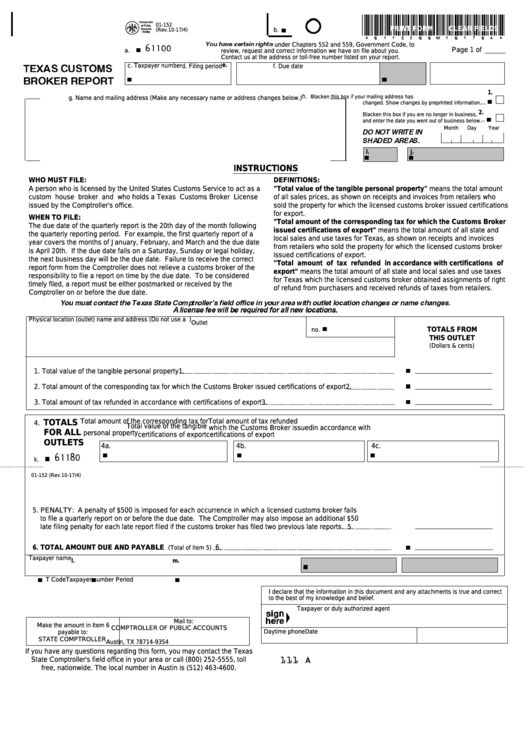

01-152

PRINT FORM

CLEAR FIELDS

b.

(Rev.10-17/4)

b

61100

under Chapters 552 and 559, Government Code, to

You have certain rights

Page 1 of

a.

review, request and correct information we have on file about you.

Contact us at the address or toll-free number listed on your report.

TEXAS CUSTOMS

e.

c. Taxpayer number

d. Filing period

f. Due date

BROKER REPORT

b

b

1.

b

h.

Blacken this box if your mailing address has

g. Name and mailing address (Make any necessary name or address changes below.)

changed. Show changes by preprinted information.

2.

b

Blacken this box if you are no longer in business,

and enter the date you went out of business below.

DO NOT WRITE IN

Month

Day

Year

SHADED AREAS.

b

b

i.

j.

INSTRUCTIONS

WHO MUST FILE:

DEFINITIONS:

A person who is licensed by the United States Customs Service to act as a

"Total value of the tangible personal property" means the total amount

custom house broker and who holds a Texas Customs Broker License

of all sales prices, as shown on receipts and invoices from retailers who

issued by the Comptroller's office.

sold the property for which the licensed customs broker issued certifications

for export.

WHEN TO FILE:

"Total amount of the corresponding tax for which the Customs Broker

The due date of the quarterly report is the 20th day of the month following

issued certifications of export" means the total amount of all state and

the quarterly reporting period. For example, the first quarterly report of a

local sales and use taxes for Texas, as shown on receipts and invoices

year covers the months of January, February, and March and the due date

from retailers who sold the property for which the licensed customs broker

is April 20th. If the due date falls on a Saturday, Sunday or legal holiday,

issued certifications of export.

the next business day will be the due date. Failure to receive the correct

"Total amount of tax refunded in accordance with certifications of

report form from the Comptroller does not relieve a customs broker of the

export" means the total amount of all state and local sales and use taxes

responsibility to file a report on time by the due date. To be considered

for Texas which the licensed customs broker obtained assignments of right

timely filed, a report must be either postmarked or received by the

of refund from purchasers and received refunds of taxes from retailers.

Comptroller on or before the due date.

You must contact the Texas State Comptroller's field office in your area with outlet location changes or name changes.

A license fee will be required for all new locations.

Physical location (outlet) name and address (Do not use a P.O. box address.)

Outlet

b

no.

TOTALS FROM

THIS OUTLET

(Dollars & cents)

b

1. Total value of the tangible personal property

1.

b

2. Total amount of the corresponding tax for which the Customs Broker issued certifications of export

2.

b

3. Total amount of tax refunded in accordance with certifications of export

3.

Total amount of the corresponding tax for

Total amount of tax refunded

TOTALS

4.

Total value of the tangible

which the Customs Broker issued

in accordance with

FOR ALL

personal property

certifications of export

certifications of export

OUTLETS

4a.

4b.

4c.

b

b

b

b

61180

k.

01-152 (Rev.10-17/4)

5. PENALTY: A penalty of $500 is imposed for each occurrence in which a licensed customs broker fails

to file a quarterly report on or before the due date. The Comptroller may also impose an additional $50

late filing penalty for each late report filed if the customs broker has filed two previous late reports.

5.

b

6. TOTAL AMOUNT DUE AND PAYABLE

6.

(Total of Item 5)

Taxpayer name

b

l.

m.

AB

b

b

b

T Code

Taxpayer number

Period

I declare that the information in this document and any attachments is true and correct

to the best of my knowledge and belief.

Taxpayer or duly authorized agent

Mail to:

Make the amount in Item 6

COMPTROLLER OF PUBLIC ACCOUNTS

Daytime phone

Date

payable to:

P.O. Box 149354

STATE COMPTROLLER

Austin, TX 78714-9354

If you have any questions regarding this form, you may contact the Texas

111 A

State Comptroller's field office in your area or call (800) 252-5555, toll

free, nationwide. The local number in Austin is (512) 463-4600.

1

1