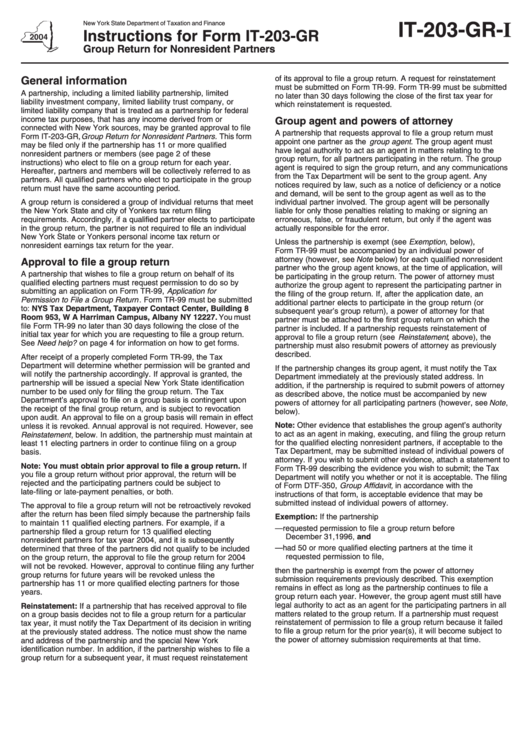

Instructions For Form It-203-Gr - Group Return For Nonresident Partners - 2004

ADVERTISEMENT

New York State Department of Taxation and Finance

IT-203-GR-I

Instructions for Form IT-203-GR

Group Return for Nonresident Partners

of its approval to file a group return. A request for reinstatement

General information

must be submitted on Form TR-99. Form TR-99 must be submitted

A partnership, including a limited liability partnership, limited

no later than 30 days following the close of the first tax year for

liability investment company, limited liability trust company, or

which reinstatement is requested.

limited liability company that is treated as a partnership for federal

income tax purposes, that has any income derived from or

Group agent and powers of attorney

connected with New York sources, may be granted approval to file

A partnership that requests approval to file a group return must

Form IT-203-GR, Group Return for Nonresident Partners. This form

appoint one partner as the group agent . The group agent must

may be filed only if the partnership has 11 or more qualified

have legal authority to act as an agent in matters relating to the

nonresident partners or members (see page 2 of these

group return, for all partners participating in the return. The group

instructions) who elect to file on a group return for each year.

agent is required to sign the group return, and any communications

Hereafter, partners and members will be collectively referred to as

from the Tax Department will be sent to the group agent. Any

partners. All qualified partners who elect to participate in the group

notices required by law, such as a notice of deficiency or a notice

return must have the same accounting period.

and demand, will be sent to the group agent as well as to the

A group return is considered a group of individual returns that meet

individual partner involved. The group agent will be personally

the New York State and city of Yonkers tax return filing

liable for only those penalties relating to making or signing an

requirements. Accordingly, if a qualified partner elects to participate

erroneous, false, or fraudulent return, but only if the agent was

in the group return, the partner is not required to file an individual

actually responsible for the error.

New York State or Yonkers personal income tax return or

Unless the partnership is exempt (see Exemption , below),

nonresident earnings tax return for the year.

Form TR-99 must be accompanied by an individual power of

attorney (however, see Note below) for each qualified nonresident

Approval to file a group return

partner who the group agent knows, at the time of application, will

A partnership that wishes to file a group return on behalf of its

be participating in the group return. The power of attorney must

qualified electing partners must request permission to do so by

authorize the group agent to represent the participating partner in

submitting an application on Form TR-99, Application for

the filing of the group return. If, after the application date, an

Permission to File a Group Return . Form TR-99 must be submitted

additional partner elects to participate in the group return (or

to: NYS Tax Department, Taxpayer Contact Center, Building 8

subsequent year’s group return), a power of attorney for that

Room 953, W A Harriman Campus, Albany NY 12227. You must

partner must be attached to the first group return on which the

file Form TR-99 no later than 30 days following the close of the

partner is included. If a partnership requests reinstatement of

initial tax year for which you are requesting to file a group return.

approval to file a group return (see Reinstatement , above), the

See Need help? on page 4 for information on how to get forms.

partnership must also resubmit powers of attorney as previously

described.

After receipt of a properly completed Form TR-99, the Tax

Department will determine whether permission will be granted and

If the partnership changes its group agent, it must notify the Tax

will notify the partnership accordingly. If approval is granted, the

Department immediately at the previously stated address. In

partnership will be issued a special New York State identification

addition, if the partnership is required to submit powers of attorney

number to be used only for filing the group return. The Tax

as described above, the notice must be accompanied by new

Department’s approval to file on a group basis is contingent upon

powers of attorney for all participating partners (however, see Note ,

the receipt of the final group return, and is subject to revocation

below).

upon audit. An approval to file on a group basis will remain in effect

Note: Other evidence that establishes the group agent’s authority

unless it is revoked. Annual approval is not required. However, see

to act as an agent in making, executing, and filing the group return

Reinstatement , below. In addition, the partnership must maintain at

for the qualified electing nonresident partners, if acceptable to the

least 11 electing partners in order to continue filing on a group

Tax Department, may be submitted instead of individual powers of

basis.

attorney. If you wish to submit other evidence, attach a statement to

Note: You must obtain prior approval to file a group return. If

Form TR-99 describing the evidence you wish to submit; the Tax

you file a group return without prior approval, the return will be

Department will notify you whether or not it is acceptable. The filing

rejected and the participating partners could be subject to

of Form DTF-350, Group Affidavit, in accordance with the

late-filing or late-payment penalties, or both.

instructions of that form, is acceptable evidence that may be

submitted instead of individual powers of attorney.

The approval to file a group return will not be retroactively revoked

after the return has been filed simply because the partnership fails

Exemption: If the partnership

to maintain 11 qualified electing partners. For example, if a

— requested permission to file a group return before

partnership filed a group return for 13 qualified electing

December 31,1996, and

nonresident partners for tax year 2004, and it is subsequently

— had 50 or more qualified electing partners at the time it

determined that three of the partners did not qualify to be included

requested permission to file,

on the group return, the approval to file the group return for 2004

will not be revoked. However, approval to continue filing any further

then the partnership is exempt from the power of attorney

group returns for future years will be revoked unless the

submission requirements previously described. This exemption

partnership has 11 or more qualified electing partners for those

remains in effect as long as the partnership continues to file a

years.

group return each year. However, the group agent must still have

legal authority to act as an agent for the participating partners in all

Reinstatement: If a partnership that has received approval to file

matters related to the group return. If a partnership must request

on a group basis decides not to file a group return for a particular

reinstatement of permission to file a group return because it failed

tax year, it must notify the Tax Department of its decision in writing

to file a group return for the prior year(s), it will become subject to

at the previously stated address. The notice must show the name

the power of attorney submission requirements at that time.

and address of the partnership and the special New York

identification number. In addition, if the partnership wishes to file a

group return for a subsequent year, it must request reinstatement

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4