Instructions For Form 9041 - Internal Revenue Service - 1999

ADVERTISEMENT

Form 9041 (Rev. 9-1999

Page 2

)

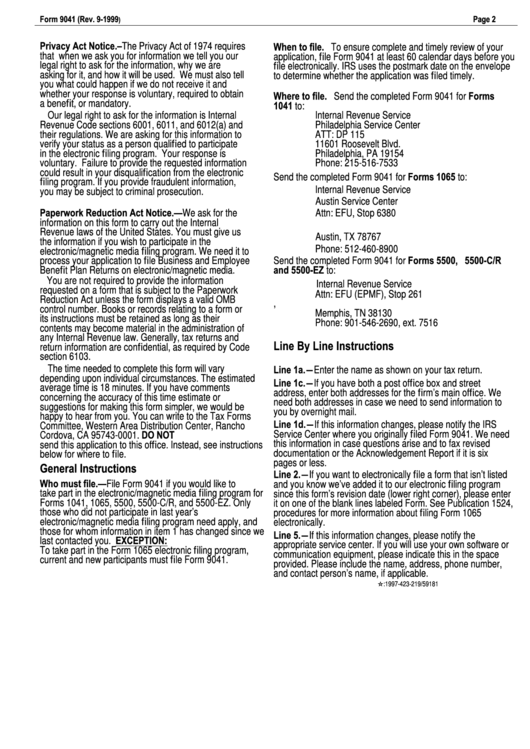

Privacy Act Notice.–The Privacy Act of 1974 requires

When to file. To ensure complete and timely review of your

that when we ask you for information we tell you our

application, file Form 9041 at least 60 calendar days before you

legal right to ask for the information, why we are

file electronically. IRS uses the postmark date on the envelope

asking for it, and how it will be used. We must also tell

to determine whether the application was filed timely.

you what could happen if we do not receive it and

whether your response is voluntary, required to obtain

Where to file. Send the completed Form 9041 for Forms

a benefit, or mandatory.

1041 to:

Our legal right to ask for the information is Internal

Internal Revenue Service

Revenue Code sections 6001, 6011, and 6012(a) and

Philadelphia Service Center

their regulations. We are asking for this information to

ATT: DP 115

verify your status as a person qualified to participate

11601 Roosevelt Blvd.

in the electronic filing program. Your response is

Philadelphia, PA 19154

voluntary. Failure to provide the requested information

Phone: 215-516-7533

could result in your disqualification from the electronic

Send the completed Form 9041 for Forms 1065 to:

filing program. If you provide fraudulent information,

Internal Revenue Service

you may be subject to criminal prosecution.

Austin Service Center

Paperwork Reduction Act Notice.—We ask for the

Attn: EFU, Stop 6380

information on this form to carry out the Internal

P.O. Box 1231

Revenue laws of the United States. You must give us

Austin, TX 78767

the information if you wish to participate in the

Phone: 512-460-8900

electronic/magnetic media filing program. We need it to

process your application to file Business and Employee

Send the completed Form 9041 for Forms 5500, 5500-C/R

Benefit Plan Returns on electronic/magnetic media.

and 5500-EZ to:

You are not required to provide the information

Internal Revenue Service

requested on a form that is subject to the Paperwork

Attn: EFU (EPMF), Stop 261

Reduction Act unless the form displays a valid OMB

P.O. Box 30309, A.M.F.

control number. Books or records relating to a form or

Memphis, TN 38130

its instructions must be retained as long as their

Phone: 901-546-2690, ext. 7516

contents may become material in the administration of

any Internal Revenue law. Generally, tax returns and

Line By Line Instructions

return information are confidential, as required by Code

section 6103.

The time needed to complete this form will vary

Line 1a.―Enter the name as shown on your tax return.

depending upon individual circumstances. The estimated

Line 1c.―If you have both a post office box and street

average time is 18 minutes. If you have comments

address, enter both addresses for the firm’s main office. We

concerning the accuracy of this time estimate or

need both addresses in case we need to send information to

suggestions for making this form simpler, we would be

you by overnight mail.

happy to hear from you. You can write to the Tax Forms

Line 1d.―If this information changes, please notify the IRS

Committee, Western Area Distribution Center, Rancho

Service Center where you originally filed Form 9041. We need

Cordova, CA 95743-0001. DO NOT

this information in case questions arise and to fax revised

send this application to this office. Instead, see instructions

documentation or the Acknowledgement Report if it is six

below for where to file.

pages or less.

General Instructions

Line 2.―If you want to electronically file a form that isn’t listed

Who must file.—File Form 9041 if you would like to

and you know we’ve added it to our electronic filing program

take part in the electronic/magnetic media filing program for

since this form’s revision date (lower right corner), please enter

Forms 1041, 1065, 5500, 5500-C/R, and 5500-EZ. Only

it on one of the blank lines labeled Form. See Publication 1524,

those who did not participate in last year’s

procedures for more information about filing Form 1065

electronic/magnetic media filing program need apply, and

electronically.

those for whom information in item 1 has changed since we

Line 5.―If this information changes, please notify the

last contacted you. EXCEPTION:

appropriate service center. If you will use your own software or

To take part in the Form 1065 electronic filing program,

communication equipment, please indicate this in the space

current and new participants must file Form 9041.

provided. Please include the name, address, phone number,

and contact person’s name, if applicable.

U.S. GPO:1997-423-219/59181

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1