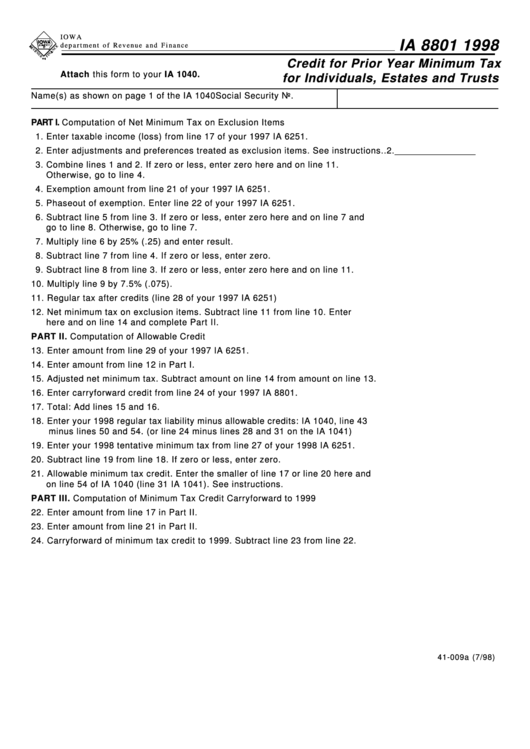

I OWA

IA 8801 1998

d e p a r t m e n t o f R eve n u e a n d F i n a n c e

Credit for Prior Year Minimum Tax

Attach this form to your IA 1040.

for Individuals, Estates and Trusts

Name(s) as shown on page 1 of the IA 1040

Social Security No.

PART I. Computation of Net Minimum Tax on Exclusion Items

1. Enter taxable income (loss) from line 17 of your 1997 IA 6251. ................................ 1. _________________

2. Enter adjustments and preferences treated as exclusion items. See instructions. . 2. _________________

3. Combine lines 1 and 2. If zero or less, enter zero here and on line 11.

Otherwise, go to line 4. ................................................................................................... 3. _________________

4. Exemption amount from line 21 of your 1997 IA 6251. ............................................... 4. _________________

5. Phaseout of exemption. Enter line 22 of your 1997 IA 6251. ..................................... 5. _________________

6. Subtract line 5 from line 3. If zero or less, enter zero here and on line 7 and

go to line 8. Otherwise, go to line 7. .............................................................................. 6. _________________

7. Multiply line 6 by 25% (.25) and enter result. ............................................................... 7. _________________

8. Subtract line 7 from line 4. If zero or less, enter zero. ................................................ 8. _________________

9. Subtract line 8 from line 3. If zero or less, enter zero here and on line 11. ............. 9. _________________

10. Multiply line 9 by 7.5% (.075). ........................................................................................ 10. _________________

11. Regular tax after credits (line 28 of your 1997 IA 6251) ............................................. 11. _________________

12. Net minimum tax on exclusion items. Subtract line 11 from line 10. Enter

here and on line 14 and complete Part II. .................................................................... 12. _________________

PART II. Computation of Allowable Credit

13. Enter amount from line 29 of your 1997 IA 6251. ........................................................ 13. _________________

14. Enter amount from line 12 in Part I. ............................................................................... 14. _________________

15. Adjusted net minimum tax. Subtract amount on line 14 from amount on line 13. .... 15. _________________

16. Enter carryforward credit from line 24 of your 1997 IA 8801. .................................... 16. _________________

17. Total: Add lines 15 and 16. .............................................................................................. 17. _________________

18. Enter your 1998 regular tax liability minus allowable credits: IA 1040, line 43

minus lines 50 and 54. (or line 24 minus lines 28 and 31 on the IA 1041) .............. 18. _________________

19. Enter your 1998 tentative minimum tax from line 27 of your 1998 IA 6251. ............ 19. _________________

20. Subtract line 19 from line 18. If zero or less, enter zero. ............................................ 20. _________________

21. Allowable minimum tax credit. Enter the smaller of line 17 or line 20 here and

on line 54 of IA 1040 (line 31 IA 1041). See instructions. .......................................... 21. _________________

PART III. Computation of Minimum Tax Credit Carryforward to 1999

22. Enter amount from line 17 in Part II. ............................................................................. 22. _________________

23. Enter amount from line 21 in Part II. ............................................................................. 23. _________________

24. Carryforward of minimum tax credit to 1999. Subtract line 23 from line 22. ............ 24. _________________

41-009a (7/98)

1

1