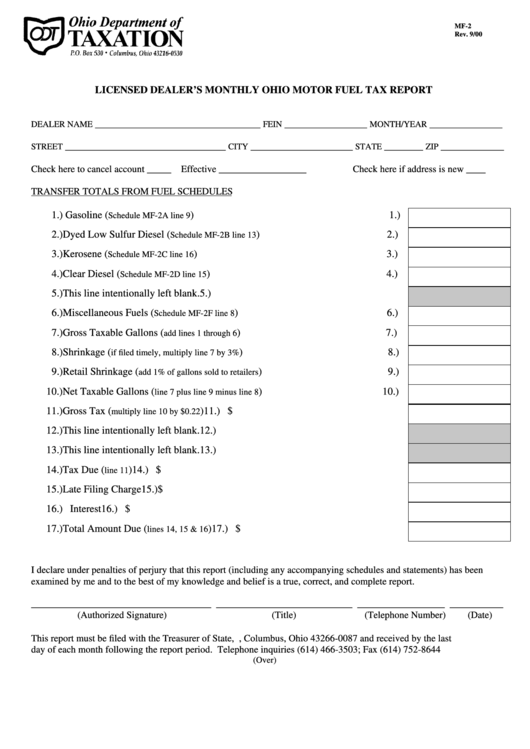

Form Mf-2 - Licensed Dealer'S Monthly Ohio Motor Fuel Tax Report

ADVERTISEMENT

MF-2

Rev. 9/00

LICENSED DEALER’S MONTHLY OHIO MOTOR FUEL TAX REPORT

__________________________________

_________________

_______________

DEALER NAME

FEIN

MONTH/YEAR

_________________________________

_____________________

________

_____________

STREET

CITY

STATE

ZIP

Check here to cancel account _____ Effective __________________

Check here if address is new ____

TRANSFER TOTALS FROM FUEL SCHEDULES

1.) Gasoline (

)

1.)

Schedule MF-2A line 9

2.) Dyed Low Sulfur Diesel (

)

2.)

Schedule MF-2B line 13

3.) Kerosene (

)

3.)

Schedule MF-2C line 16

4.) Clear Diesel (

)

4.)

Schedule MF-2D line 15

5.) This line intentionally left blank.

5.)

6.) Miscellaneous Fuels (

)

6.)

Schedule MF-2F line 8

7.) Gross Taxable Gallons (

)

7.)

add lines 1 through 6

8.) Shrinkage (

)

8.)

if filed timely, multiply line 7 by 3%

9.) Retail Shrinkage (

)

9.)

add 1% of gallons sold to retailers

10.) Net Taxable Gallons (

)

10.)

line 7 plus line 9 minus line 8

11.) Gross Tax (

)

11.) $

multiply line 10 by $0.22

12.) This line intentionally left blank.

12.)

13.) This line intentionally left blank.

13.)

14.) Tax Due (

)

14.) $

line 11

15.) Late Filing Charge

15.) $

16.) Interest

16.) $

17.) Total Amount Due (

)

17.) $

lines 14, 15 & 16

I declare under penalties of perjury that this report (including any accompanying schedules and statements) has been

examined by me and to the best of my knowledge and belief is a true, correct, and complete report.

_____________________________________ ____________________________ __________________ ___________

(Authorized Signature)

(Title)

(Telephone Number)

(Date)

This report must be filed with the Treasurer of State, P.O. Box 87, Columbus, Ohio 43266-0087 and received by the last

day of each month following the report period. Telephone inquiries (614) 466-3503; Fax (614) 752-8644

(Over)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1