Form F-1120a - Florida Department Of Revenue - Corporate Income Tax - 2004

ADVERTISEMENT

F-1120A

R. 01/04

Page 3

Who Must File a Florida Corporate Income/

General Information

(continued)

Franchise Tax Return?

(continued from Page 1)

Florida return. Florida Form F-7004 must be filed to extend the time to file.

An extension for Florida tax purposes may be granted, even though no

• A single member limited liability company that is disregarded for Florida

federal extension was granted, if good cause for an extension is shown. For

and federal tax purposes is not required to file a separate Florida corporate

more information, see IRS announcements 60-90 and 63-113. Florida Form

income tax return. However, the income of the company is not exempt from

F-7004, along with payment of all the tax due (tentative tax), must be filed

tax if it is owned by a corporation, whether directly or indirectly. In this case,

on or before the original due date of Florida Form F-1120A. An extension of

the corporation is required to file Form F-1120 reporting its own income,

time will be void if: 1) payment is not made with the application, or 2) the

together with the income of the single member limited liability company.

required payment is underpaid by the greater of $2,000 or 30 percent of the

tax shown on Florida Form F-1120A when filed. Extensions are valid for six

• Homeowner and condominium associations that file federal Form 1120

months. Only one extension is permitted per tax year.

must file Florida Form F-1120 or F-1120A regardless of whether any tax may

be due. If federal Form 1120H is filed, a Florida return is not required.

Payment of Tax

• Political organizations that file federal Form 1120POL.

The amount of tax due, as shown on Line 9 of the return, must be submitted

by the original due date along with the return or extension of time. Payment

• S corporations that have federal taxable income must file Florida Form

must be made in U.S. funds. If the tax is not paid on time, penalties and

F-1120 or F-1120A and are subject to Florida corporate income tax.

interest apply.

• Tax-exempt organizations that are fully exempt from federal income tax

Taxable Year and Accounting Methods

but have “unrelated trade or business income” are subject to Florida

The taxable year and method of accounting is the same for Florida income

corporate income tax and must file Florida Form F-1120 or F-1120A.

tax purposes as that used for federal income tax purposes. If the taxable year

or method of accounting is changed for federal income tax purposes, the

General Information

taxable year or method of accounting must be changed for Florida purposes.

When is Florida Form F-1120A Due?

Rounding Off to Whole-Dollar Amounts

Generally, Florida Form F-1120A is due on or before the first day of the fourth

Whole-dollar amounts may be entered on the return. To round off dollar

month following the close of the tax year or the 15th day following the due

amounts, drop amounts less than 50 cents to the next lowest dollar and

date, without extension, for the filing of the related federal return for the

increase amounts from 50 cents to 99 cents to the next highest dollar. If this

taxable year, whichever is later. A return is considered timely filed if

method is used on the federal return, it must be used on the Florida return;

postmarked on or before the applicable due date. If the due date falls on a

otherwise, the treatment is optional.

Saturday, Sunday, or federal or state holiday, the return is considered timely

Federal Employer Identification Number (FEIN)

filed if postmarked on the next business day. A return must be filed, even if no

If you have not received your FEIN, write “Applied For” in the space provided.

tax is due.

When the number is received, send a copy of the IRS notification to:

NOTE: A late-filed return will subject a corporation to penalty, whether

or not tax is due.

FLORIDA DEPARTMENT OF REVENUE

5050 W TENNESSEE ST

Extension of Time to File

TALLAHASSEE FL 32399-0100

To apply for an extension of time for filing Florida Form F-1120A, detach and

complete Florida Form F-7004, Florida Tentative Income/Franchise and/or

Emergency Excise Tax Return and Application for Extension of Time to File

Return . A copy of the federal extension will not extend the time for filing the

(Continued on Page 4)

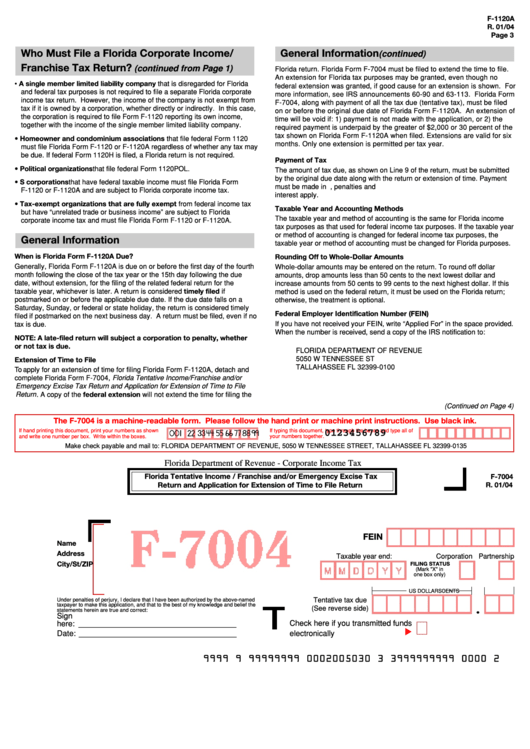

The F-7004 is a machine-readable form. Please follow the hand print or machine print instructions. Use black ink.

If hand printing this document, print your numbers as shown

If typing this document, type through the boxes and type all of

0123456789

0 0 0 0 0 1 1 1 1 1 2 2 2 2 2 3 3 3 3 3 4 4 4 4 4 5 5 5 5 5 6 6 6 6 6 7 7 7 7 7 8 8 8 8 8 9 9 9 9 9

and write one number per box. Write within the boxes.

your numbers together.

Make check payable and mail to: FLORIDA DEPARTMENT OF REVENUE, 5050 W TENNESSEE STREET, TALLAHASSEE FL 32399-0135

Florida Department of Revenue - Corporate Income Tax

Florida Tentative Income / Franchise and/or Emergency Excise Tax

F-7004

Return and Application for Extension of Time to File Return

R. 01/04

FEIN

Name

Address

Taxable year end:

Corporation Partnership

City/St/ZIP

FILING STATUS

(Mark "X" in

one box only)

US DOLLARS

CENTS

Under penalties of perjury, I declare that I have been authorized by the above-named

Tentative tax due

taxpayer to make this application, and that to the best of my knowledge and belief the

(See reverse side)

statements herein are true and correct:

Sign

Check here if you transmitted funds

here: ____________________________________

Date: ____________________________________

electronically

9999090999999990000200503003039999999990000002

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4