Form Ct-38 - Minimum Tax Credit - 2011

ADVERTISEMENT

Staple forms here

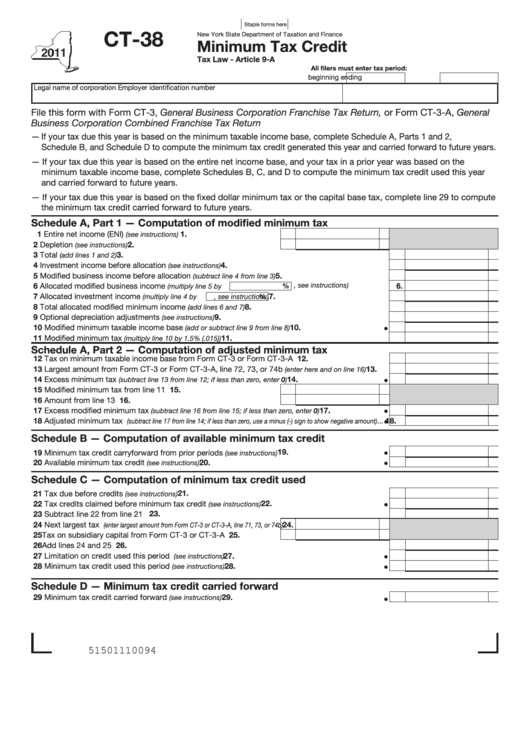

CT-38

New York State Department of Taxation and Finance

Minimum Tax Credit

Tax Law - Article 9-A

All filers must enter tax period:

beginning

ending

Legal name of corporation

Employer identification number

File this form with Form CT-3, General Business Corporation Franchise Tax Return, or Form CT-3-A, General

Business Corporation Combined Franchise Tax Return

— If your tax due this year is based on the minimum taxable income base, complete Schedule A, Parts 1 and 2,

Schedule B, and Schedule D to compute the minimum tax credit generated this year and carried forward to future years.

— If your tax due this year is based on the entire net income base, and your tax in a prior year was based on the

minimum taxable income base, complete Schedules B, C, and D to compute the minimum tax credit used this year

and carried forward to future years.

— If your tax due this year is based on the fixed dollar minimum tax or the capital base tax, complete line 29 to compute

the minimum tax credit carried forward to future years.

Schedule A, Part 1 — Computation of modified minimum tax

1 Entire net income (ENI)

..........................................

1.

(see instructions)

2 Depletion

................................................................

2.

(see instructions)

3 Total

3.

.........................................................................................................................

(add lines 1 and 2)

4 Investment income before allocation

4.

........................................................................

(see instructions)

5 Modified business income before allocation

...............................................

5.

(subtract line 4 from line 3)

6 Allocated modified business income

..................

6.

%

(multiply line 5 by

, see instructions)

7 Allocated investment income

%

............................

7.

(multiply line 4 by

, see instructions)

8 Total allocated modified minimum income

..............................................................

8.

(add lines 6 and 7)

9 Optional depreciation adjustments

9.

............................................................................

(see instructions)

10 Modified minimum taxable income base

10.

.........................................

(add or subtract line 9 from line 8)

11 Modified minimum tax

........................................................................... 11.

(multiply line 10 by 1.5% (.015))

Schedule A, Part 2 — Computation of adjusted minimum tax

12 Tax on minimum taxable income base from Form CT-3 or Form CT-3-A ........................................... 12.

13 Largest amount from Form CT-3 or Form CT-3-A, line 72, 73, or 74b

......... 13.

(enter here and on line 16)

14 Excess minimum tax

14.

...........................................

(subtract line 13 from line 12; if less than zero, enter 0)

15 Modified minimum tax from line 11 .................................................. 15.

16 Amount from line 13 ......................................................................... 16.

17 Excess modified minimum tax

............................

17.

(subtract line 16 from line 15; if less than zero, enter 0)

18 Adjusted minimum tax

...

18.

(subtract line 17 from line 14; if less than zero, use a minus (-) sign to show negative amount)

Schedule B — Computation of available minimum tax credit

19.

19 Minimum tax credit carryforward from prior periods

...............................................

(see instructions)

20 Available minimum tax credit

...................................................................................

20.

(see instructions)

Schedule C — Computation of minimum tax credit used

............................................................................................... 21.

21 Tax due before credits

(see instructions)

22.

22 Tax credits claimed before minimum tax credit

.......................................................

(see instructions)

23 Subtract line 22 from line 21 ............................................................................................................... 23.

24 Next largest tax

24.

(enter largest amount from Form CT-3 or CT-3-A, line 71, 73, or 74b)

25 Tax on subsidiary capital from Form CT-3 or CT-3-A ....................... 25.

26 Add lines 24 and 25 ............................................................................................................................ 26.

27 Limitation on credit used this period

........................................................................

27.

(see instructions)

28 Minimum tax credit used this period

.......................................................................

28.

(see instructions)

Schedule D — Minimum tax credit carried forward

29 Minimum tax credit carried forward

29.

.........................................................................

(see instructions)

51501110094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2