Instructions For Preparing The Fountain Soft Drink Tax Return - 7590 - Chicago Department Of Revenue

ADVERTISEMENT

I,

ACCOUNT NUMBER

iil ............. i ..............................................................

!:

LINE 1.

LINE 2.

2a.

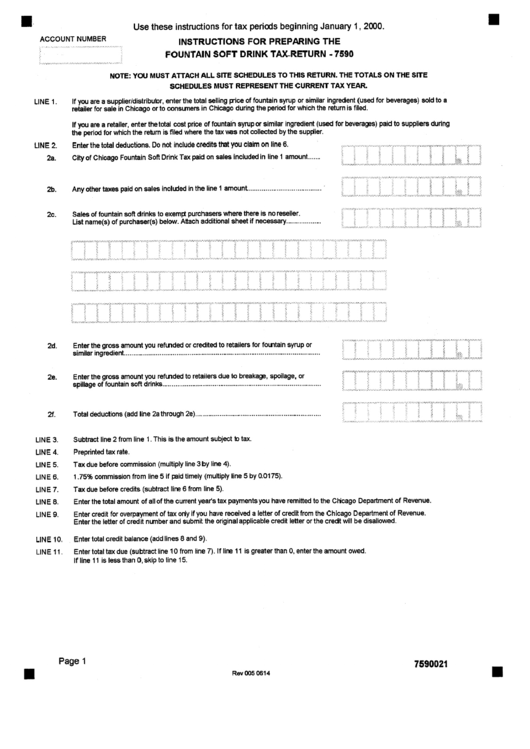

Use these instructions for tax ped~s beginning January 1, 2000.

INSTRUCTIONS FOR PREPARING THE

FOUNTAIN SOFT DRINK TAX-RETURN - 7590

NOTE: YOU MUST ATTACH ALL SITE SCHEDULES TO THIS RETURN. THE TOTALS ON THE SITE

SCHEDULES MUST REPRESENT THE CURRENT TAX YEAR.

If you are a supplier/distribu~r, enter the total selling price of fountain syrup or similar ingredent (used for beverages) sold to a

retailer for sale in Chicago or to consumers in Chicago during the period for which the return is filed.

If you are a retailer, enter the total cost price of fountain syrup or similar ingredient (used for beverages) paid to suppliers dudng

the period for which the return is filed where the tax vtes not collected by the supplier.

Enter the total deductions. Do not include credits that you claim on line 6.

City of Chicago Fountain Soft Drink Tax paid on sales included in line 1 amount .......

2b.

Any other taxes paid on sales included in the line 1 amount. ....................................... •

i

i

2c.

Sales of fountain soft drinks to exempt purchasers where there is no reseller,

ii ............. ii .......... il ............ i i .......... !!i

LEst name(s) of purchaser(s) below. Altach additional sheet if necessary ..................

:::r:.:....,:.:::.......:_ } ........ +. -:.. ,:,>:.......:. +..:.:.....+..:...;...:+......:.:+ ...,:,..;..., +t + :.....:<.>:.:,:.:.:,..:

i

i

"" ...........

...................................... i ......................... ! ril ............ il ........... i ........... ....................... i .................................... ............ i ....................... i

..........................................

:

.................................................

2d.

Enter the gross amount you refunded or credited to retailers for fountain syrup or

similar ingredient

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2e.

Enter the gross amount you refunded to retailers due to breakage, spoilage, or

spillage of fountain soft drinks ...................................................................................

2f.

Total deductions (add line 2athrough 2e)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

LINE 3.

LINE 4.

LINE 5.

LINE 6.

LINE 7.

LINE 8.

LINE 9.

Subtract line 2 from line 1. This is the amount subject t~ tax.

Preprinted tax rate.

Tax due before commission (multiply line 3 by line 4).

1.75% commission from line 5 if paid timely (multiply line 5 by 0.0175).

Tax due before credits (subtract line 6 from line 5).

Enter the total amount of all of the current year's tax payments you have remitted to the CPicago Department of Revenue.

Enter credit for overpayment of tax only if you have received a letter of credit from the Chicago Department of Revenue.

Enter the letter of credit number and submit the original applicable credit letter or the credt will be disallowed.

LINE 10.

LINE 11.

Enter total credit balance (add lines 8 and 9).

Enter total tax due (subtract line 10 from line 7). If line 11 is greater than 0, enter the amount owed.

If line 11 is lees than 0, skip to line 15.

B

Page 1

7590021

B

Rev 005 0614

B

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2