Instructions For Form Ct-38 - Minimum Tax Credit - 2004

ADVERTISEMENT

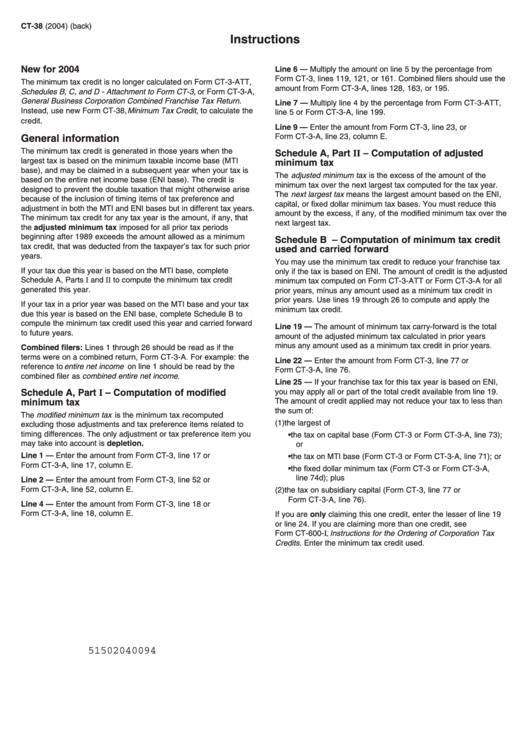

CT-38 (2004) (back)

Instructions

New for 2004

Line 6 — Multiply the amount on line 5 by the percentage from

Form CT-3, lines 119, 121, or 161. Combined filers should use the

The minimum tax credit is no longer calculated on Form CT-3-ATT,

amount from Form CT-3-A, lines 128, 163, or 195.

Schedules B, C, and D - Attachment to Form CT-3, or Form CT-3-A,

General Business Corporation Combined Franchise Tax Return.

Line 7 — Multiply line 4 by the percentage from Form CT-3-ATT,

Instead, use new Form CT-38, Minimum Tax Credit, to calculate the

line 5 or Form CT-3-A, line 199.

credit.

Line 9 — Enter the amount from Form CT-3, line 23, or

Form CT-3-A, line 23, column E.

General information

The minimum tax credit is generated in those years when the

Schedule A, Part II – Computation of adjusted

largest tax is based on the minimum taxable income base (MTI

minimum tax

base), and may be claimed in a subsequent year when your tax is

The adjusted minimum tax is the excess of the amount of the

based on the entire net income base (ENI base). The credit is

minimum tax over the next largest tax computed for the tax year.

designed to prevent the double taxation that might otherwise arise

The next largest tax means the largest amount based on the ENI,

because of the inclusion of timing items of tax preference and

capital, or fixed dollar minimum tax bases. You must reduce this

adjustment in both the MTI and ENI bases but in different tax years.

amount by the excess, if any, of the modified minimum tax over the

The minimum tax credit for any tax year is the amount, if any, that

next largest tax.

the adjusted minimum tax imposed for all prior tax periods

beginning after 1989 exceeds the amount allowed as a minimum

Schedule B – Computation of minimum tax credit

tax credit, that was deducted from the taxpayer’s tax for such prior

used and carried forward

years.

You may use the minimum tax credit to reduce your franchise tax

If your tax due this year is based on the MTI base, complete

only if the tax is based on ENI. The amount of credit is the adjusted

Schedule A, Parts I and II to compute the minimum tax credit

minimum tax computed on Form CT-3-ATT or Form CT-3-A for all

generated this year.

prior years, minus any amount used as a minimum tax credit in

prior years. Use lines 19 through 26 to compute and apply the

If your tax in a prior year was based on the MTI base and your tax

minimum tax credit.

due this year is based on the ENI base, complete Schedule B to

compute the minimum tax credit used this year and carried forward

Line 19 — The amount of minimum tax carry-forward is the total

to future years.

amount of the adjusted minimum tax calculated in prior years

minus any amount used as a minimum tax credit in prior years.

Combined filers: Lines 1 through 26 should be read as if the

terms were on a combined return, Form CT-3-A. For example: the

Line 22 — Enter the amount from Form CT-3, line 77 or

reference to entire net income on line 1 should be read by the

Form CT-3-A, line 76.

combined filer as combined entire net income.

Line 25 — If your franchise tax for this tax year is based on ENI,

you may apply all or part of the total credit available from line 19.

Schedule A, Part I – Computation of modified

The amount of credit applied may not reduce your tax to less than

minimum tax

the sum of:

The modified minimum tax is the minimum tax recomputed

(1) the largest of

excluding those adjustments and tax preference items related to

timing differences. The only adjustment or tax preference item you

• the tax on capital base (Form CT-3 or Form CT-3-A, line 73);

may take into account is depletion.

or

Line 1 — Enter the amount from Form CT-3, line 17 or

• the tax on MTI base (Form CT-3 or Form CT-3-A, line 71); or

Form CT-3-A, line 17, column E.

• the fixed dollar minimum tax (Form CT-3 or Form CT-3-A,

line 74d); plus

Line 2 — Enter the amount from Form CT-3, line 52 or

Form CT-3-A, line 52, column E.

(2) the tax on subsidiary capital (Form CT-3, line 77 or

Form CT-3-A, line 76).

Line 4 — Enter the amount from Form CT-3, line 18 or

Form CT-3-A, line 18, column E.

If you are only claiming this one credit, enter the lesser of line 19

or line 24. If you are claiming more than one credit, see

Form CT-600-I, Instructions for the Ordering of Corporation Tax

Credits. Enter the minimum tax credit used.

51502040094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1