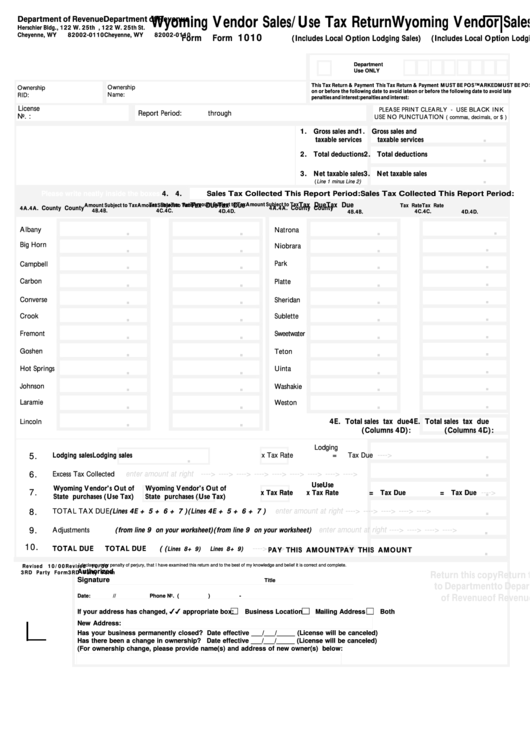

Form 10 - Wyoming Vendor Sales/use Tax Return

ADVERTISEMENT

Wyoming Vendor Sales/Use Tax Return

Wyoming Vendor Sales/Use Tax Return

Department of Revenue

Department of Revenue

Herschler Bldg., 122 W. 25th St.

Herschler Bldg., 122 W. 25th St.

Cheyenne, WY

Cheyenne, WY

82002-0110

82002-0110

10

10

Form

Form

(Includes Local Option Lodging Sales)

(Includes Local Option Lodging Sales)

Department

Use ONLY

This Tax Return & Payment

This Tax Return & Payment MUST BE POSTMARKED

MUST BE POSTMARKED

Ownership

Ownership

on or before the following date to avoid late

on or before the following date to avoid late

Name:

RID:

penalties and interest:

penalties and interest:

License

PLEASE PRINT CLEARLY - USE BLACK INK

Report Period:

through

No. :

USE NO PUNCTUATION

( commas, decimals, or $ )

.

1. Gross sales and

1. Gross sales and

taxable services

taxable services

.

2. Total deductions

2. Total deductions

.

3. Net taxable sales

3. Net taxable sales

(Line 1 minus Line 2)

4. 4. Sales Tax Collected This Report Period:

Sales Tax Collected This Report Period:

Please write neatly inside the boxes!

Please write neatly inside the boxes!

Tax Due

Tax Due

Tax Due

Tax Due

Amount Subject to Tax

Amount Subject to Tax

Amount Subject to Tax

Amount Subject to Tax

Tax Rate

Tax Rate

Tax Rate

Tax Rate

County

County

County

County

4A.

4A.

4A.

4A.

4B.

4B.

4C.

4C.

4D.

4D.

4B.

4B.

4C.

4C.

4D.

4D.

.

.

.

.

Albany

Natrona

.

.

.

.

Big Horn

Niobrara

.

.

.

.

Park

Campbell

.

.

.

.

Carbon

Platte

.

.

.

.

Converse

Sheridan

.

.

.

.

Crook

Sublette

.

.

.

.

Fremont

Sweetwater

.

.

.

.

Goshen

Teton

.

.

.

.

Hot Springs

Uinta

.

.

.

.

Johnson

Washakie

.

.

.

.

Laramie

Weston

.

.

.

4E. Total sales tax due

4E. Total sales tax due

Lincoln

(Columns 4D):

(Columns 4D):

.

.

Lodging

---->

5.

Lodging sales

Lodging sales

$

x Tax Rate

=

Tax Due

.

6.

enter amount at right ---->---->---->---->---->---->---->---->---->

Excess Tax Collected

.

.

Use

Use

Wyoming Vendor's Out of

Wyoming Vendor's Out of

7.

---->

$ $

x Tax Rate

x Tax Rate

= Tax Due

= Tax Due

State purchases (Use Tax)

State purchases (Use Tax)

.

8.

enter amount at right ---->---->---->---->---->

TOTAL TAX DUE (Lines 4E + 5 + 6 + 7 )

(Lines 4E + 5 + 6 + 7 )

.

9.

enter amount at right ---->---->---->---->

Adjustments

(from line 9 on your worksheet)

(from line 9 on your worksheet)

.

F

10.

---->---->---->---->---->---->

TOTAL DUE

TOTAL DUE

( (

Lines 8+ 9)

Lines 8+ 9)

PAY THIS AMOUNT

PAY THIS AMOUNT

R e v i s e d 1 0 / 0 0

R e v i s e d 1 0 / 0 0

I declare, under penalty of perjury, that I have examined this return and to the best of my knowledge and belief it is correct and complete.

Authorized

Return this copy

Return this copy

3RD Party Form

3RD Party Form

,

Signature

Title

to Department

to Department

of Revenue

of Revenue

Date:

/

/

Phone No. (

)

-

If your address has changed, 4 4 appropriate box:

Business Location

Mailing Address

Both

New Address:

Has your business permanently closed? Date effective ___/___/_____ (License will be canceled)

Has there been a change in ownership? Date effective ___/___/_____ (License will be canceled)

(For ownership change, please provide name(s) and address of new owner(s) below:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1