Information And Instructions For South Carolina Schedule Tc-13 - Department Of Revenue

ADVERTISEMENT

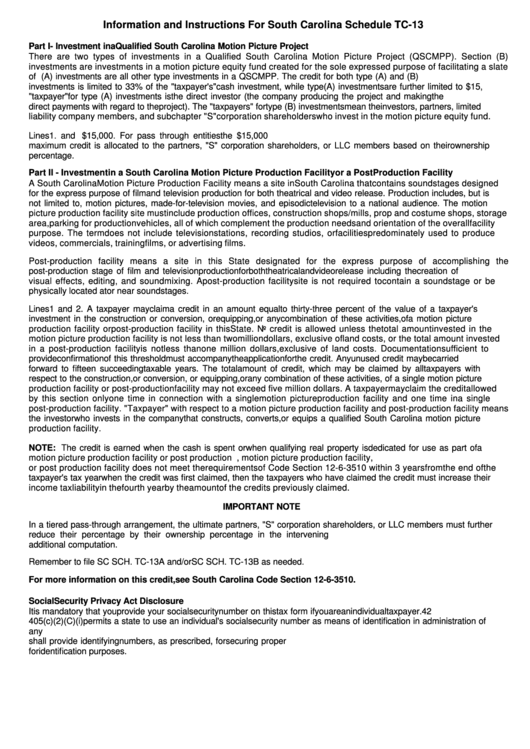

Information and Instructions For South Carolina Schedule TC-13

Part I - Investment in a Qualified South Carolina Motion Picture Project

There are two types of investments in a Qualified South Carolina Motion Picture Project (QSCMPP). Section (B)

investments are investments in a motion picture equity fund created for the sole expressed purpose of facilitating a slate

of QSCMPPs. Section (A) investments are all other type investments in a QSCMPP. The credit for both type (A) and (B)

investments is limited to 33% of the "taxpayer's" cash investment, while type (A) investments are further limited to $15,

000. The "taxpayer" for type (A) investments is the direct investor (the company producing the project and making the

direct payments with regard to the project). The "taxpayers" for type (B) investments mean the investors, partners, limited

liability company members, and subchapter "S" corporation shareholders who invest in the motion picture equity fund.

Lines 1. and 2. The maximum credit per motion picture project is $15,000. For pass through entities the $15,000

maximum credit is allocated to the partners, "S" corporation shareholders, or LLC members based on their ownership

percentage.

Part II - Investment in a South Carolina Motion Picture Production Facility or a Post Production Facility

A South Carolina Motion Picture Production Facility means a site in South Carolina that contains soundstages designed

for the express purpose of film and television production for both theatrical and video release. Production includes, but is

not limited to, motion pictures, made-for-television movies, and episodic television to a national audience. The motion

picture production facility site must include production offices, construction shops/mills, prop and costume shops, storage

area, parking for production vehicles, all of which complement the production needs and orientation of the overall facility

purpose. The term does not include television stations, recording studios, or facilities predominately used to produce

videos, commercials, training films, or advertising films.

Post-production facility means a site in this State designated for the express purpose of accomplishing the

post-production stage of film and television production for both theatrical and video release including the creation of

visual effects, editing, and sound mixing. A post-production facility site is not required to contain a soundstage or be

physically located at or near soundstages.

Lines 1 and 2. A taxpayer may claim a credit in an amount equal to thirty-three percent of the value of a taxpayer's

investment in the construction or conversion, or equipping, or any combination of these activities, of a motion picture

production facility or post-production facility in this State. No credit is allowed unless the total amount invested in the

motion picture production facility is not less than two million dollars, exclusive of land costs, or the total amount invested

in a post-production facility is not less than one million dollars, exclusive of land costs. Documentation sufficient to

provide confirmation of this threshold must accompany the application for the credit. Any unused credit may be carried

forward to fifteen succeeding taxable years. The total amount of credit, which may be claimed by all taxpayers with

respect to the construction, or conversion, or equipping, or any combination of these activities, of a single motion picture

production facility or post-production facility may not exceed five million dollars. A taxpayer may claim the credit allowed

by this section only one time in connection with a single motion picture production facility and one time in a single

post-production facility. "Taxpayer" with respect to a motion picture production facility and post-production facility means

the investor who invests in the company that constructs, converts, or equips a qualified South Carolina motion picture

production facility.

NOTE: The credit is earned when the cash is spent or when qualifying real property is dedicated for use as part of a

motion picture production facility or post production facility. If the motion picture project, motion picture production facility,

or post production facility does not meet the requirements of Code Section 12-6-3510 within 3 years from the end of the

taxpayer's tax year when the credit was first claimed, then the taxpayers who have claimed the credit must increase their

income tax liability in the fourth year by the amount of the credits previously claimed.

IMPORTANT NOTE

In a tiered pass-through arrangement, the ultimate partners, "S" corporation shareholders, or LLC members must further

reduce their percentage by their ownership percentage in the intervening entity. Attach a schedule showing the

additional computation.

Remember to file SC SCH. TC-13A and/or SC SCH. TC-13B as needed.

For more information on this credit, see South Carolina Code Section 12-6-3510.

Social Security Privacy Act Disclosure

It is mandatory that you provide your social security number on this tax form if you are an individual taxpayer. 42 U.S.C

405(c)(2)(C)(i) permits a state to use an individual's social security number as means of identification in administration of

any tax. SC Regulation 117-1 mandates that any person required to make a return to the SC Department of Revenue

shall provide identifying numbers, as prescribed, for securing proper identification. Your social security number is used

for identification purposes.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1