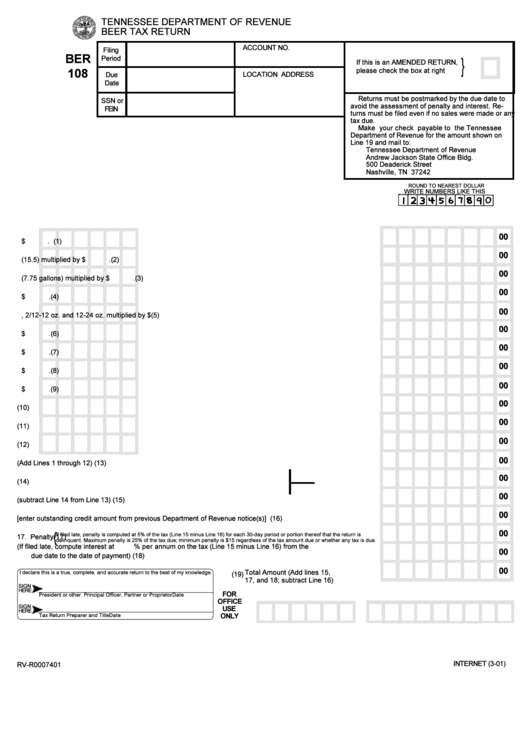

Form Ber108 - Beer Tax Return

ADVERTISEMENT

TENNESSEE DEPARTMENT OF REVENUE

BEER TAX RETURN

BER

}

108

ROUND TO NEAREST DOLLAR

WRITE NUMBERS LIKE THIS

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

{

If filed late, penalty is computed at 5% of the tax (Line 15 minus Line 16) for each 30-day period or portion thereof that the return is

delinquent. Maximum penalty is 25% of the tax due; minimum penalty is $15 regardless of the tax amount due or whether any tax is due.

00

00

I declare this is a true, complete, and accurate return to the best of my knowledge.

SIGN

HERE

FOR

President or other Principal Officer, Partner or Proprietor

Date

OFFICE

SIGN

USE

HERE

Tax Return Preparer and Title

Date

ONLY

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1