Instructions For Schedule Acrs - Minnesota Department Of Revenue

ADVERTISEMENT

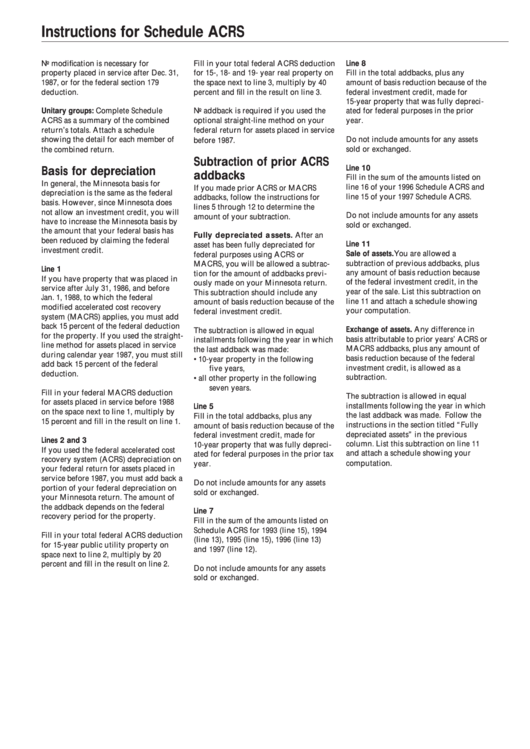

Instructions for Schedule ACRS

Line 8

No modification is necessary for

Fill in your total federal ACRS deduction

property placed in service after Dec. 31,

for 15-, 18- and 19- year real property on

Fill in the total addbacks, plus any

1987, or for the federal section 179

the space next to line 3, multiply by 40

amount of basis reduction because of the

deduction.

percent and fill in the result on line 3.

federal investment credit, made for

15-year property that was fully depreci-

Unitary groups: Complete Schedule

No addback is required if you used the

ated for federal purposes in the prior

ACRS as a summary of the combined

optional straight-line method on your

year.

return’s totals. Attach a schedule

federal return for assets placed in service

showing the detail for each member of

Do not include amounts for any assets

before 1987.

sold or exchanged.

the combined return.

Subtraction of prior ACRS

Line 10

Basis for depreciation

addbacks

Fill in the sum of the amounts listed on

In general, the Minnesota basis for

line 16 of your 1996 Schedule ACRS and

If you made prior ACRS or MACRS

depreciation is the same as the federal

line 15 of your 1997 Schedule ACRS.

addbacks, follow the instructions for

basis. However, since Minnesota does

lines 5 through 12 to determine the

not allow an investment credit, you will

Do not include amounts for any assets

amount of your subtraction.

have to increase the Minnesota basis by

sold or exchanged.

the amount that your federal basis has

Fully depreciated assets. After an

been reduced by claiming the federal

Line 11

asset has been fully depreciated for

investment credit.

Sale of assets. You are allowed a

federal purposes using ACRS or

subtraction of previous addbacks, plus

MACRS, you will be allowed a subtrac-

Line 1

any amount of basis reduction because

tion for the amount of addbacks previ-

If you have property that was placed in

of the federal investment credit, in the

ously made on your Minnesota return.

service after July 31, 1986, and before

year of the sale. List this subtraction on

This subtraction should include any

Jan. 1, 1988, to which the federal

line 11 and attach a schedule showing

amount of basis reduction because of the

modified accelerated cost recovery

your computation.

federal investment credit.

system (MACRS) applies, you must add

back 15 percent of the federal deduction

Exchange of assets. Any difference in

The subtraction is allowed in equal

for the property. If you used the straight-

basis attributable to prior years’ ACRS or

installments following the year in which

line method for assets placed in service

MACRS addbacks, plus any amount of

the last addback was made:

during calendar year 1987, you must still

basis reduction because of the federal

•

10-year property in the following

add back 15 percent of the federal

investment credit, is allowed as a

five years,

deduction.

subtraction.

•

all other property in the following

seven years.

Fill in your federal MACRS deduction

The subtraction is allowed in equal

for assets placed in service before 1988

Line 5

installments following the year in which

on the space next to line 1, multiply by

the last addback was made. Follow the

Fill in the total addbacks, plus any

15 percent and fill in the result on line 1.

instructions in the section titled “Fully

amount of basis reduction because of the

depreciated assets” in the previous

federal investment credit, made for

Lines 2 and 3

column. List this subtraction on line 11

10-year property that was fully depreci-

If you used the federal accelerated cost

and attach a schedule showing your

ated for federal purposes in the prior tax

recovery system (ACRS) depreciation on

year.

computation.

your federal return for assets placed in

service before 1987, you must add back a

Do not include amounts for any assets

portion of your federal depreciation on

sold or exchanged.

your Minnesota return. The amount of

the addback depends on the federal

Line 7

recovery period for the property.

Fill in the sum of the amounts listed on

Schedule ACRS for 1993 (line 15), 1994

Fill in your total federal ACRS deduction

(line 13), 1995 (line 15), 1996 (line 13)

for 15-year public utility property on

and 1997 (line 12).

space next to line 2, multiply by 20

percent and fill in the result on line 2.

Do not include amounts for any assets

sold or exchanged.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1