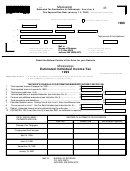

Mississippi

MS

IE

Voucher 1

Estimated Tax Declaration for Individuals -

April 15, 1999

This Payment Due Date

Form 80-300-99-3-1-000 (Rev. 4/987)

803009931000

Your Social Security Number

Spouse's Social Security Number

Check Box if Fiduciary Return

1999

N

Total amount of this installment

A

C

Mail to:

Bureau of Revenue

Return this voucher with check

Print Social Security Number

or money order payable to

P. O. Box 23075

on check - Spouse's

State Tax Commission

if JOINT ACCOUNT

Jackson, MS 39225-3075

CUT HERE

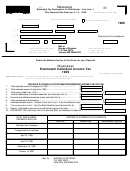

Retain the Bottom Portion of this Form for your Records

Mississippi

Estimated Individual Income Tax

1999

Form 80-300-99-3-1-000 (Rev. 4/98)

IMPORTANT NOTICE

DO NOT MAIL ESTIMATED TAX VOUCHER WITH YOUR INCOME TAX RETURN.

DO NOT COMBINE PAYMENTS ON A SINGLE CHECK.

TAXPAYER'S SCHEDULE FOR ESTIMATING MISSISSIPPI INCOME TAX FOR 1998

1.

Total expected income of taxpayer for 1999.....................................................

$

2.

Total expected income of spouse for 1999........................................................

$

3.

Total income (add Lines 1 & 2)......................................................................................................................

$

4.

Itemized deductions or standard deduction (see Instruction No. 4)..................

$

5.

Personal and additional exemptions (see Instruction No. 3).............................

$

6.

Total exemptions and deductions...................................................................................................................

$

7.

Estimated taxable income. Subtract Line 6 from Line 3. Enter the difference here.....................................

$

8.

Tax on amount on Line 7. Use Tax Rate Schedule (see Instruction No. 5)....

$

9.

Deduct - Estimated income tax to be withheld during the entire year...............

$

10.

ESTIMATED TAX (Line 8 less Line 9) (if less than $200, no declaration is required)...................................

$

RECORD OF ESTIMATED TAX PAYMENTS

DATE INSTALLMENT

PAYMENTS ARE DUE

Date Paid

Amount Paid

Accumulated Payments

Calendar Year Taxpayers

Overpayment from last year

April 15, 1999

June 15, 1999

September 15, 1999

January 15, 2000

Mail To:

BUREAU OF REVENUE

P.O. BOX 23075

JACKSON, MS 39225-3075

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16