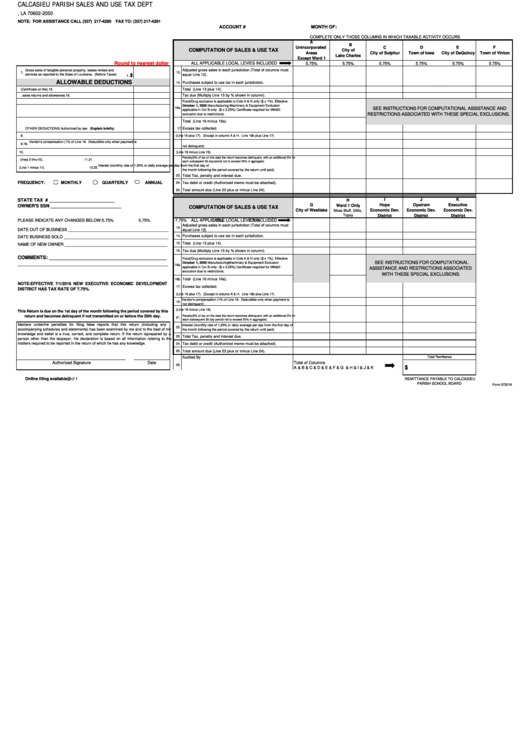

Form 072016 - Computation Of Sales & Use Tax

ADVERTISEMENT

CALCASIEU PARISH SALES AND USE TAX DEPT

P.O. DRAWER 2050

LAKE CHARLES, LA 70602-2050

NOTE: FOR ASSISTANCE CALL (337) 217-4280

FAX TO: (337) 217-4281

ACCOUNT #

MONTH OF:

COMPLETE ONLY THOSE COLUMNS IN WHICH TAXABLE ACTIVITY OCCURS

A

B

Unincorporated

C

D

E

F

COMPUTATION OF SALES & USE TAX

City of

Areas

City of Sulphur

Town of Iowa

City of DeQuincy

Town of Vinton

Lake Charles

Except Ward 1

Round to nearest dollar

ALL APPLICABLE LOCAL LEVIES INCLUDED

5.75%

5.75%

5.75%

5.75%

5.75%

5.75%

Adjusted gross sales in each jurisdiction (Total of columns must

Gross sales of tangible personal property, leases rentals and

1.

13.

services as reported to the State of Louisiana. (Before Taxes)

equal Line 12).

.$

1

ALLOWABLE DEDUCTIONS

14.

Purchases subject to use tax in each jurisdiction.

Total (Line 13 plus 14).

2. Sales for resale or further processing. (Certificate on file).

15.

Tax due (Multiply Line 15 by % shown in column).

3. Cash discounts, sales returns and allowances.

16.

4. Sales delivered or shipped outside Calcasieu Parish.

Food/Drug exclusion is applicable in Cols A & H only ($ x 1%). Effective

October 1, 2005 Manufacturing Machinery & Equipment Exclusion

5. Sales of gasoline and motor fuels.

16a.

SEE INSTRUCTIONS FOR COMPUTATIONAL ASSISTANCE AND

applicable in Col B only ($ x 2.25%) Certificate required for MM&E

exclusion due to restrictions.

RESTRICTIONS ASSOCIATED WITH THESE SPECIAL EXCLUSIONS.

6. Sales to tax exempt government agencies.

7. Purchases paid with Food Stamps or WIC vouchers.

16b.

Total (Line 16 minus 16a).

OTHER DEDUCTIONS Authorized by law. (Explain briefly)

17.

Excess tax collected.

8.

18. Total (Line 16 plus 17). (Except in column A & H. Line 16b plus Line 17)

Vendor's compensation (1% of Line 18. Deductible only when payment is

9.

19.

not delinquent)

10.

20. Net tax due (Line 18 minus Line 19).

Penalty(5% of tax on the date the return becomes delinquent, with an additional 5% for

11. Total allowable deductions (lines 2 thru10).

11.

21.

each subsequent 30 day period not to exceed 25% in aggregate)

Interest (monthly rate of 1.25% or daily average per day from the first day of

12. Adjusted gross sales (Line 1 minus 11).

12.

22.

the month following the period covered by the return until paid).

Total Tax, penalty and interest due.

23.

FREQUENCY:

MONTHLY

QUARTERLY

ANNUAL

24.

Tax debit or credit (Authorized memo must be attached).

25.

Total amount due (Line 23 plus or minus Line 24).

I

J

K

STATE TAX I.D. # __________________________

H

G

Hope

Opelram

Executive

OWNER'S SSN ____________________________

Ward 1 Only

COMPUTATION OF SALES & USE TAX

City of Westlake

Economic Dev.

Economic Dev.

Economic Dev.

Moss Bluff, Gillis,

Topsy

District

District

District

ALL APPLICABLE LOCAL LEVIES INCLUDED

PLEASE INDICATE ANY CHANGES BELOW:

5.75%

5.75%

7.75%

7.75%

7.75%

Adjusted gross sales in each jurisdiction (Total of columns must

13.

DATE OUT OF BUSINESS _____________________________________________

equal Line 12).

14.

Purchases subject to use tax in each jurisdiction.

DATE BUSINESS SOLD _______________________________________________

15.

Total (Line 13 plus 14).

NAME OF NEW OWNER ______________________________________________

Tax due (Multiply Line 15 by % shown in column).

16.

COMMENTS: ___________________________________________

Food/Drug exclusion is applicable in Cols A & H only ($ x 1%). Effective

SEE INSTRUCTIONS FOR COMPUTATIONAL

October 1, 2005 Manufacturing Machinery & Equipment Exclusion

_______________________________________________________

16a.

applicable in Col B only ($ x 2.25%) Certificate required for MM&E

ASSISTANCE AND RESTRICTIONS ASSOCIATED

exclusion due to restrictions.

WITH THESE SPECIAL EXCLUSIONS.

16b.

Total (Line 16 minus 16a).

NOTE: EFFECTIVE 7/1/2016 NEW EXECUTIVE ECONOMIC DEVELOPMENT

17.

Excess tax collected.

DISTRICT HAS TAX RATE OF 7.75%.

18. Total (Line 16 plus 17). (Except in column A & H. Line 16b plus Line 17)

Vendor's compensation (1% of Line 18. Deductible only when payment is

19.

not delinquent)

20. Net tax due (Line 18 minus Line 19).

This Return is due on the 1st day of the month following the period covered by this

Penalty(5% of tax on the date the return becomes delinquent, with an additional 5% for

return and becomes delinquent if not transmitted on or before the 20th day.

21.

each subsequent 30 day period not to exceed 25% in aggregate)

I declare under the penalties for filing false reports that this return (including any

Interest (monthly rate of 1.25% or daily average per day from the first day of

22.

accompanying schedules and statements) has been examined by me and to the best of my

the month following the period covered by the return until paid).

knowledge and belief is a true, correct, and complete return. If the return is prepared by a

23.

Total Tax, penalty and interest due.

person other than the taxpayer, his declaration is based on all information relating to the

matters required to be reported in the return of which he has any knowledge.

24.

Tax debit or credit (Authorized memo must be attached).

Total amount due (Line 23 plus or minus Line 24).

25.

Total Remittance

Audited By

Authorized Signature

Date

Total of Columns

26.

$

A & B & C & D & E & F & G & H & I & J & K

Online filing available@ and https://parishe-file.revenue.louisiana.gov. Check it out today!

REMITTANCE PAYABLE TO CALCASIEU

PARISH SCHOOL BOARD

Form 072016

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1