Instructions For Schedule Tc - Kentucky Department Of Revenue

ADVERTISEMENT

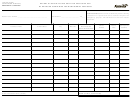

INSTRUCTIONS—SCHEDULE TC

You must file Schedule TC if:

sources must be attached to verify this credit. If you owe tax

in more than one state, the credit for each state must be

you received a lump-sum distribution and compute your

computed separately.

tax on Form 4972-K;

Reciprocal States—Kentucky has reciprocal agreements with

you are a farmer and elect to income average; or

specific states. These agreements provide that taxpayers be

you claim any of the nonrefundable tax credits listed

taxed by their state of residence, and not the state where

below.

income is earned. Persons who live in Kentucky for more

than 183 days during the tax year are considered residents

Line 2—Use the Tax Rate Schedule in Part III to compute

and reciprocity does not apply. The states and types of ex-

your tax.

emptions are as follows:

Illinois, Ohio, West Virginia—wages and salaries

Personal tax credits will be deducted on line 5(a). You cannot

Indiana—wages, salaries and commissions

use the optional tax table in the instructions.

Michigan, Wisconsin—income from personal services

(including salaries and wages)

Farmers—If you elect Farm Income Averaging on your federal

Virginia—commuting daily, salaries and wages

return, you may also use this method for Kentucky. Complete

federal Schedule J, using Kentucky income and tax rates.

Kentucky does not allow a credit for tax paid to a reciprocal

Enter tax before deducting personal tax credits on Line 2,

state on the above income. If tax was withheld by a recipro-

and write “SCH. J” between Lines 1 and 2 of Schedule TC.

cal state, you must file directly with the other state for a refund

Attach completed Schedule J.

of those taxes.

Line 3, Lump-sum Distribution—Special Five– or 10–Year

Line 5(d), Employer’s Unemployment Tax Credit—If you hired

Averaging—Kentucky allows a special five- or 10-year

unemployed Kentucky residents to work for you during the

averaging method for determining tax on lump-sum

last six months of 1998 or during 1999, you may be eligible to

distributions received from certain retirement plans that

claim the unemployment tax credit. In order to claim a credit,

qualify for federal five- or 10-year averaging. If this special

each person hired must meet specific criteria. For each qualified

method is used for federal purposes, Form 4972-K, Kentucky

person, you may claim a tax credit of $100. The period of

Tax on Lump-Sum Distributions, and Schedule P, Pension

unemployment must be certified by the Department for

Income Exclusion, must be filed with Form 740 and tax must

Employment Services, Cabinet for Workforce Development,

be determined on Schedule TC.

Second Floor West, 275 East Main Street, Frankfort, KY 40621-

0001, and you must maintain a copy of the certification in your

Line 5(a), Tax Credits—You may deduct $20 for each tax credit

files. To claim this credit you must file Schedule UTC, and use

claimed.

Schedule TC to calculate your tax.

Line 5(b), Skills Training Investment Tax Credit—Enter the

Line 5(e), Recycling and/or Composting Tax Credit—

amount of credit certified by the Bluegrass State Skills Cor-

Individuals who purchase recycling or composting equipment

poration. Attach a copy of the certification in the first year

to be used exclusively in Kentucky for recycling or

claimed. A taxpayer (corporation or individual) who has

composting postconsumer waste materials, are entitled to a

received a final authorizing resolution from the Bluegrass

credit against the tax equal to 50 percent of the installed cost

State Skills Corporation is entitled to a nonrefundable credit

of the equipment. Application for this credit must be made

against Kentucky individual or corporation income tax. The

on Schedule RC, which may be obtained from the Revenue

credit is equal to 50 percent of the approved cost incurred in

Cabinet. A copy of Schedule RC and/or Schedule RC (K-1)

connection with the company’s occupational or skills upgrade

reflecting the amount of credit approved by the Revenue

training program. The credit shall not exceed $500 per em-

Cabinet and Schedule TC must be attached to the return.

ployee and $100,000 per approved company per biennium.

(See Schedules RC and TC.)

The excess credit over the company's income tax liability in

Line 5(f), Kentucky Investment Fund Tax Credit—Enter 25

the year approved may be carried forward for three succes-

percent of the total amount certified by the Kentucky Eco-

sive taxable years. Partners and shareholders should con-

nomic Development Finance Authority (KEDFA). Attach a

tact the Revenue Cabinet for instructions.

copy of the certification by KEDFA in the first year claimed.

Effective for taxable years beginning after December 31, 1998,

Line 5(c), Credit for Tax Paid to Another State—Kentucky

an investor (corporation or individual) whose cash contribu-

residents are required to report all income received includ-

tion to an investment fund has been certified by KEDFA is

ing income from sources outside Kentucky. Within certain

entitled to a nonrefundable credit against Kentucky individual

limitations, a credit for income tax paid to another state may

income tax, corporation income tax or corporation license

be claimed on Schedule TC. The credit is limited to the

tax equal to 40 percent of the cash contribution. The amount

amount of Kentucky tax savings had the income reported to

of credit an investor may claim in any taxable year is limited

the other state been omitted, or the amount of tax paid to

to 25 percent of the total amount of credit certified by the

the other state, whichever is less.

authority as available to the investor. Any excess credit that

You may not claim credit for tax withheld by another state.

may be claimed in any given year over the investor’s

You must file a return with the other state, and pay tax on

combined income and license tax liabilities for the year may

income also taxed by Kentucky in order to claim the credit. A

be carried forward. No credit may extend beyond 15 years

copy of the other state’s return including a schedule of income

of the initial certification.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1