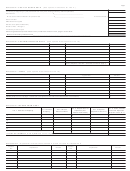

Form D-30 - Unincorporated Business Franchise Tax Return - 2002 Page 2

ADVERTISEMENT

*020300120000*

D-30 PAGE 2

TAXPAYER NAME :

FEDERAL EMPLOYER I.D. NUMBER/SSN :

ENTER DOLLAR AMOUNTS ONLY

$

.00

23.

NET INCOME (Line 10 minus Line 22)

Fill in if minus

23

$

.00

24.

NET OPERATING LOSS DEDUCTION

24

$

.00

25.

NET INCOME AFTER NOL DEDUCTION

Fill in if minus

25

(Line 23 minus Line 24)

$

.00

26

26.

(a) NON-BUSINESS INCOME (Attach statement)

$

.00

(b) MINUS: RELATED EXPENSE (Attach statement)

$

.00

(c) SUBTRACT 26(b) FROM 26(a)

(see instructions)

Fill in if minus

$

27.

NET INCOME FROM TRADE OR BUSINESS SUBJECT TO

.00

27

APPORTIONMENT (Line 25 minus 26(c))

Fill in if minus

.00

.

28.

D.C. APPORTIONMENT FACTOR (from Line 5, Col. 3, Schedule F)

28

$

.00

29.

NET INCOME FROM TRADE OR BUSINESS APPORTIONED TO THE

29

Fill in if minus

DISTRICT (Multiply Line 27 by Line 28)

$

Fill in if minus

.00

30.

ADD PORTION OF LINE 26(c) ATTRIBUTABLE TO D.C.

30

0 0

(Attach statement)

$

31.

TOTAL DISTRICT NET INCOME (OR LOSS)

Fill in if minus

31

.00

(line 29 plus line 30)

32.

MINUS: SALARY FOR TAXPAYER(S) SERVICES

32

$

.00

(from Schedule J,

Column 4)

33. EXEMPTION (if part year return, enter number of days in

Fill in if minus

$

33

.00

___________

D.C. -

)

$

34.

TOT AL TAXABLE INCOME (before Apportioned NOL Deduction)

.00

34

.0

.0

(Line 31 minus Lines 32 and 33)

$

.00

35

35.

APPOR TIONED NOL DEDUCTION

$

.00

Fill in if minus

36.

TOTAL TAXABLE INCOME (Line 34 minus Line 35)

36

.0

$

.00

37

37.

TAX (9.975% OF LINE 36). IF TAX DUE IS LESS THAN $100, ENTER $100

38.

MINUS: (a) TAX PAID, IF ANY, WITH REQUEST FOR EXTENSION OF TIME TO

$

.00

38

FILE (or with ORIGINAL RETURN if filing an AMENDED RETURN)

$

.00

(b) 2002 ESTIMATED TAX PAYMENTS

(c) ECONOMIC DEVELOPMENT ZONE INCENTIVES CREDIT

$

.00

(from worksheet)

$

.00

39.

TOTAL OF LINES 38(a), (b), and (c)

39

$

.00

40

40.

BALANCE DUE (Line 37 minus Line 39)

41.

PENALTY

$_________________

INTEREST

$_________________

$

.00

41

TOTAL PENALTY AND INTEREST

42.

TOT AL UNPAID BALANCE, PLUS PENALTY AND INTEREST

$

.00

42

(Add Lines 40 and 41)

$

.00

43

43.

OVERPAYMENT (Line 39 minus Line 37)

$

.00

44.

(a) CREDIT TO 2003 ESTIMATED TAX

44a

$

.00

44b

(b) AMOUNT TO BE REFUNDED -

(Line 43 minus Line 44a)

Under penalties of law, I declare that I have examined this return and, to the best of my knowledge, it is correct. Declaration of paid preparer is based on all information available to the preparer.

PLEASE

Telephone Number of Person to Contact

SIGN

-

-

HERE

DATE

TAXPAYER’S SIGNATURE

PAID

PREPARER

PREPARER’S SIGNATURE (If other than taxpayer)

DATE

FIRM NAME

FIRM ADDRESS

ONLY

Preparer ’ s FEIN, SSN or PTIN

2002 D-30

Unincorporated Business Franchise Tax Return page 2

Revised 10/02

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5