140003E11283

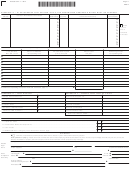

Alabama ET-1 – 2014

Page 3

Schedule K – Allocation of Nonbusiness Income, Loss, and Expense – Use only if you checked Filing Status 2, page 1

Identify by account name and amount all items of nonbusiness income, loss and expense removed from apportionable income and those items which are directly allocable to Alabama.

ALLOCABLE GROSS INCOME / LOSS

RELATED EXPENSE

NET OF RELATED EXPENSE

1

Directly Allocable Items of

Column A

Column B

Column C

Column D

Column E

Column F

Nonbusiness Income/Loss

Everywhere

Alabama

Everywhere

Alabama

Everywhere

Alabama

•

a

•

b

•

c

•

d

•

e

2 NET NONBUSINESS INCOME / LOSS

•

Enter Column E total ((income)/loss) on line 22 of page 1. Enter Column F total (income/(loss)) on line 26 of page 1 . . . . . . . . . . . . . . .

SCHEDULE L – Apportionment Factor – Use only if you checked Filing Status 2, page 1

TANGIBLE PROPERTY AT COST FOR

A

ALABAMA

B

A

EVERYWHERE

B

PRODUCTION OF BUSINESS INCOME

BEGINNING OF YEAR

END OF YEAR

BEGINNING OF YEAR

END OF YEAR

•

1 Loans and credit card receivables . . . . . . . . . . . . . .

1

1

•

2 Premises and fixed assets . . . . . . . . . . . . . . . . . . . .

2

2

•

3

3

3 Other real estate owned . . . . . . . . . . . . . . . . . . . . . .

•

4 Other real and tangible personal property . . . . . .

4

4

•

5 Total (lines 1 through 4). . . . . . . . . . . . . . . . . . . . . . . .

5

5

//////////////////////////////////

////////////////////////////////

6 Average value (total of line 5, Columns A and B,

•

•

//////////////////////////////////

////////////////////////////////

divided by 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

6

•

7 Annual rental expense . . . . . . . . . . . . . . . . . . . . . . . .

7

x8 =

7

x8 =

•

•

8 Total average property (add line 6 and line 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8a

. . . . . . . . . . . . . . . . . . . . . .

8b

•

%

9 Alabama property factor — 8a ÷ 8b = line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

10a

ALABAMA

10b

EVERYWHERE

10c

SALARIES, WAGES, COMMISSIONS AND OTHER COMPENSATION

RELATED TO THE PRODUCTION OF BUSINESS INCOME

•

10 Alabama payroll factor — 10a ÷ 10b = 10c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

%

EVERYWHERE

RECEIPTS

ALABAMA

•

11 Receipts from lease or rental of real property. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

12 Receipts from lease or rental of tangible personal property . . . . . . . . . . . . . . . . . . .

•

13 Interest from loans secured by real property. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

14 Interest from loans not secured by real property . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

15 Net gains from the sale of loans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

16 Interest from credit card receivables and fees charged to card holders . . . . . . . .

•

17 Net gains from sale of credit card receivables . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

18 Credit card issuer’s reimbursement fees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

19 Receipts from merchant discount . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

20 Loan servicing fees from loans secured by real property . . . . . . . . . . . . . . . . . . . . .

•

21 Loan servicing fees from loans not secured by real property. . . . . . . . . . . . . . . . . .

22 Interest, dividends, net gains, and other income from investment and

•

trading assets and activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

23 Receipts of sales of tangible personal property . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

24 Other receipts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

%

25b

25c

25 Alabama receipts factor — 25a ÷ 25b = line 25c. . . . . . . . . . . . . . . . . . . . . . . . . . . . .

25a

•

%

26 Sum of lines 9, 10c, and 25c ÷ 3 = ALABAMA APPORTIONMENT FACTOR (Enter here and on line 24, page 1) . . . . . . . . . . . . . . . . . . . . . . . . . .

26

ADOR

1

1 2

2 3

3 4

4