Instructions For Day Care Facilities Credit & Dependent Care Assistance Credit - Montana Department Of Revenue

ADVERTISEMENT

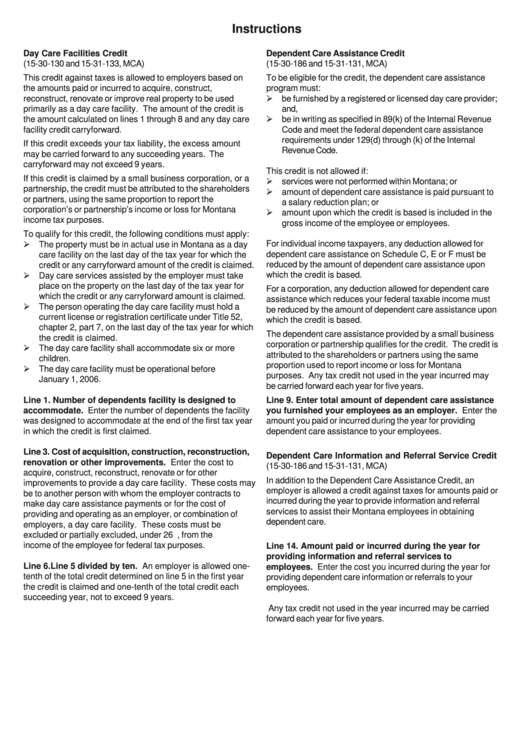

Instructions

Day Care Facilities Credit

Dependent Care Assistance Credit

(15-30-130 and 15-31-133, MCA)

(15-30-186 and 15-31-131, MCA)

This credit against taxes is allowed to employers based on

To be eligible for the credit, the dependent care assistance

the amounts paid or incurred to acquire, construct,

program must:

reconstruct, renovate or improve real property to be used

be furnished by a registered or licensed day care provider;

primarily as a day care facility. The amount of the credit is

and,

the amount calculated on lines 1 through 8 and any day care

be in writing as specified in 89(k) of the Internal Revenue

facility credit carryforward.

Code and meet the federal dependent care assistance

requirements under 129(d) through (k) of the Internal

If this credit exceeds your tax liability, the excess amount

Revenue Code.

may be carried forward to any succeeding years. The

carryforward may not exceed 9 years.

This credit is not allowed if:

If this credit is claimed by a small business corporation, or a

services were not performed within Montana; or

partnership, the credit must be attributed to the shareholders

amount of dependent care assistance is paid pursuant to

or partners, using the same proportion to report the

a salary reduction plan; or

corporation’s or partnership’s income or loss for Montana

amount upon which the credit is based is included in the

income tax purposes.

gross income of the employee or employees.

To qualify for this credit, the following conditions must apply:

For individual income taxpayers, any deduction allowed for

The property must be in actual use in Montana as a day

dependent care assistance on Schedule C, E or F must be

care facility on the last day of the tax year for which the

reduced by the amount of dependent care assistance upon

credit or any carryforward amount of the credit is claimed.

which the credit is based.

Day care services assisted by the employer must take

place on the property on the last day of the tax year for

For a corporation, any deduction allowed for dependent care

which the credit or any carryforward amount is claimed.

assistance which reduces your federal taxable income must

The person operating the day care facility must hold a

be reduced by the amount of dependent care assistance upon

current license or registration certificate under Title 52,

which the credit is based.

chapter 2, part 7, on the last day of the tax year for which

The dependent care assistance provided by a small business

the credit is claimed.

corporation or partnership qualifies for the credit. The credit is

The day care facility shall accommodate six or more

attributed to the shareholders or partners using the same

children.

proportion used to report income or loss for Montana

The day care facility must be operational before

purposes. Any tax credit not used in the year incurred may

January 1, 2006.

be carried forward each year for five years.

Line 1. Number of dependents facility is designed to

Line 9. Enter total amount of dependent care assistance

accommodate. Enter the number of dependents the facility

you furnished your employees as an employer. Enter the

was designed to accommodate at the end of the first tax year

amount you paid or incurred during the year for providing

in which the credit is first claimed.

dependent care assistance to your employees.

Line 3. Cost of acquisition, construction, reconstruction,

Dependent Care Information and Referral Service Credit

renovation or other improvements. Enter the cost to

(15-30-186 and 15-31-131, MCA)

acquire, construct, reconstruct, renovate or for other

In addition to the Dependent Care Assistance Credit, an

improvements to provide a day care facility. These costs may

employer is allowed a credit against taxes for amounts paid or

be to another person with whom the employer contracts to

incurred during the year to provide information and referral

make day care assistance payments or for the cost of

services to assist their Montana employees in obtaining

providing and operating as an employer, or combination of

dependent care.

employers, a day care facility. These costs must be

excluded or partially excluded, under 26 U.S.C. 129, from the

income of the employee for federal tax purposes.

Line 14. Amount paid or incurred during the year for

providing information and referral services to

Line 6. Line 5 divided by ten. An employer is allowed one-

employees. Enter the cost you incurred during the year for

tenth of the total credit determined on line 5 in the first year

providing dependent care information or referrals to your

the credit is claimed and one-tenth of the total credit each

employees.

succeeding year, not to exceed 9 years.

Any tax credit not used in the year incurred may be carried

forward each year for five years.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1