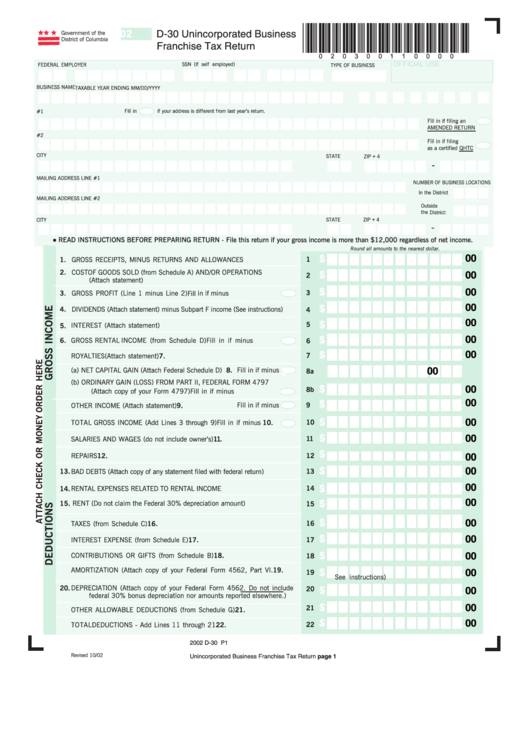

Form D-30 - Unincorporated Business Franchise Tax Return - 2002

ADVERTISEMENT

*020300110000*

2002

D-30 Unincorporated Business

Government of the

District of Columbia

Franchise Tax Return

OFFICIAL USE

SSN (If self employed)

FEDERAL EMPLOYER I.D. NUMBER

TYPE OF BUSINESS

BUSINESS NAME

TAXABLE YEAR ENDING MM/DD/YYYY

Fill in

if your address is different from last year’s return.

D.C. BUSINESS ADDRESS LINE #1

Fill in if filing an

AMENDED RETURN

D.C. BUSINESS ADDRESS LINE #2

mmm

Fill in if filing

as a certified QHTC

CITY

STATE

ZIP + 4

-

MAILING ADDRESS LINE #1

MAILING ADDRESS LINE #1

MAILING ADDRESS LINE #1

NUMBER OF BUSINESS LOCATIONS

In the District

MAILING ADDRESS LINE #2

Outside

the District:

ZIP + 4

CITY

STATE

-

•

READ INSTRUCTIONS BEFORE PREPARING RETURN - File this return if your gross income is more than $12,000 regardless of net income.

Round all amounts to the nearest dollar.

.00

$

1

1. GROSS RECEIPTS, MINUS RETURNS AND ALLOWANCES

2. COST OF GOODS SOLD (from Schedule A) AND/OR OPERATIONS

$

.00

2

(Attach statement)

$

.00

3. GROSS PROFIT (Line 1 minus Line 2)

Fill in if minus

3

.00

$

4. DIVIDENDS (Attach statement) minus Subpart F income (See instructions)

4

.00

$

5

INTEREST (Attach statement)

5.

.00

$

6.

GROSS RENTAL INCOME (from Schedule D)

Fill in if minus

6

.00

$

7.

ROYALTIES (Attach statement)

7

Fill in if minus

.00

8.

(a) NET CAPITAL GAIN (Attach Federal Schedule D)

$

8a

(b) ORDINARY GAIN (LOSS) FROM PART II, FEDERAL FORM 4797

$

.00

8b

(Attach copy of your Form 4797)

Fill in if minus

.00

$

9.

OTHER INCOME (Attach statement)

Fill in if minus

9

$

.00

10

10.

TOTAL GROSS INCOME (Add Lines 3 through 9)

Fill in if minus

$

.00

11.

SALARIES AND WAGES (do not include owner ’s)

11

$

12.

REPAIRS

12

.00

$

.00

13.

BAD DEBTS (Attach copy of any statement filed with federal return)

13

.00

$

14

14.

RENTAL EXPENSES RELATED TO RENTAL INCOME

.00

$

15.

RENT (Do not claim the Federal 30% depreciation amount)

15

$

.00

16.

TAXES (from Schedule C)

16

$

.00

17

17.

INTEREST EXPENSE (from Schedule E)

$

.00

18.

CONTRIBUTIONS OR GIFTS (from Schedule B)

18

19.

AMORTIZATION (Attach copy of your Federal Form 4562, Part VI.

$

.00

19

See instructions)

20.

DEPRECIATION (Attach copy of your Federal Form 4562. Do not include

20

$

.00

federal 30% bonus depreciation nor amounts reported elsewhere.)

$

.00

21

21.

OTHER ALLOWABLE DEDUCTIONS (from Schedule G )

$

.00

22.

TOT AL DEDUCTIONS - Add Lines 11 through 21

22

2002 D-30 P1

Revised 10/02

Unincorporated Business Franchise Tax Return page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5