Form Ct-38 - Minimum Tax Credit - 2014

ADVERTISEMENT

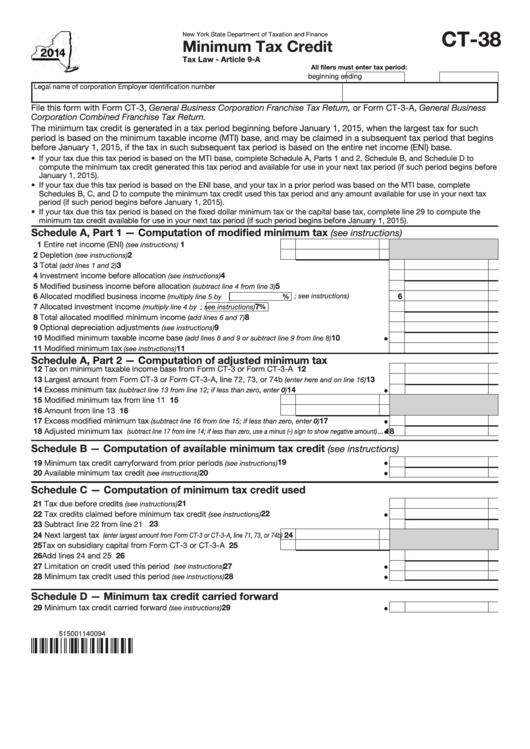

CT-38

New York State Department of Taxation and Finance

Minimum Tax Credit

Tax Law - Article 9-A

All filers must enter tax period:

beginning

ending

Legal name of corporation

Employer identification number

File this form with Form CT-3, General Business Corporation Franchise Tax Return, or Form CT-3-A, General Business

Corporation Combined Franchise Tax Return.

The minimum tax credit is generated in a tax period beginning before January 1, 2015, when the largest tax for such

period is based on the minimum taxable income (MTI) base, and may be claimed in a subsequent tax period that begins

before January 1, 2015, if the tax in such subsequent tax period is based on the entire net income (ENI) base.

• If your tax due this tax period is based on the MTI base, complete Schedule A, Parts 1 and 2, Schedule B, and Schedule D to

compute the minimum tax credit generated this tax period and available for use in your next tax period (if such period begins before

January 1, 2015).

• If your tax due this tax period is based on the ENI base, and your tax in a prior period was based on the MTI base, complete

Schedules B, C, and D to compute the minimum tax credit used this tax period and any amount available for use in your next tax

period (if such period begins before January 1, 2015).

• If your tax due this tax period is based on the fixed dollar minimum tax or the capital base tax, complete line 29 to compute the

minimum tax credit available for use in your next tax period (if such period begins before January 1, 2015).

Schedule A, Part 1 — Computation of modified minimum tax

(see instructions)

1 Entire net income (ENI)

..........................................

1

(see instructions)

2 Depletion

2

................................................................

(see instructions)

3 Total

.........................................................................................................................

3

(add lines 1 and 2)

4 Investment income before allocation

........................................................................

4

(see instructions)

5 Modified business income before allocation

5

...............................................

(subtract line 4 from line 3)

6 Allocated modified business income

...................

6

%

(multiply line 5 by

; see instructions)

7 Allocated investment income

............................

7

%

(multiply line 4 by

; see instructions)

8 Total allocated modified minimum income

..............................................................

8

(add lines 6 and 7)

9 Optional depreciation adjustments

9

............................................................................

(see instructions)

10 Modified minimum taxable income base

......................

10

(add lines 8 and 9 or subtract line 9 from line 8)

11 Modified minimum tax

............................................................................................... 11

(see instructions)

Schedule A, Part 2 — Computation of adjusted minimum tax

12 Tax on minimum taxable income base from Form CT-3 or Form CT-3-A ........................................... 12

13 Largest amount from Form CT-3 or Form CT-3-A, line 72, 73, or 74b

......... 13

(enter here and on line 16)

14 Excess minimum tax

14

...........................................

(subtract line 13 from line 12; if less than zero, enter 0)

15 Modified minimum tax from line 11 ..................................................

15

16 Amount from line 13 .........................................................................

16

17 Excess modified minimum tax

17

............................

(subtract line 16 from line 15; if less than zero, enter 0)

18 Adjusted minimum tax

18

...

(subtract line 17 from line 14; if less than zero, use a minus (-) sign to show negative amount)

Schedule B — Computation of available minimum tax credit

(see instructions)

19

19 Minimum tax credit carryforward from prior periods

...............................................

(see instructions)

20 Available minimum tax credit

...................................................................................

20

(see instructions)

Schedule C — Computation of minimum tax credit used

............................................................................................... 21

21 Tax due before credits

(see instructions)

22

22 Tax credits claimed before minimum tax credit

.......................................................

(see instructions)

23 Subtract line 22 from line 21 ............................................................................................................... 23

24 Next largest tax

24

(enter largest amount from Form CT-3 or CT-3-A, line 71, 73, or 74b)

25 Tax on subsidiary capital from Form CT-3 or CT-3-A .......................

25

26 Add lines 24 and 25 ............................................................................................................................ 26

27 Limitation on credit used this period

27

........................................................................

(see instructions)

28 Minimum tax credit used this period

.......................................................................

28

(see instructions)

Schedule D — Minimum tax credit carried forward

29 Minimum tax credit carried forward

.........................................................................

29

(see instructions)

515001140094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2