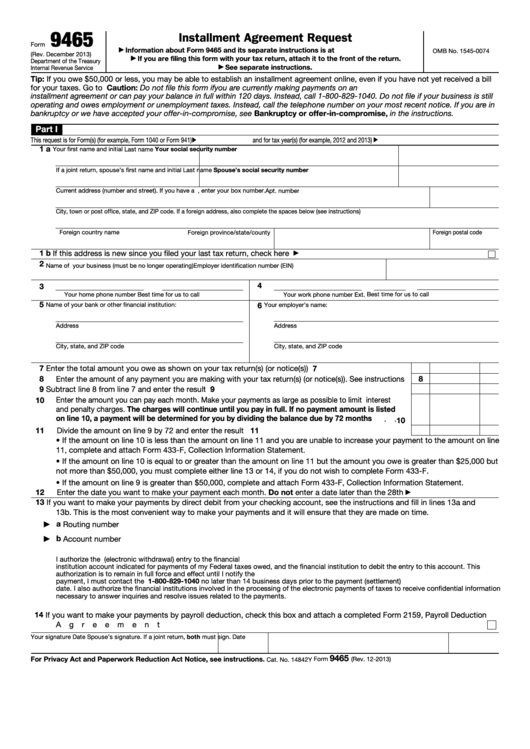

9465

Installment Agreement Request

Form

Information about Form 9465 and its separate instructions is at

▶

OMB No. 1545-0074

(Rev. December 2013)

If you are filing this form with your tax return, attach it to the front of the return.

▶

Department of the Treasury

See separate instructions.

Internal Revenue Service

▶

Tip: If you owe $50,000 or less, you may be able to establish an installment agreement online, even if you have not yet received a bill

for your taxes. Go to IRS.gov to apply to pay online. Caution: Do not file this form if you are currently making payments on an

installment agreement or can pay your balance in full within 120 days. Instead, call 1-800-829-1040. Do not file if your business is still

operating and owes employment or unemployment taxes. Instead, call the telephone number on your most recent notice. If you are in

bankruptcy or we have accepted your offer-in-compromise, see Bankruptcy or offer-in-compromise, in the instructions.

Part I

This request is for Form(s) (for example, Form 1040 or Form 941)

and for tax year(s) (for example, 2012 and 2013)

▶

▶

1 a

Your first name and initial

Your social security number

Last name

If a joint return, spouse’s first name and initial

Last name

Spouse’s social security number

Current address (number and street). If you have a P.O. box and no home delivery, enter your box number.

Apt. number

City, town or post office, state, and ZIP code. If a foreign address, also complete the spaces below (see instructions)

Foreign country name

Foreign province/state/county

Foreign postal code

1 b If this address is new since you filed your last tax return, check here

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

▶

2

Name of your business (must be no longer operating)

Employer identification number (EIN)

4

3

Best time for us to call

Your home phone number

Best time for us to call

Your work phone number

Ext.

5

6

Name of your bank or other financial institution:

Your employer’s name:

Address

Address

City, state, and ZIP code

City, state, and ZIP code

7

Enter the total amount you owe as shown on your tax return(s) (or notice(s)) .

.

.

.

.

.

.

.

7

8

Enter the amount of any payment you are making with your tax return(s) (or notice(s)). See instructions

8

9

Subtract line 8 from line 7 and enter the result .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

9

Enter the amount you can pay each month. Make your payments as large as possible to limit interest

10

and penalty charges. The charges will continue until you pay in full. If no payment amount is listed

on line 10, a payment will be determined for you by dividing the balance due by 72 months

.

.

10

11

Divide the amount on line 9 by 72 and enter the result .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

11

• If the amount on line 10 is less than the amount on line 11 and you are unable to increase your payment to the amount on line

11, complete and attach Form 433-F, Collection Information Statement.

• If the amount on line 10 is equal to or greater than the amount on line 11 but the amount you owe is greater than $25,000 but

not more than $50,000, you must complete either line 13 or 14, if you do not wish to complete Form 433-F.

• If the amount on line 9 is greater than $50,000, complete and attach Form 433-F, Collection Information Statement.

12

Enter the date you want to make your payment each month. Do not enter a date later than the 28th

▶

13

If you want to make your payments by direct debit from your checking account, see the instructions and fill in lines 13a and

13b. This is the most convenient way to make your payments and it will ensure that they are made on time.

a Routing number

▶

b Account number

▶

I authorize the U.S. Treasury and its designated Financial Agent to initiate a monthly ACH debit (electronic withdrawal) entry to the financial

institution account indicated for payments of my Federal taxes owed, and the financial institution to debit the entry to this account. This

authorization is to remain in full force and effect until I notify the U.S. Treasury Financial Agent to terminate the authorization. To revoke

payment, I must contact the U.S. Treasury Financial Agent at 1-800-829-1040 no later than 14 business days prior to the payment (settlement)

date. I also authorize the financial institutions involved in the processing of the electronic payments of taxes to receive confidential information

necessary to answer inquiries and resolve issues related to the payments.

14

If you want to make your payments by payroll deduction, check this box and attach a completed Form 2159, Payroll Deduction

Agreement

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Your signature

Date

Spouse’s signature. If a joint return, both must sign.

Date

9465

For Privacy Act and Paperwork Reduction Act Notice, see instructions.

Form

(Rev. 12-2013)

Cat. No. 14842Y

1

1 2

2