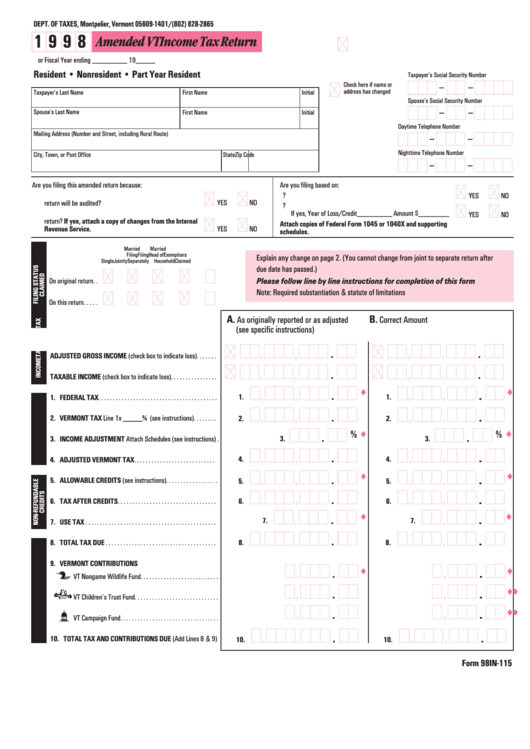

Form 98in -115 - Amended Vt Income Tax Return - 1998

ADVERTISEMENT

DEPT. OF TAXES, Montpelier, Vermont 05609-1401/(802) 828-2865

1 9 9 8

Amended VT Income Tax Return

or Fiscal Year ending _________ 19_____

Resident • Nonresident • Part Year Resident

Taxpayer’s Social Security Number

Check here if name or

address has changed

Taxpayer’s Last Name

First Name

Initial

Spouse’s Social Security Number

Spouse’s Last Name

First Name

Initial

Daytime Telephone Number

Mailing Address (Number and Street, including Rural Route)

Nighttime Telephone Number

City, Town, or Post Office

State

Zip Code

Are you filing this amended return because:

Are you filing based on:

a. The Vermont Department of Taxes has notified you that your

a. The filing of a federal amended return?

YES

NO

YES

NO

return will be audited?

b. Carry back of net operating loss or investment tax credit?

b. The Internal Revenue Service has corrected your federal

If yes, Year of Loss/Credit_________ Amount $________

YES

NO

return? If yes, attach a copy of changes from the Internal

Attach copies of Federal Form 1045 or 1040X and supporting

Revenue Service.

YES

NO

schedules.

Married

Married

Filing

Filing

Head of

Exemptions

Explain any change on page 2. (You cannot change from joint to separate return after

Single

Jointly

Separately Household

Claimed

due date has passed.)

On original return. .

Please follow line by line instructions for completion of this form

Note: Required substantiation & statute of limitations

On this return . . . . .

A.

B.

As originally reported or as adjusted

Correct Amount

(see specific instructions)

ADJUSTED GROSS INCOME (check box to indicate loss) . . . . . . .

TAXABLE INCOME (check box to indicate loss) . . . . . . . . . . . . . . . .

1. FEDERAL TAX . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1.

1.

2. VERMONT TAX Line 1x _____% (see instructions) . . . . . . . .

2.

2.

%

%

3. INCOME ADJUSTMENT Attach Schedules (see instructions) .

3.

3.

4.

4.

4. ADJUSTED VERMONT TAX . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5. ALLOWABLE CREDITS (see instructions) . . . . . . . . . . . . . . . . . .

5.

5.

6. TAX AFTER CREDITS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6.

6.

7.

7.

7. USE TAX . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8. TOTAL TAX DUE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8.

8.

9. VERMONT CONTRIBUTIONS

VT Nongame Wildlife Fund. . . . . . . . . . . . . . . . . . . . . . . . . . .

VT Children’s Trust Fund. . . . . . . . . . . . . . . . . . . . . . . . . . . . .

VT Campaign Fund. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10. TOTAL TAX AND CONTRIBUTIONS DUE (Add Lines 8 & 9)

10.

10.

Form 98IN-115

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2