Instructions For Form Fia-40n, Form Fia-40p, And Schedule Z, For Farm Income Averaging - 2002 Page 3

ADVERTISEMENT

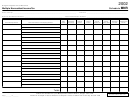

Oregon (b)

Oregon (b)

Federal (a)

Federal (a)

17. If there is a loss on your

Oregon only, enter it as a

2000 federal Schedule D,

positive amount in the Ore-

line 18, add that loss (as a

gon column. Otherwise, en-

positive amount) and your

ter as a positive amount the

2000 capital loss carryover

portion (if any) of the NOL

to 2001. Subtract from that

carryovers and carrybacks

sum the amount of the

to 2001 that were not used

loss on your 2000 federal

in 2001 and were carried to

Schedule D, line 17. Enter

tax years after 2001 ...................... $ ________ $ ________

the result here .................................................... $ ________

24. Add lines 22 and 23 ..................... $ ________ $ ________

18. If you had an NOL for 2000,

enter it as a positive amount

25. Subtract line 24 from line

here. Otherwise, enter the

21. Enter the result here and

portion (if any) of the NOL

as a negative amount on

carryovers and carrybacks to

your 2002 Schedule Z, tax

2000 that were not used in

year 2001, Computation

2000 and were carried to tax

A or B, line 1 ................................. $ ________ $ ________

years after 2000 as a positive

amount here ...................................................... $ ________

Full Year Return for 2001

19. Add lines 17 and 18 .......................................... $ ________

26. Figure the taxable income

from your 2001 tax return

20. Subtract line 19 from line 16.

Enter the result here, and as

without limiting it to zero.

a negative amount on your

If you had an NOL for 2001,

2002 Schedule Z, tax year

do not include any NOL

2000, Computation C, line 1 ............................. $ ________

carryovers or carrybacks

to 2001. Enter the result as

2001 Taxable Income Worksheet

a positive amount here .................................... $ ________

Part-Year or Nonresident Return for 2001

27. If there is a loss on your

21. Figure income after sub-

2001 federal Schedule D,

tractions for either federal

line 18, add that loss (as a

or Oregon, or both, from

positive amount) and your

your 2001 Form 40P or

2001 capital loss carryover

Form 40N without limiting

to 2002. Subtract from that

it to zero. If you had an

sum the amount of the loss

NOL for 2001, do not in-

on your 2001 federal

clude any NOL carryovers

Schedule D, line 17. Enter

or carrybacks to 2001.

the result here .................................................... $ ________

Enter the result as a

positive amount here .................. $ ________ $ ________

28. If you had an NOL for 2001,

22. If you have a capital loss in

enter it as a positive amount

either or both columns on

here. Otherwise, enter the

Form 40P or Form 40N, you

portion (if any) of the NOL

must make an additional

carryovers and carrybacks

computation. If there is a

to 2001 that were not used

loss on your 2001 federal

in 2001 and were carried to

Schedule D, line 18, add

tax years after 2001 as a

that loss (as a positive

positive amount here ....................................... $ ________

amount) and your 2001

29. Add lines 27 and 28 .......................................... $ ________

capital loss carryover to

tax year 2002. Subtract from

30. Subtract line 29 from line

that sum the amount of the

26. Enter the result here,

loss on your 2001 federal

and as a negative amount

on your 2002 Schedule Z,

Schedule D, line 17. Enter

tax year 2001, Computation

the result here ............................... $ ________ $ ________

C, line 1 .............................................................. $ ________

23. If you had an NOL for 2001

for federal only, enter it as a

Example: John Farmington owns a farm in Ontario, Oregon but

positive amount in the federal

is a resident of Idaho. John files as a nonresident for Oregon

column. If you had an NOL

each year. John did not use farm income averaging for 1999,

for 2001 for both federal and

2000, or 2001. For tax year 2002, John has elected farm income

Oregon, enter it in both col-

of $18,000 on line 2 of Form FIA-40N. His 1999 income after

umns as a positive amount.

subtractions shown on line 39 of Form 40N is $25,906 in the fed-

If you had an NOL for

eral column and $6,150 in the Oregon column.

7

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4