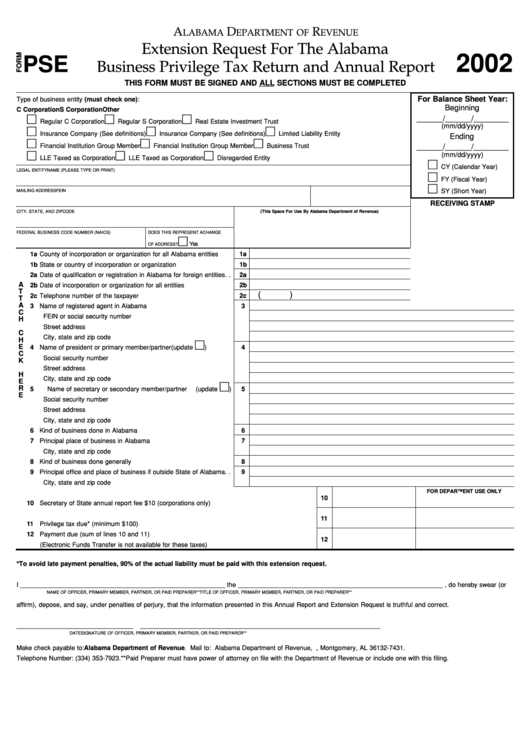

Form Pse - Extension Request For The Alabama Business Privilege Tax Return And Annual Report - 2002

ADVERTISEMENT

A

D

R

LABAMA

EPARTMENT OF

EVENUE

Extension Request For The Alabama

2002

PSE

Business Privilege Tax Return and Annual Report

THIS FORM MUST BE SIGNED AND ALL SECTIONS MUST BE COMPLETED

Type of business entity (must check one):

For Balance Sheet Year:

Beginning

C Corporation

S Corporation

Other

______/______/________

Regular C Corporation

Regular S Corporation

Real Estate Investment Trust

(mm/dd/yyyy)

Insurance Company (See definitions)

Insurance Company (See definitions)

Limited Liability Entity

Ending

Financial Institution Group Member

Financial Institution Group Member

Business Trust

______/______/________

(mm/dd/yyyy)

LLE Taxed as Corporation

LLE Taxed as Corporation

Disregarded Entity

CY (Calendar Year)

LEGAL ENTITY NAME (PLEASE TYPE OR PRINT)

FY (Fiscal Year)

SY (Short Year)

MAILING ADDRESS

FEIN

RECEIVING STAMP

CITY, STATE, AND ZIP CODE

(This Space For Use By Alabama Department of Revenue)

FEDERAL BUSINESS CODE NUMBER (NAICS)

DOES THIS REPRESENT A CHANGE

Yes

OF ADDRESS?

1a County of incorporation or organization for all Alabama entities. . . .

1a

1b State or country of incorporation or organization . . . . . . . . . . . . . . .

1b

2a Date of qualification or registration in Alabama for foreign entities. .

2a

A

2b Date of incorporation or organization for all entities . . . . . . . . . . . . .

2b

T

(

)

2c Telephone number of the taxpayer . . . . . . . . . . . . . . . . . . . . . . . . . .

2c

T

A

3 Name of registered agent in Alabama. . . . . . . . . . . . . . . . . . . . . . . .

3

C

FEIN or social security number . . . . . . . . . . . . . . . . . . . . . . . . . . . .

H

Street address . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

C

City, state and zip code . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

H

E

4 Name of president or primary member/partner . . . . . . . (update

)

4

C

Social security number . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

K

Street address . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

H

City, state and zip code . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

E

R

5 Name of secretary or secondary member/partner . . . . (update

)

5

E

Social security number . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Street address . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

City, state and zip code . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6 Kind of business done in Alabama . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7 Principal place of business in Alabama. . . . . . . . . . . . . . . . . . . . . . .

7

City, state and zip code . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8 Kind of business done generally . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

9 Principal office and place of business if outside State of Alabama. .

9

City, state and zip code . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

FOR DEPARTMENT USE ONLY

10

10 Secretary of State annual report fee $10 (corporations only) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

11 Privilege tax due* (minimum $100) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12 Payment due (sum of lines 10 and 11)

12

(Electronic Funds Transfer is not available for these taxes) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

*To avoid late payment penalties, 90% of the actual liability must be paid with this extension request.

I __________________________________________________________ the __________________________________________________________ , do hereby swear (or

NAME OF OFFICER, PRIMARY MEMBER, PARTNER, OR PAID PREPARER**

TITLE OF OFFICER, PRIMARY MEMBER, PARTNER, OR PAID PREPARER**

affirm), depose, and say, under penalties of perjury, that the information presented in this Annual Report and Extension Request is truthful and correct.

_________________________________ ____________________________________________________________________

DATE

SIGNATURE OF OFFICER, PRIMARY MEMBER, PARTNER, OR PAID PREPARER**

Make check payable to: Alabama Department of Revenue. Mail to: Alabama Department of Revenue, P.O. Box 327431, Montgomery, AL 36132-7431.

Telephone Number: (334) 353-7923.

**Paid Preparer must have power of attorney on file with the Department of Revenue or include one with this filing.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1