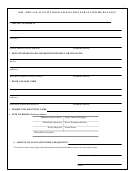

Private Activity Bond Application For Statewide Balance - 2011 Page 6

ADVERTISEMENT

7

HOUSING PROJECTS

(housing applicants only)

1.

If the proposed financing is for single family mortgage revenue bonds, is the entity eligible to use any other

authority's PAB issues? If so, how much of this authority remains to be utilized? For rental projects, is

bond cap from local jurisdictions included?

2.

How many units of housing will be constructed or rehabilitated by this project? Please indicate the percent

of units serving persons with lower incomes and the qualifying income levels.

3.

Who will be the developer and property manager? What is their experience with developing or managing

this type of property?

4.

Please attach a detailed development budget, a sources and uses statement, a detailed operating budget that

includes detail of unit rents, with a ten-year pro forma, architectural plans and market data. A

professionally prepared market study is preferred.

5.

Does the project intend to utilize Low Income Housing Tax Credits? If so, what is the estimated price per

dollar credit that the project intends to receive? Is an investor identified? If so, include their offer to

purchase the credits.

THE FOLLOWING TO BE COMPLETED BY MORTGAGE CREDIT CERTIFICATE (MCC)

APPLICANTS

6.

What is the upper limit of income qualifications for your proposed MCCs? What income thresholds will

be placed on the program? How many homes are listed in your community’s Multiple Listing Service that

people at this income could afford?

7.

Have mortgage companies agreed to participate in your MCC program? If so, please list them.

8.

Who will administer your Mortgage Credit Certificate program? What is their experience administering

housing finance programs?

9.

What counties/cities will be included in the program?

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10