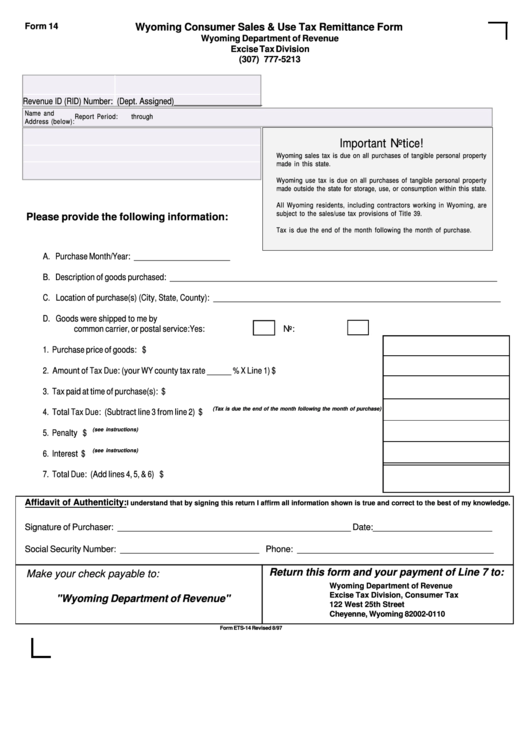

Form 14

Wyoming Consumer Sales & Use Tax Remittance Form

Wyoming Department of Revenue

Excise Tax Division

(307) 777-5213

Revenue ID (RID) Number: (Dept. Assigned)______________________

Name and

Report Period:

through

Address (below):

Important Notice!

Wyoming sales tax is due on all purchases of tangible personal property

made in this state.

Wyoming use tax is due on all purchases of tangible personal property

made outside the state for storage, use, or consumption within this state.

All Wyoming residents, including contractors working in Wyoming, are

subject to the sales/use tax provisions of Title 39.

Please provide the following information:

Tax is due the end of the month following the month of purchase.

A. Purchase Month/Year: ________________________

B. Description of goods purchased: __________________________________________________________________________________

C. Location of purchase(s) (City, State, County): ________________________________________________________________________

D. Goods were shipped to me by

common carrier, or postal service:

Yes:

No:

1. Purchase price of goods: ..........................................................................................................

$

2. Amount of Tax Due: (your WY county tax rate ______ % X Line 1)..........................................

$

3. Tax paid at time of purchase(s): ................................................................................................

$

4. Total Tax Due: (Subtract line 3 from line 2) .............................................................................

$

(Tax is due the end of the month following the month of purchase)

5. Penalty ........................................................................................................................................

(see instructions)

$

6. Interest ........................................................................................................................................

$

(see instructions)

7. Total Due: (Add lines 4, 5, & 6) ...............................................................................................

$

Affidavit of Authenticity:

I understand that by signing this return I affirm all information shown is true and correct to the best of my knowledge.

Signature of Purchaser: _________________________________________________ Date:_________________________

Social Security Number: _____________________________ Phone: _________________________________________

Return this form and your payment of Line 7 to:

Make your check payable to:

Wyoming Department of Revenue

Excise Tax Division, Consumer Tax

"Wyoming Department of Revenue"

122 West 25th Street

Cheyenne, Wyoming 82002-0110

Form ETS-14 Revised 8/97

1

1