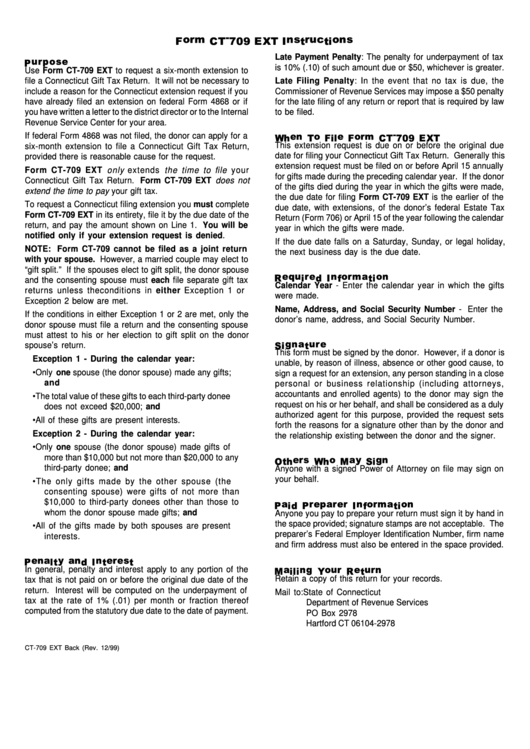

Form Ct-709 Ext Instructions - Connecticut Department Of Revenue Services

ADVERTISEMENT

Late Payment Penalty: The penalty for underpayment of tax

is 10% (.10) of such amount due or $50, whichever is greater.

Use Form CT-709 EXT to request a six-month extension to

file a Connecticut Gift Tax Return. It will not be necessary to

Late Filing Penalty: In the event that no tax is due, the

include a reason for the Connecticut extension request if you

Commissioner of Revenue Services may impose a $50 penalty

have already filed an extension on federal Form 4868 or if

for the late filing of any return or report that is required by law

you have written a letter to the district director or to the Internal

to be filed.

Revenue Service Center for your area.

If federal Form 4868 was not filed, the donor can apply for a

This extension request is due on or before the original due

six-month extension to file a Connecticut Gift Tax Return,

date for filing your Connecticut Gift Tax Return. Generally this

provided there is reasonable cause for the request.

extension request must be filed on or before April 15 annually

Form CT-709 EXT only extends the time to file your

for gifts made during the preceding calendar year. If the donor

Connecticut Gift Tax Return. Form CT-709 EXT does not

of the gifts died during the year in which the gifts were made,

extend the time to pay your gift tax.

the due date for filing Form CT-709 EXT is the earlier of the

To request a Connecticut filing extension you must complete

due date, with extensions, of the donor’s federal Estate Tax

Form CT-709 EXT in its entirety, file it by the due date of the

Return (Form 706) or April 15 of the year following the calendar

return, and pay the amount shown on Line 1. You will be

year in which the gifts were made.

notified only if your extension request is denied.

If the due date falls on a Saturday, Sunday, or legal holiday,

NOTE: Form CT-709 cannot be filed as a joint return

the next business day is the due date.

with your spouse. However, a married couple may elect to

“gift split.” If the spouses elect to gift split, the donor spouse

and the consenting spouse must each file separate gift tax

Calendar Year - Enter the calendar year in which the gifts

returns unless the conditions in either Exception 1 or

were made.

Exception 2 below are met.

Name, Address, and Social Security Number - Enter the

If the conditions in either Exception 1 or 2 are met, only the

donor’s name, address, and Social Security Number.

donor spouse must file a return and the consenting spouse

must attest to his or her election to gift split on the donor

spouse’s return.

This form must be signed by the donor. However, if a donor is

Exception 1 - During the calendar year:

unable, by reason of illness, absence or other good cause, to

• Only one spouse (the donor spouse) made any gifts;

sign a request for an extension, any person standing in a close

and

personal or business relationship (including attorneys,

accountants and enrolled agents) to the donor may sign the

• The total value of these gifts to each third-party donee

request on his or her behalf, and shall be considered as a duly

does not exceed $20,000; and

authorized agent for this purpose, provided the request sets

• All of these gifts are present interests.

forth the reasons for a signature other than by the donor and

Exception 2 - During the calendar year:

the relationship existing between the donor and the signer.

• Only one spouse (the donor spouse) made gifts of

more than $10,000 but not more than $20,000 to any

third-party donee; and

Anyone with a signed Power of Attorney on file may sign on

your behalf.

• The only gifts made by the other spouse (the

consenting spouse) were gifts of not more than

$10,000 to third-party donees other than those to

whom the donor spouse made gifts; and

Anyone you pay to prepare your return must sign it by hand in

the space provided; signature stamps are not acceptable. The

• All of the gifts made by both spouses are present

preparer’s Federal Employer Identification Number, firm name

interests.

and firm address must also be entered in the space provided.

In general, penalty and interest apply to any portion of the

Retain a copy of this return for your records.

tax that is not paid on or before the original due date of the

return. Interest will be computed on the underpayment of

Mail to: State of Connecticut

tax at the rate of 1% (.01) per month or fraction thereof

Department of Revenue Services

computed from the statutory due date to the date of payment.

PO Box 2978

Hartford CT 06104-2978

CT-709 EXT Back (Rev. 12/99)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1