Form F-1193 - Florida Department Of Revenue Application For Florida Renewable Energy Production Credit Allocation

ADVERTISEMENT

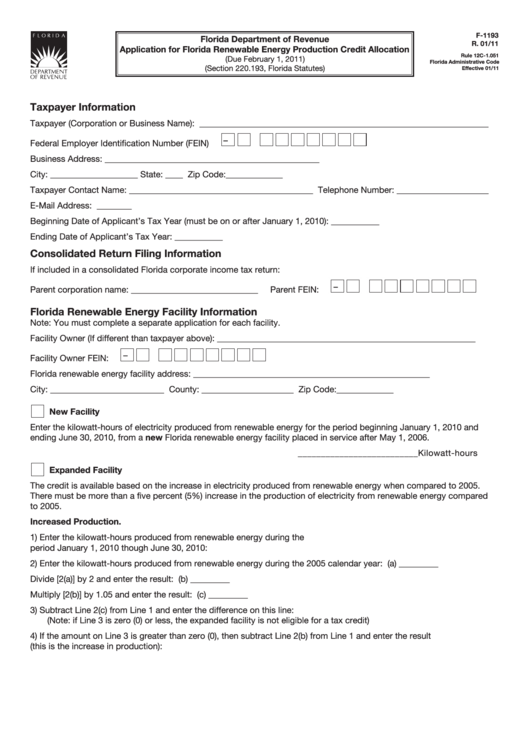

F-1193

Florida Department of Revenue

R. 01/11

Application for Florida Renewable Energy Production Credit Allocation

Rule 12C-1.051

(Due February 1, 2011)

Florida Administrative Code

(Section 220.193, Florida Statutes)

Effective 01/11

Taxpayer Information

Taxpayer (Corporation or Business Name): __________________________________________________________________

–

Federal Employer Identification Number (FEIN)

Business Address: _________________________________________________

City: ____________________ State: ____ Zip Code:_____________

Taxpayer Contact Name: __________________________________________ Telephone Number: _____________________

E-Mail Address: ________

Beginning Date of Applicant’s Tax Year (must be on or after January 1, 2010): ___________

Ending Date of Applicant’s Tax Year: ___________

Consolidated Return Filing Information

If included in a consolidated Florida corporate income tax return:

–

Parent corporation name: _____________________________

Parent FEIN:

Florida Renewable Energy Facility Information

Note: You must complete a separate application for each facility.

Facility Owner (If different than taxpayer above): ___________________________________________________________

–

Facility Owner FEIN:

Florida renewable energy facility address: ______________________________________________________

City: __________________________ County: _____________________ Zip Code:_____________

New Facility

Enter the kilowatt-hours of electricity produced from renewable energy for the period beginning January 1, 2010 and

ending June 30, 2010, from a new Florida renewable energy facility placed in service after May 1, 2006.

__________________________Kilowatt-hours

Expanded Facility

The credit is available based on the increase in electricity produced from renewable energy when compared to 2005.

There must be more than a five percent (5%) increase in the production of electricity from renewable energy compared

to 2005.

Increased Production.

1) Enter the kilowatt-hours produced from renewable energy during the

period January 1, 2010 though June 30, 2010: .......................................................................................... 1 _________

2) Enter the kilowatt-hours produced from renewable energy during the 2005 calendar year: ..................2(a) _________

Divide [2(a)] by 2 and enter the result: ..................................................................................................... 2(b) _________

Multiply [2(b)] by 1.05 and enter the result: ..............................................................................................2(c) _________

3) Subtract Line 2(c) from Line 1 and enter the difference on this line: .......................................................... 3 _________

(Note: if Line 3 is zero (0) or less, the expanded facility is not eligible for a tax credit)

4) If the amount on Line 3 is greater than zero (0), then subtract Line 2(b) from Line 1 and enter the result

(this is the increase in production): .............................................................................................................. 4 _________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4