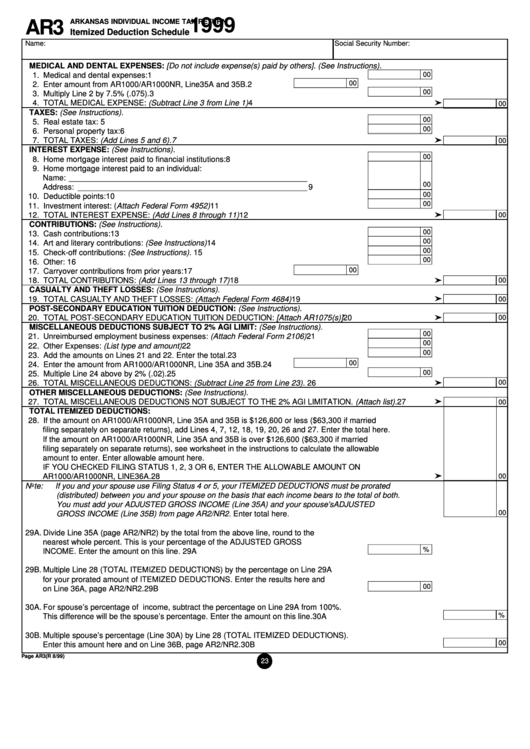

Form Ar3 - Arkansas Individual Income Tax Return Itemized Deduction Schedule - 1999

ADVERTISEMENT

1999

ARKANSAS INDIVIDUAL INCOME TAX RETURN

AR3

Itemized Deduction Schedule

Name:

Social Security Number:

MEDICAL AND DENTAL EXPENSES: [Do not include expense(s) paid by others]. (See Instructions).

1. Medical and dental expenses: ................................................................................................ 1

00

00

2. Enter amount from AR1000/AR1000NR, Line35A and 35B. ................. 2

00

3. Multiply Line 2 by 7.5% (.075). ................................................................................................ 3

4. TOTAL MEDICAL EXPENSE: (Subtract Line 3 from Line 1). ................................................................................ 4

00

TAXES: (See Instructions).

00

5. Real estate tax: ....................................................................................................................... 5

00

6. Personal property tax: ............................................................................................................. 6

7. TOTAL TAXES: (Add Lines 5 and 6). .................................................................................................................... 7

00

INTEREST EXPENSE: (See Instructions).

00

8. Home mortgage interest paid to financial institutions: ............................................................ 8

9. Home mortgage interest paid to an individual:

Name: ______________________________________________________

00

Address: ____________________________________________________ . ...................... 9

00

10. Deductible points: ................................................................................................................. 10

00

11. Investment interest: (Attach Federal Form 4952). ................................................................. 11

12. TOTAL INTEREST EXPENSE: (Add Lines 8 through 11). .................................................................................. 12

00

CONTRIBUTIONS: (See Instructions).

00

13. Cash contributions: ............................................................................................................... 13

00

14. Art and literary contributions: (See Instructions). .................................................................. 14

00

15. Check-off contributions: (See Instructions). .......................................................................... 15

00

16. Other: .................................................................................................................................... 16

00

17. Carryover contributions from prior years: ............................................ 17

18. TOTAL CONTRIBUTIONS: (Add Lines 13 through 17). ...................................................................................... 18

00

CASUALTY AND THEFT LOSSES: (See Instructions).

19. TOTAL CASUALTY AND THEFT LOSSES: (Attach Federal Form 4684). .......................................................... 19

00

POST-SECONDARY EDUCATION TUITION DEDUCTION: (See Instructions).

20. TOTAL POST-SECONDARY EDUCATION TUITION DEDUCTION: [Attach AR1075(s)]. .................................. 20

00

MISCELLANEOUS DEDUCTIONS SUBJECT TO 2% AGI LIMIT: (See Instructions).

00

21. Unreimbursed employment business expenses: (Attach Federal Form 2106). .................... 21

00

22. Other Expenses: (List type and amount). .............................................................................. 22

00

23. Add the amounts on Lines 21 and 22. Enter the total. .......................................................... 23

00

24. Enter the amount from AR1000/AR1000NR, Line 35A and 35B. ........ 24

00

25. Multiple Line 24 above by 2% (.02). ...................................................................................... 25

00

26. TOTAL MISCELLANEOUS DEDUCTIONS: (Subtract Line 25 from Line 23). ..................................................... 26

OTHER MISCELLANEOUS DEDUCTIONS: (See Instructions).

27. TOTAL MISCELLANEOUS DEDUCTIONS NOT SUBJECT TO THE 2% AGI LIMITATION. (Attach list). .......... 27

00

TOTAL ITEMIZED DEDUCTIONS:

28. If the amount on AR1000/AR1000NR, Line 35A and 35B is $126,600 or less ($63,300 if married

filing separately on separate returns), add Lines 4, 7, 12, 18, 19, 20, 26 and 27. Enter the total here.

If the amount on AR1000/AR1000NR, Line 35A and 35B is over $126,600 ($63,300 if married

filing separately on separate returns), see worksheet in the instructions to calculate the allowable

amount to enter. Enter allowable amount here.

IF YOU CHECKED FILING STATUS 1, 2, 3 OR 6, ENTER THE ALLOWABLE AMOUNT ON

AR1000/AR1000NR, LINE36A. ............................................................................................................................ 28

00

Note:

If you and your spouse use Filing Status 4 or 5, your ITEMIZED DEDUCTIONS must be prorated

(distributed) between you and your spouse on the basis that each income bears to the total of both.

You must add your ADJUSTED GROSS INCOME (Line 35A) and your spouse’s ADJUSTED

00

GROSS INCOME (Line 35B) from page AR2/NR2. Enter total here.

29A. Divide Line 35A (page AR2/NR2) by the total from the above line, round to the

nearest whole percent. This is your percentage of the ADJUSTED GROSS

%

INCOME. Enter the amount on this line. ............................................................................. 29A

29B. Multiple Line 28 (TOTAL ITEMIZED DEDUCTIONS) by the percentage on Line 29A

for your prorated amount of ITEMIZED DEDUCTIONS. Enter the results here and

00

on Line 36A, page AR2/NR2. .............................................................................................. 29B

30A. For spouse’s percentage of income, subtract the percentage on Line 29A from 100%.

%

This difference will be the spouse’s percentage. Enter the amount on this line. ................................................. 30A

30B. Multiple spouse’s percentage (Line 30A) by Line 28 (TOTAL ITEMIZED DEDUCTIONS).

00

Enter this amount here and on Line 36B, page AR2/NR2. .................................................................................. 30B

Page AR3 (R 8/99)

23

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1